Investment Tips - Burgundy - 16. February 2022

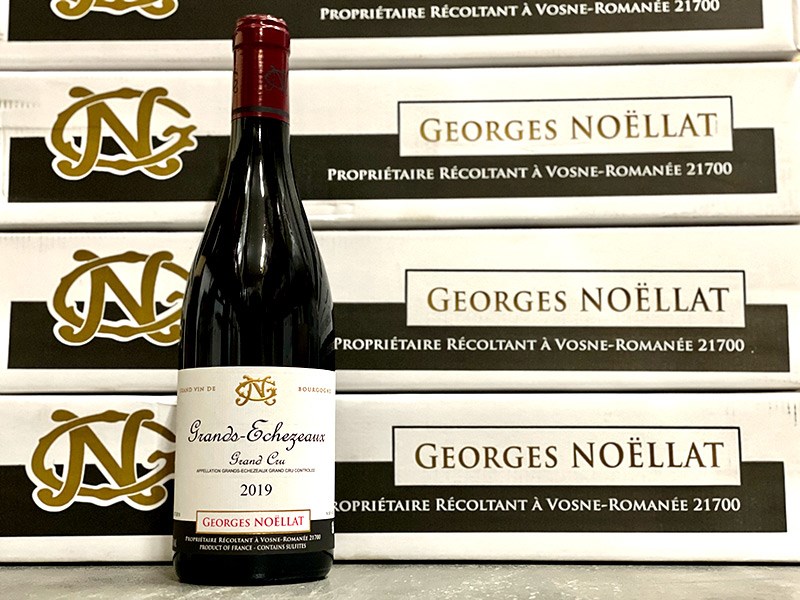

Burgundy Drought Lurks: Invest In 2019 Grands-Echezeaux From Domaine George Noëllat While You Can.

Rising star delivers great potential in extremely sparse quantities. Meanwhile, supply is falling while demand is rising in Burgundy. Read more here...

Very Interesting Things Are Happening In Burgundy

This investment tip can really be boiled down to three strong arguments: Grand Cru with rising-star status, an already mythical 2019 vintage and massive thirst for increasingly scarce Burgundy supply.

The Burgundy market is hot, and for good reason. Demand is enormous, and at the same time all the arrows point to even less supply in the coming years thanks to several vintages with poor harvests. Paradoxically, these go hand in hand with impressive quality, with the 2019 vintage, for example, predicted to be perhaps the greatest since 1865.

At the same time, Liv-ex testifies that the Burgundy 150, is the sub-index of the wine exchange that has risen the most since 2004*, and one would not think that this would continue. Yet the outlook is for an even more imbalanced relationship between supply and demand, which can only be met in one way - namely by continued price rises.

This is not just an investment tip about a rising star in Burgundy. This is an investment in Grands-Echezeaux from Domaine Georges Noëllat from that particular 2019 vintage. And last but not least, it is an investment in ever-smaller quantities of Burgundy.

*Burgundy 150: +652%. By comparison, the S&P500 is up 292% over the same period. Source: Liv-ex Analysis Tool

Domaine Georges Noëllat - Among Burgundy's Best

The Noëllat name is no stranger to the Vosne-Romanée in Burgundy. Indeed, the family has been involved in several domains for many years, and in fact the family is related to another godfather of all Burgundy, and perhaps the greatest of them all: Henri Jayer.

Georges Roger Noëllat founded the domain, and the family DNA was built primarily on a love for wine and a talent for making it. It was therefore not surprising that Noëllat's wife Marcelle Lorillard took over the domain after Georges' death, or that her daughter Marie-Thérése took over the baton from her mother until 2009.

Maxime is Marie-Thérése's grandson, and in 2010 he took over winemaking at Domaine Georges Noëllat.

2019 Grands-Echezeaux From Domaine George Noëllat

2019 Grands-Echezeaux From Domaine George Noëllat

From Champagne To Burgundy: A Rising Wine Star At The Helm

Maxime Cheurlin was only 20 years old when he took over the helm of the domain from his grandmother. In fact, for 20 years Marié-Thérese had sold most of the production to the houses of Jadot and Drouhin, but the contract expired when Maxime took over.

Maxime grew up in Champagne, and his DNA is similar to that of his family. He studied wine at the Lycé du Viticole in Beaune with a stay at Domaine Emmaniel Rouget, whose children Maxime is actually a cousin of.

The pressure on Maxime's young shoulders was great, but he has shown that his DNA, passion and hard work are great ingredients for world-class winemaking.

Grands-Echezeaux Grand Cru

Competition is fierce in Burgundy, and therefore it requires both talent and world-class terroir to play with the absolute top.

Maxime's portfolio includes Vosne Les Chaumes, Les Petits Monts and Les Beaux Monts, but his Grands-Echezeaux is by far his best and biggest. Domaine Geroge Noëllat has just 0.4 hectares of Grands-Echezeaux, which cover more than 9 hectares. Here, according to the rules for Grand Cru in Burgundy, 35 hectolitres can be produced per hectare, which gives Georges Noëllat an annual production of Grands-Echezeaux of just around 1,900 bottles.

In fact, Maxime Cheurlin told Burghound that the yield for the domain's 2019 Grands-Echezeaux was reduced to just 20-22 hectolitres per hectare. This means that only approx. 1,100-1,200 bottles of this vintage were produced.

Masterly 2019 Vintage: High Quality And Low Yield

If you have been following us here at RareWine Invest, this is not the first time you have heard about the potential of Burgundy. Indeed, we have long argued that Burgundy is worth keeping an eye on. And we (still) have the warmest recommendation for Burgundy. A recommendation that is not diminished by the fact that favorable weather conditions have given the vines the very best conditions in the 2019 vintage, which has resulted in a sublime vintage that is described as perhaps the best ever.

As mentioned earlier, these optimal growing conditions were followed by difficult conditions during the harvest season, which according to Liv-ex reduced the 2019 harvest yield by 15% in Burgundy. In other words, the already microscopic production was thus further reduced.

Add to this that the Burgundy harvest in 2021 is described as catastrophic, which of course means another vintage with reduced yields, which according to Liv-ex so far are 37.5% lower compared to the average of the last 10 years. This means that there will be more competition for existing volumes of quality wine from previous vintages - including the 2019 vintage.

The 2019 Grands-Echezeaux from Georges Noëllat has yet to receive scores from Wine Advocate. Burghound gives it 91-93 points, while Vinous has given 96-98. These scores place the vintage among the producer's best and only reinforce expectations for the sublime 2019 vintage.

Many of the major producers have not yet released their 2019s, but it is expected that there will be wines among them that will set both records and, not least, a whole new standard for what an "regular" bottle of wine in an "regular" release can cost. This is another mechanism that could help to pull up the prices of existing vintages in the market.

Demand Is Rising - So Is The Price

The minimal supply in Burgundy cannot keep up with demand. In fact, Decanter refers to a Liv-ex report on Burgundy that describes an "insatiable global buying appetite". When supply is low and demand high and still rising, prices will inevitably rise.

Liv-ex also addresses the question of whether prices for Burgundy wines have a ceiling. The answer is no. There is a market for both the older and new releases, and Burgundy has been the most traded region by value since the start of 2022 (28.8% of the total).

Furthermore, the Burgundy paradox means that the harder it becomes to find wines and the more the price rises - the greater the demand. For example, the higher the price of some of the most prestigious wines, the fewer buyers there will be for them. These buyers will look for a cheaper alternative and thus drive-up demand in the given segment and thus the dynamics can push up the price of the different segments.

Also read our article Analysis: wine investors are looking forward to some really exciting years from September 2021 where we also touched on some of these topics.

Rarewine Invest's Opinion

The amount of sources in this investment tip is the strongest argument for why there is potential in Burgundy. Like the rest of the world, we are keeping a close eye on the best of Burgundy these years, and when 2019 is on the label, we are extra attentive. We are, of course, because 2019 is being praised, and because the volumes are small.

This is therefore your opportunity to get your share of Burgundy. Even Grand Cru from a producer who receives great praise and is promised a great future. 1,200 bottles are a microscopic quantity the market and ongoing consumption can quickly process.

Add here that the price is extremely attractive compared to prices on wine-searcher.com, where the lowest price is currently €555*, while the average price is €585*. Although the wine is new, the price has already been on an upward trend according to wine-searcher, with the average price across all deals facilitated by wine-searcher increasing almost 45% from April 2021 to January 2022.

Burgundy is in demand. And even in this investment tip, volumes are small. So we recommend striking fast and contacting us via the form below if you want a share in 2019 Geroges Noëllat Grands-Echezeaux or get started with Burgundy investing.

Invest in 2019 George Noëllat Grands-Echezeaux

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2019 | George Noëllat Grands-Echezeaux | 750 | OC6 | € 500 |