Market Analysis - Other - 10. August 2023

Analysis of French Wine Harvest 2023: Double-trouble for Bordeaux

French wine production is a captivating tale of contrasts. From Bordeaux's challenges to Burgundy & Champagne's promise, the stage is set for enthusiasts & investors.

Picture this: the rolling vineyards of France, adorned with the promise of a new wine harvest. As the sun-dappled grapes reach their peak of maturity, wine enthusiasts and investors eagerly await the annual bounty. However, as the corks are about to pop, a complex tale unfolds - one of contrasts, challenges, and the potential for lucrative investment. The stage is set, and the curtain rises on the French wine production scene of 2023.

With its rich history and exquisite taste, French wine has long captured the hearts and palates of connoisseurs worldwide. This year, the scene is painted with both optimism and caution, as the French farm ministry's report, reported by Reuters unveils an intriguing narrative that reads like a fine blend of flavors.

A Vintage Overview

In the heart of the vineyards, the numbers are the first to take the stage. The 2023 projection places overall wine output in a range of 44 to 47 million hectoliters. This encompassing span includes the five-year average of 44.5 million hectoliters and last year's yield of 46.1 million hectoliters. To put this into perspective, a hectoliter translates to 100 liters or 133 standard wine bottles, a symbol of the profound influence that volume holds in the world of wine investment.

Unveiling the Regions

Bordeaux, a name that resonates deeply with wine enthusiasts, grapples with a double conundrum. Unpredictable weather patterns, including a dance of storm showers and sizzling heat, have given rise to the menacing mildew disease in the Bordeaux and Southwest growing regions. The ministry's report paints a cautious portrait of these areas, reminding us that production forecasts in these domains are cast under the shadow of uncertainty.

In the midst of this tempest, Jerome Despey, a respected producer and chair of FranceAgriMer's wine committee, lends his voice to the discourse. In an interview with Reuters, he confesses that the contrast between uncertainty and opportunity has never been more palpable. Despey's words mirror the delicate dance between the natural world's unpredictability and the wine industry's ceaseless pursuit of excellence.

The 2023 harvest in France is a tale of mixed fates and will arguably be one to remember as Bordeaux is facing a vital crossroad.

The 2023 harvest in France is a tale of mixed fates and will arguably be one to remember as Bordeaux is facing a vital crossroad.

Bordeaux's Crossroads

With clouds of uncertainty looming over Bordeaux, a historical player in the wine landscape, the stakes are high. The region faces the intertwined challenges of falling demand and a disease-ridden harvest. The heavy French red wines, once the crown jewels of cellars worldwide have lost their allure among the younger generations in France, according to an article published by The Guardian earlier this year. However, one must remember that there is a difference between table wine and fine wine. There will always be a demand for the Mouton Rothschild, Petrus or Le Pin among others. In October 2022, a Global Data analysis revealed that the demand for fine wine alone in China will almost double towards 2026.

To stem the tide, the government offers a helping hand to producers in Bordeaux, a testament to the sector's pivotal role in the nation's economy.

The wine community echoes a plea for further support, particularly for the distillation scheme that could clear out excess stocks. This scheme, if expanded, could see a significant 3 million hectoliters of wine bidding adieu to the barrels, primarily in Bordeaux and Languedoc-Roussillon. A separate endeavor to uproot vines in Bordeaux, a strategic move in response to dwindling consumption and economic pressures, has garnered considerable attention. This initiative's allure has prompted applications for nearly 8% of Bordeaux's wine-growing area.

Harvest of Contrasts

As the curtain rises on the grand stage of French vineyards, it's essential to acknowledge the diversity that defines the narrative. While Bordeaux grapples with storms, Burgundy and Champagne bask in a contrasting glow. These regions, untouched by their Bordeaux counterpart's challenges, are set to yield an abundance of grapes. Ideal weather conditions during flowering, combined with a refreshing summer rain, have paved the way for a triumphant harvest.

Despite encountering mildew cases in Burgundy, the ministry predicts a production that soars a bit beyond the five-year average. Similarly, in the Champagne region, the specters of frost and hail have been held at bay, painting a promising picture for investors eyeing the bubbly delight even though it will take at least ten years to see the top cuvées in the market.

The climate changes is just one of many challenges. Also changing preferences and drinking habits can potentially affect the wine market.

The climate changes is just one of many challenges. Also changing preferences and drinking habits can potentially affect the wine market.

A Sip of Insight

As we uncork the intricacies of French wine production in 2023, it becomes evident that this year's vintage is as multifaceted as the flavors that swirl in a glass. The dichotomy between regions, the delicate balance of demand and supply, and the dance between nature's unpredictability and human resilience shape this year's narrative.

For the discerning investor, these nuances present a tantalizing proposition. The intricacies of weather, demand, and production intertwine to create a tapestry of investment opportunities. So, let your glasses be raised not just to the exquisite taste of the vintage that 2023 holds but also to the potential within the vines, the barrels, and the ever-evolving landscape of the wine investment market.

As the harvest season beckons, investors have a unique chance to sip from the chalice of history and possibility, all while making their mark on the storied world of French wine.

How will this affect wine investors at RareWine Invest?

As we raise our glasses to the intricate symphony of French wine production in 2023, the question inevitably arises: how does this unfolding narrative impact wine investors at RareWine Invest? The answer, quite simply, is: not much at all.

At RareWine Invest, we have always defied conventional beliefs, charting our own course amidst the ever-changing tides of the wine investment world. In 2016, while many were captivated by Bordeaux's allure, we took a different path. Our insights and data led us to recommend Burgundy and Champagne investments with a fervor that proved prescient. And today, as the aroma of novelty fills the air, our commitment to this strategy remains steadfast.

Our data-driven approach has illuminated the path less traveled. We stand resolute in recommending that a substantial 70% of your wine investment portfolio find its home within the realms of Burgundy and Champagne. The reasons are clear – these regions offer a canvas upon which investment potential can be painted with vibrant hues.

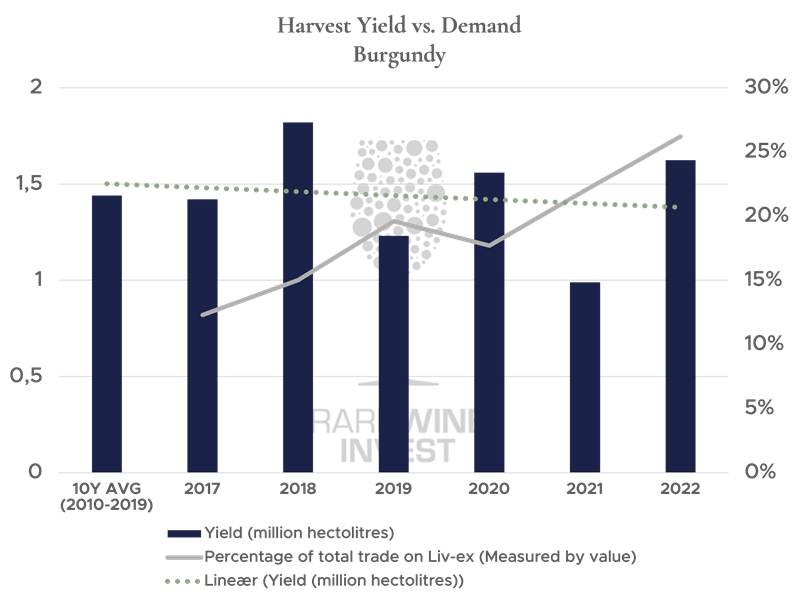

The ratio between demand and supply will always favor the investor as Burgundy's production is microscopic compared to Bordeaux. Furthermore, data from the world's largest wine exchange, Liv-ex, shows that since 2017, the demand for Burgundy wine has been rising sharply, while the volume of production is on a downward trend as shown in the graph below.

But let's not overlook the rising star on the horizon: Italian wine. The Barolos, the Brunellos, the Super-Tuscans – they beckon with unfulfilled potential. As the world's recognition of Italian excellence swells, our recommendations follow suit. As a guideline, we suggest that a dedicated 15% or more of your portfolio embrace these Italian treasures.

Yet, our story does not end here. As we traverse continents and oceans, the appeal of overseas treasures has grown. Whisky and a handful of international wines now capture our attention, rising through the ranks of our data.

But what about mighty Bordeaux? Though the stage has shifted, it remains a protagonist in the grand saga of wine. The palates of younger enthusiasts gravitate toward wines that speak of light refinement and drinkability. While the traditional heavy Bordeaux wines maintain their storied place in the hearts of the older generation of connoisseurs, we recommend investing very selectively and strategically in Bordeaux for the near future.

The realm of Bordeaux, however, grapples with an imbalance between supply and demand. On the one side, we see an overproduction in the area, and on the other side, a persisting pricing structure that makes the wines hard to trade.

The dawn of a potential distillation scheme hints at a remedy, a step that might tilt the scales in favor of investment potential by reducing availability. As producers wage their battle against climate change, the essence of Bordeaux wines may evolve to resonate with modern sensibilities. Only time can unveil this evolution, but for now, we take pride in our recommendations being rooted in empirical data rather than our own fondness for Bordeaux's historic beauty.

In conclusion, as the sun sets on the vineyards and the curtain falls on the drama of French wine production in 2023, RareWine Invest stands firm in our investment strategy with a primary focus on Burgundy, Champagne, and Italy complemented with a shat of Whisky or Napa.