Investment Tips - Bordeaux - 14. February 2019

Legendary Petrus outperforms Bordeaux with great returns

With an extremely limited annual production of these famous wines, the world's growing number of wealthy wine drinkers may be challenged providing these particular vintages

Petrus - Known by Many, Tasted by Few!

Petrus is clearly amongst Bordeaux’s most coveted and costly wines and, even without a broader knowledge of wine, the name and the iconic label reveal that this is something exceptional.

Although the name Petrus can be traced back to Roman rule in Gaul (today France), it was not until 1837 that the first records of the name Petrus are to be found in the context of wine. Since the end of the eighteenth century, the property that was initially just 7 hectares in area has been owned by the Arnaud family who made a living from wine cultivation. However, in spite of proud family traditions, it was first in 1878 that attention really focused on both the name Petrus and the area of Pomerol and entered the limelight, when Petrus won a Gold Medal at the World Exhibition in Paris in 1878. In 1925, the Arnaud family began to sell off parts of the land to Madame Edmond Loubat who, at the end of the 2nd World War, had taken over the property in its entirety.

Château Petrus today

Château Petrus today

An impressive Madame passes on the Torch

Madame Loubat, who also owned Chateau Latour à Pomerol, was a visionary and prosperous woman with extreme quality consciousness and a focus on detail, who considered that the Petrus wines were of a calibre that could be compared with the best-rated wines from the rest of France. The region is, however, still not subject to official ratings. Madame Loubat set out alone to convince the wine world that it lacked something extraordinary. The campaign continued in 1953 when Madame Loubat participated in Queen Elizabeth II’s coronation and, in this connection, sent a box of Petrus (maybe 1947 or. 1949) to Buckingham Palace as a gift - reportedly with the monarch’s great enthusiasm as a consequence.

Seven years later, Madame Loubat dies and her niece Madame Lacoste-Loubat takes over for a short period while Jean-Pierre Moueix gradually takes over Château Petrus. Jean-Pierre Moueix had been a close business partner to Madame Loubat and had, amongst others, introduced Petrus to the American market. Under his competent management, Petrus's reputation grew further and his sons, Christian and Jean François Mouiex, were brought into the business. They took over responsibility as directeur technique (technical director) and geránt (director) respectively upon Mouiex's death in 2003. The competent management of Petrus was ensured, and heritage and history could live on!

The significant coat of arms of Petrus

The significant coat of arms of Petrus

Investment in Bordeaux

Investing in wine has for many years been synonymous with investment in Bordeaux and the region must be regarded as being the breeding ground of investment in wine. Since the beginning of the 1970s, the coveted Bordeaux wines invited investment, and both castles, restaurants, private individuals and collectors have purchased more than they needed to use and have, as a result, benefited from the significant price increases and coveted status. After decades of stable returns, Bordeaux’s prices started to accelerate seriously from the middle of the 2000s and rose to an unprecedented high level. Right until 2011, when the Bordeaux bubble burst, and prices plummeted.

The cause of this bubble is the intense speculation in the very large quantities of wines. In particular, the castles' own speculation is considered to have contributed considerably to this development. In spite of this, it should be mentioned that Bordeaux wines still clearly constitute the most significant proportion of traded wines on the Liv-ex wine exchange. At the same time, the region's historic importance means that there are still many who swear to Bordeaux.

Iconic Petrus is not a typical Bordeaux Wine

Petrus’s wines are produced with enormously meticulous care where the feminine focus on detail is said to be the cornerstone of this legendary wine production. Furthermore, the castle's fields have an entirely unique vineyard terrain. These are two of the main reasons for why precisely Petrus, with its distinctive menthol-nose, is unlike any other Bordeaux wine and is a very prestigious utterly unique experience. In addition to the unique taste experiences hidden in the wine, Petrus possesses several qualities that, despite the situation in Bordeaux, make these very wines particularly attractive to investors.

Exceptionally Small and Exclusive Production

2016 was the most productive year in Bordeaux for over ten years. The total output was an astronomical 557 million litres of wine, corresponding to 770 million bottles! Of this enormous number, it is, of course, only a fraction that meets just the most essential criteria for being considered as a suitable investment. However, while the well-known 1st Cru castles such as Mouton Rothschild and Latour, that both produce around 200,000 bottles of wine per year on average, Château Petrus produces only about 30,000 bottles per year - and these must supply the whole of the global market!

That Petrus is extremely rare and prestigious is hardly a surprise for wine experts, but with the above figures the perspective is clear to all: With only 30,000 bottles per year of one of the most iconic Bordeaux wines, Petrus wines are enormously coveted and disappear from the market almost before they have really been launched for sale.

2005 Petrus in OWC3

2005 Petrus in OWC3

Seen in Burgundy and seen in Champagne…

It is no secret that, in later years, Bordeaux has provided a lower return on investment than, for example, Burgundy and Champagne. Yet, in spite of this, Bordeaux continues to have an important place in history, and the importance of this region cannot be underestimated. Although a higher return on investment has been achieved in other regions in recent years, Rare Wine Invest continues to recommend Bordeaux as a minor component in a properly diversified portfolio.

Although Bordeaux has not in later years been able to keep up with, for example, Burgundy and Champagne when it comes to returns on investment, individual Bordeaux wines, with Petrus and Le Pin at the forefront, continue to provide an attractive return on investment. In an attempt to explain this development, we can look to Burgundy to find common features. It has been seen here, during the last few years, that the highest returns on investment are provided by the most expensive bottles from the most iconic producers. The trend also applies in Champagne where last year there was a decrease in the number of bottles sold, but an unchanged value for the total sales - the explanation here is also that the most expensive wines have become even more expensive. In this comparison, it should also be understood that Petrus is for Bordeaux what DRC and Domaine Leroy are for Burgundy!

Petrus has risen Three Times as much as the rest of Bordeaux

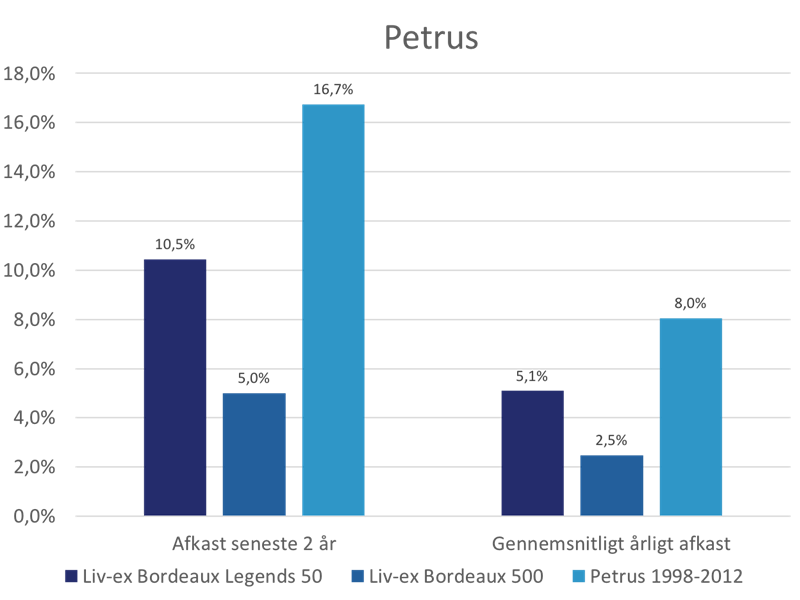

If this observation is scaled up to Bordeaux, the last two years’ price development will confirm the thesis. If a more general view is taken of Bordeaux, Liv-ex Bordeaux 500 has on average increased by 5.0 % over the last two years. At the same time, Liv-ex Bordeaux Legends 50 has over the same period increased by 10.5 %. The more exclusive wines have thus achieved higher price increases than Liv-ex's top 500. However, the trend is only further validated when looking at the best of the best.

Individual wines will increase the general price level of Bordeaux wines, and, in particular, Petrus has contributed to the increase in prices in the region. The prices of Petrus across all vintages from 1998 - 2012 has increased by 16.7 % over the past two years, which, on average, has provided investors with an annual return on investment of 8.0 %.

This development only confirms the observed trends mentioned above: The increasing demand for the most expensive bottles from the very best producers has led to price increases for precisely these wines - wines that at the same time are often only available in minimal quantities right from their release on the market.

Rare Wine Invest’s Opinion

The story of Petrus is fantastic as are many other great wine stories. Stories where short anecdotes together constitute the whole just as the many minor taste nuances together form a wine’s sophisticated experience.

However, Petrus differs and is, in a Bordeaux context, an attractive investment object. Petrus is one of the few Bordeaux wines that have provided attractive returns on investment in recent years and, if one wants to invest in Bordeaux, Petrus is the right choice.

Petrus has excellent potential and, when looking at the trends in Burgundy and Champagne, the latest year’s price increases at Petrus are probably explained thus: the most expensive and best have become even more desirable and have increased in price, and it is precisely in this category that Petrus belongs.

Despite a decline in interest for Bordeaux in general, we recommend continued investment in wines from the region - in fact, up to 10 % of the total portfolio. We do so precisely because of Petrus and, to some extent, Le Pin, since it is precisely these iconic cult wines that continue to draw attention and demand on the global wine market!

An investment in Petrus is for those of you who are looking for a solid investment in Bordeaux that can contribute to ensuring an optimally diversified portfolio.

Petrus may also be for those of you who are speculating in Bordeaux and believe in the continuing investment potential in Bordeaux.

Petrus is, in truth, an extremely rare wine that is known by many but tasted by few. Invest in Petrus, and you will invest in one of the best and most coveted wines - not just from Bordeaux, but throughout the world.

Rare Wine Invest sells the following Chateau Petrus wines for Investment:

| Vintage | Wine | Vol. | Unit | Qty. | Price* |

|---|---|---|---|---|---|

| 1982 | Petrus | 750 ml. | OWC12 | 12 | €4.600 |

| 1998 | Petrus | 750 ml. | Loose | 12 | €2.950 |

| 1998 | Petrus | 750 ml. | OWC6 | 12 | €3.100 |

| 2005 | Petrus | 1500 ml. | OWC3 | 12 | €8.000 |

| 2009 | Petrus | 750 ml. | OWC6 | 60 | €3.300 |

| 2010 | Petrus | 750 ml. | OWC6 | 24 | €3.300 |