Investment Tips - Burgundy - 7. November 2019

Big Muscles In Play At The White Burgundy Stronghold – Here You Get A Strong White Wine Investment

The interest in the white Burgundy wines is growing strongly and this regular business case may well be even more water on the mill!

Seen in the Napa Valley, seen in Burgundy?

Bonneau du Martray is one of Burgundy's many historical wineries, with a history stretching back more than 200 years at the same family's hands.

However, the family ownership ended in early 2017 when real estate and sports mogul Stanley Kroenke bought the house. While that might sound like sad news, it is in fact extremely fascinating, whether you are a wine lover, wine investor or both.

Stanley Kroenke can take a large credit for the success of Napa Valley and Screaming Eagle for the past 10 years. He is an exceptionally successful businessman with near-infinite resources.

A unique product is usually a requirement to create a global wine success. But without the right commercial angle and capital it can be difficult to seriously change a brand today.

Bonneau du Martray has a great product and a strong brand. Through a lifetime, Stan Kroenke has proven to have the commercial capacity and created magnificent resources. In transferred sense, this moved mountains for the Screaming Eagle and also have the potential to do so for Bonneau du Martray.

2013 Bonneau du Martray Corton-Charlemagne

2013 Bonneau du Martray Corton-Charlemagne

Stanley Kroenke - A World Class Man

Stanley Kroenke is not a Mr. Anyone. He can take pride in the fact that he is more than being the man behind USA's most expensive wine, the Screaming Eagle. As the current holder of a 49th place on Forbes list of the world's richest, he is estimated to have a fortune of nearly $10 billion US dollars. Stanley Kroenke is often referred to as a real estate and sports mogul and owns around 2.8 million square meters rental properties, primarily shopping centres. In addition, Stanley Kroenke owns more than 8,000 square kilometers of land across ranches in the United States and Canada. It is scantly equal to the area of the department Côte-d'Or in Burgundy, France.

As a sports mogul, Standley Kroenke is the majority owner of sport teams like: The Premiere League Club Arsenal, NFL-Club Los Angeles Rams, NBA-Club Denver Nuggets and NHL-Club Colorado Avanlanches.

Stanley Kroenke is married to Ann Walton, heir to the Walmart Group.

Bonneau du Martray — One Of Corton-Charlemagne's Gems

Bonneau du Martray is one of the largest producers on the huge white Grand Cru vineyard Corton-Charlemagne - an institution in itself, in Burgundy.

Corton-Charlemagnes is approximately 52 hectares. Like many other Burgundy Grand Cru fields, it is divided into many small plots. On these plots, producers produce their Corton-Charlemagne under their own domain or sell the grapes to Négociants who produce wine from purchased grapes.

Corton-Charlemagne's big stars and reigning kings are undoubtedly Coche-Dury and Leroy. If another gem is to be mentioned here, it is Bonneau du Martray. Coche Dury's Corton-Charlemagne cannot be compared to Bonneau du Martrays, but looking at the price, it is also a whole other story. For example, it is almost impossible to get Coche-Dury Corton-Charlemagne but if one succeed, it will probably not happen at a price below €5,000 per bottle. Today's Bonneau du Martray costs no more than €220 per bottle.*

Bonneau du Martray offers the opportunity of a value-for-money investment from a recognized name. With it follows the option of investment in white Burgundy, which, compared with the red wines, is not produced to a large extent.

Critics' reviews can also be read as a second-tier wine. Considering the price and the forces at stake, including Domaine de la Romanée-Conti (DRC) and Stanley Kroenke, there is a solid investment potential in Bonneau du Martray's Corton-Charlemagne - read more about it below.

| Vintage | Burghound | Wine Advocate | Vinous |

|---|---|---|---|

| 2011 | 92 | 93 | 92 |

| 2013 | 93 | 92+ | 91 |

| 2014 | 95 | 93 | 95 |

| 2015 | 94 | 93 | 95 |

The White Burgundy Hype May Escalate Further: Mighty DRC Enters Corton-Charlemagne

In February this year, we reported an increasing potential among the white Burgundy wines with DRC and Coche-Dury at the forefront. They delivered great returns to investors with up to 44.6% return in 2018. Price increases may be due to many things, but increased interest for the white wines are undeniably one of them. We expect an interest that will probably only get bigger.

In addition to Bonneau du Martray's new owner, who all things equal has an interest in promoting the global interest in his wine house’s Corton-Charlemagne, while also having the resources to do so, mighty DRC can play an important role in this game.

In May last year, the American wine magazine Wine Spectator announced spectacular news. Bonneau du Martray has leased approximately 2.8 hectares to none less than the DRC. It is a third of the domain’s approximately 10 hectares of Corton-Charlemagne. The reason for reducing the area of their demanding biodynamic operation is to focus further on the quality.

Beyond that, it can be considered a commercial stroke of genius getting DRC into Corton-Charlemagne. It might very well increase both focus and interest in wines from this particular vineyard. Especially as DRC is one of the world's best, most mythical and sought-after wine producers. Such reinforcement of the white wine hype may lead to further price increases. That may drive up prices throughout the region.

DRC's first Corton-Charlemagne harvest was gathered in and their Corton-Charlemagne may already hit the market next year.

With this rental to DRC, Domaine Bonneau du Martray has created the opportunity to raise the quality of its own wines. We expect to see a price increase of new as well as older vintages. At the same time, it has invited one of Burgundy's absolute heaviest players within. This can have a huge impact on the world's wine drinkers' attention to white burgundy. In particular to those from Corton-Charlemagne – an attention that usually leads to price increases.

Bonneau du Martray is one of Corton-Charlemagne's pearls

Bonneau du Martray is one of Corton-Charlemagne's pearls

Great Returns On Bonneau du Martray's Corton-Charlemagne

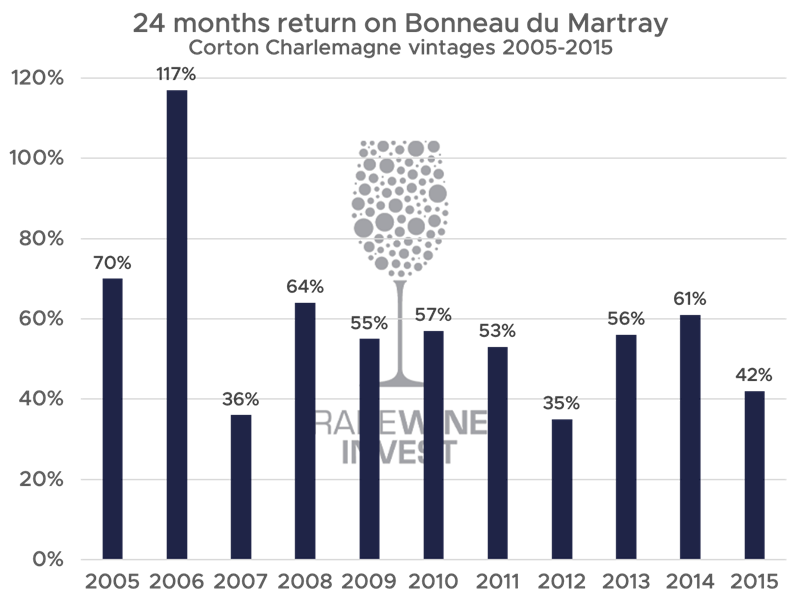

The argument that Bonneau du Martray is one of Corton-Charlemagne's gems is apparently shared by many. For good reasons, the past 11 vintages that have been on the market for at least two years have all seen solid price rises. Indeed, prices have risen by between 35% and 117% over the past two years, which is just another sign of a growing interest in white burgundy. There is clearly interest and demand, and the price can still be considered extremely attractive, despite price increases in the past years. The return is distributed as follows:

Based on data from the British wine exchange Liv-ex

Based on data from the British wine exchange Liv-ex

RareWine Invest’s Opinion

RareWine Invest recommends Bonneau du Martray Corton-Charlemagne for investment as a solid business case.

Stanley Kroenke's acquisition of the domain creates the foundation for great development of the house's wines, as well as an opportunity for positioning, which is probably only possible with such a strong owner.

Interest in white Burgundy wines seems to be growing, as may the price trends at Bonneau du Martray’s Corton-Charlemagne. At the same time, there is no doubt. The rental of parts of their Corton-Charlemagne parcel to Domaine de la Romanée-Conti by Bonneau du Martray will contribute to the interest. Corton-Charlemagne will be more visible on the Burgundian map.

If this succeeds and the trend continues in the direction of today's trends, the limited quantities of top white Burgundy wines can provide good, solid returns for investors.

This is not a specific recommendation in selected vintages. It is more a recommendation for Bonneau du Martray Corton-Charlemagne in general. It is due to the nature of the case, Stanley Kroenke's acquisition and DRC's commitment to Corton-Charlemagne. This is a great opportunity to invest in one of the most promising white wine cases. An opportunity at a price level where all wine investors can join. If you want white wines in the portfolio, but does the portfolio size not fit to the extremely expensive white wines from Coche-Dury and DRC, then these are the perfect alternative.

An extremely limited amount of Bonneau du Martray Corton-Charlemagne is now being sold for investment. It may be considered the last call for these vintages. The last before disappearing more or less from the market, which under normal circumstances marks the start for price increases.

Invest in Bonneau du Martray Corton-Charlemagne and at the same time invest in a strong business case.

The following wines from Bonneau du Martray are now sold for investment.

First come first served.

| Vintage | Wine | VOL | Packing | QTY | PRICE* |

|---|---|---|---|---|---|

| 2011 | Corton-Charlemagne | 750 | OWC6 | 60 | € 145 |

| 2011 | Corton-Charlemagne | 1.500 | OWC1 | 14 | € 325 |

| 2013 | Corton-Charlemagne | 750 | OWC3 | 42 | € 145 |

| 2014 | Corton-Charlemagne | 750 | OWC6 | 24 | € 165 |

| 2015 | Corton-Charlemagne | 1.500 | OWC3 | 9 | € 350 |