Investment Tips - Champagne - 14. May 2020

2002 Krug Vintage: Take Advantage Of Unredeemed Potential

Krug is the place to be if you believe in Champagne's great potential. Right now, 2002 Krug Vintage allows you to take advantage of a strong and unfulfilled potential

King Among Kings

Should the king of prestige cuvées be crowned there will be more contenders, and possibly even more opinions. If you ask about our opinion, we cannot deny that Krug Vintage stands as one of the brightest stars in the champagne sky, and even shines well above well-known brands such as Dom Pérignon and Cristal.

In terms of quality, Krug Vintage is unique. The only one that can withstand comparison with Krug is the phenomenal Salon. At the same time, Krug is a top brand on par with both Cristal and Dom Pérignon in terms of worldwide recognition - which also holds great value for an investor.

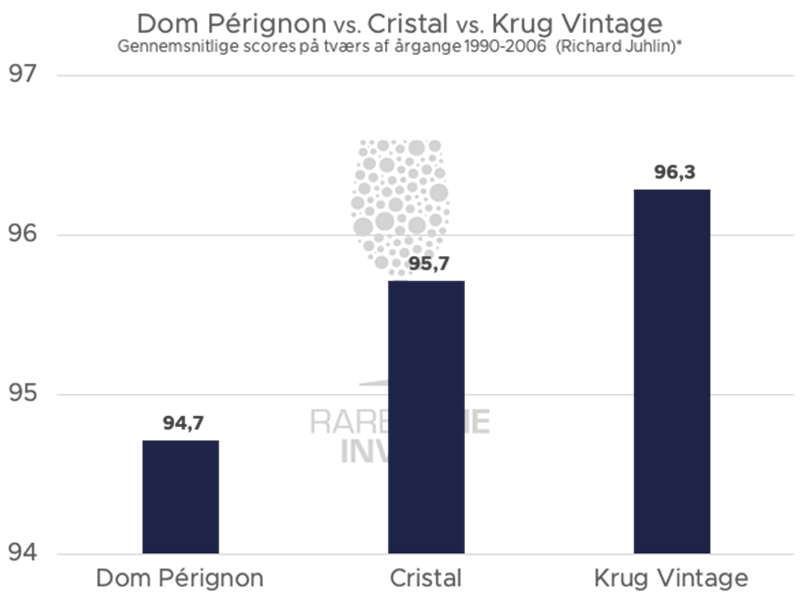

If we compare the quality between Cristal, Dom Pérignon and Krug Vintage, there is a clear hierarchy:

*Only vintages released by all three houses (90, 95, 96, 00, 02, 04, 06)

*Only vintages released by all three houses (90, 95, 96, 00, 02, 04, 06)

How Dull Returns Can Be Your Advantage

While we have seen a solid rise in price with both Cristal and Dom Pérignon, Krug prices have stagnated. Given that Krug has historically been a good Champagne investment and that Krug's reputation and quality are higher than ever, this may lead to raised eyebrows - but there is a plausible explanation.

Recent years have been all about the releases of the monumental vintage 2008, and in that perspective, Krug's releases of vintage 2004 and 2006 have not received much attention. That all focus has been on Cristal first, followed by Dom Perignon and most recently Salon's 2008 releases, may have been the biggest contributing factor to the fact that we have witnessed stagnant Krug prices over the past 18-24 months while the market, in general, has experienced growth.

Thus, Krug's Vintage 2002 looks relatively cheap - both in relation to the secondary vintages from Krug, but also compared to Cristal, who has picked up on Krug and Salon, which have put further distance to the rest of the competitors.

Champagne Investment – Here You Can Have It All

Champagne is a category characterized by stable, continuous returns and at the same time a high degree of security. For the same reason, champagne is often referred to as the government bond of the wine world, but despite this, at the same time, we see one shooting star after another, which by no means makes it boring to invest in champagne.

This applies, for example, when Salon rose 17 % in three months last year, or when Selosse's non-vintage champagne rose 30-40% in 12-24 months or when Tattingers Comtes de Champagne in December 2019 had seen an average annual return over the past two years at just under 17 %. And this is just to mention a few examples.

That being said, investing in Champagne should be made with a long time horizon to reach its full potential even though 2002 Krug Vintage was released in February 2016, which means it is already four years into its cycle and you as an investor are buying some ”free” years.

Right now, it is the obvious time to buy the 2002 Krug Vintage, as Krug is currently working on a large potential upside for those who have invested in Krug. More on that in the next section.

2002 Krug Vintage is among the best Champagnes in the world. Delivered in OC6

2002 Krug Vintage is among the best Champagnes in the world. Delivered in OC6

We're Still Waiting For Krug's 2008 Fireworks!

Recent years have been truly great in the champagne world. Here, one house after another has just presented their edition of the already legendary vintage 2008. It has been one celebration after another. Simultaneously we have seen exciting investment cases in the surrounding vintages due to the record prices of vintage 2008 and investors have seen great returns in 2019 as well. This has been possible because the new 2008 releases, almost without exception, after the release were traded at soaring prices, which have both raised the bar for what new vintages of top champagne can cost and at the same time raised prices for the surrounding vintages. For example, the 2006, 2007 and 2009 vintages of Louis Roederer's Cristal rose 30-33 % in just six months in the wake of the 2008 Cristal release. Likewise, the price increase of approx. 17 % at Salon in just three months is probably attributed to expectations of the 2008 release price from Salon.

Whether it will be the same story for Krug when they release their vintage 2008 nobody can tell, but all the same conditions are met. This, combined with what looks like an unlocked potential in 2002 Krug Vintage that has not yet seen price increases makes this is a really exciting opportunity that will not come again.

No one knows when the 2008 Krug Vintage will be released, but we expect it to happen in 2021 or 2022.

RareWine Invest's Opinion

Krug is among the greatest of the greatest, and whether it's their non-vintage champagne, Grande Cuvée, Vintage Brut, or the legendary Clos du Mesnil and Clos d'Ambonnay, there's something really special about it - and they all excel in their own category.

Krug Vintage is at the forefront, whether measured by the quality of the champagne or the strength of the brand and with our high expectations for Champagne in general, we also have high expectations for Krug in particular.

Today, 2002 Krug Vintage is the largest vintage of Krug Vintage on the market, but despite this, the price has virtually not changed over the past few years, although secondary vintages have increased in price. This triggers a great deal of excitement and unresolved potential in the top vintage 2002, as the price in such a situation more often rises on the top vintages than falls on the secondary vintages. Therefore 2002 Krug Vintage right now is an even more interesting investment case than usual.

On top of that, the vintage 2002 is four years ahead of its cycle, which means that you as an investor have an advantage, as the price has not increased accordingly - but the champagne has continued to mature, which only makes it more attractive.

This is not enough, the Krug investor has a large potential upside in the coming vintage 2008, which will undoubtedly create enormous focus and great interest in Krug precisely when the release is approaching.

Invest in 2002 Krug Vintage

Contact us via the contact form below if you would like to invest or hear more about your options.

| Vintage | Wine | VOL | PACKING | QTY | PRICE* |

|---|---|---|---|---|---|

| 2002 | Krug Vintage Brut | 750 | OC6 | 220 | € 280 |