Investment Tips - Champagne - 19. July 2019

We are celebrating Apollo 11 with an extraordinary Investment Tip on 2004 Krug Vintage

Apollo 11 was safely carried to the moon by Saturn V. The 2004 Krug Vintage is powered by a three-stage rocket as well, and you can board just before it launches!

We are celebrating Apollo 11 with an extraordinary Investment Tip on 2004 Krug Vintage

We will soon be celebrating the 50th anniversary of the Apollo 11 mission and one of engineering's greatest masterpieces, the Saturn V rocket, that sent the first man to the moon.

The rocket comprised just three powerful stages that should pave the way successively for Neil Armstrong's immortal quote: "One giant leap for mankind'.

There is no reason to fear that your future investment will end up on the moon, but just like the Saturn V rocket, 2004 Krug Vintage is also a mission, and with potential in the short, medium and long term, Krug is also a three-stage rocket that will release the huge investment potential of both Krug and Champagne.

Read more about the champagne mission and the rocket’s three stages when we focus on 2004 Krug Vintage as an investment.

Krug: The Best among the Biggest

Krug is among the absolute best premium champagnes from the biggest houses and offers some advantages from a wine investor’s point of view. The biggest champagne houses are backed by huge and exceptional marketing machineries with a capacity and willingness to participate and develop their respective brands for one simple reason: To be able to increase the price in line with the increasing value of the brand. Krug, owned by the French luxury conglomerate LVMH - a contraction of Louis Vuitton, Moët and Hennessy - since 1999 is no different in this respect.

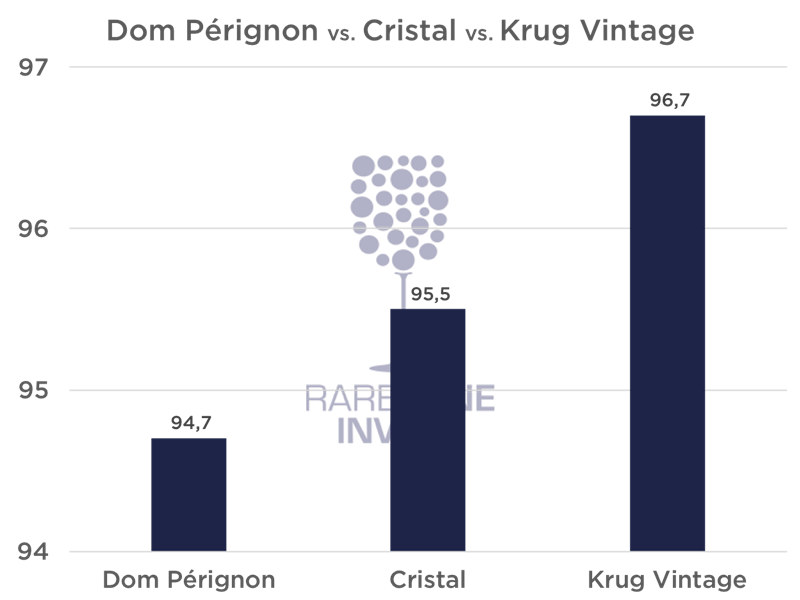

In terms of brand and size, Krug Vintage may best be compared with two of the other major prestige cuvées Dom Pérignon and Cristal. However, in terms of quality, Krug distinguishes itself and is at the level of the most exclusive of the small houses where quality comes before everything else and, in practice, Krug is at the level of the monumental Salon even though the production is many times greater.

Comparison of scores by Richard Juhlin across vintages released by all three houses (90, 95, 96, 00, 02, 04)

Comparison of scores by Richard Juhlin across vintages released by all three houses (90, 95, 96, 00, 02, 04)

In practice, this means that Krug delivers the best of both worlds: Sky-high quality that is usually only seen among the absolute best, small exclusive champagne houses such as Salon and the quantity and a strong brand at an attractive price, as is known for Cristal.

The Timing is Perfect since it will soon be too late

As is usual for Champagne, not all champagne of a new vintage is released at the same time. Instead, this is done continuously so that the house’s latest release is available on the market until the next vintage is released. Moreover, prestige cuvées are only produced for the best vintages, and 11 Krug Vintage vintages have been released over the past 20 years so that, roughly speaking, each vintage should last for two years before being replaced by the next.

2004 Krug Vintage, the latest released vintage, was launched on the market in September 2017 and is approaching its second anniversary of the release. 2006 Krug Vintage will be the next newcomer and is expected to hit the market in September of this year - approximately two years after the release of the 2004 vintage.

Krug Vintage 2004 is the least expensive Krug on the market, and there are only a few months before the launching of the 2006 vintage - a launch that Krug is expected to exploit as an opportunity to increase the prices.

This means that, in line with Krug’s usual practise, they will soon report that the 2004 vintage is sold out and replaced instead by the new 2006 vintage. When Krug no longer releases more of the 2004 vintage, the open market will be allowed to freely set the price, while the available quantities will only become more scarce, which historically has been the starting signal for price increases. That is why the end of a release period is often a good time to invest - especially if the next vintage is of high quality or is expected to be more expensive.

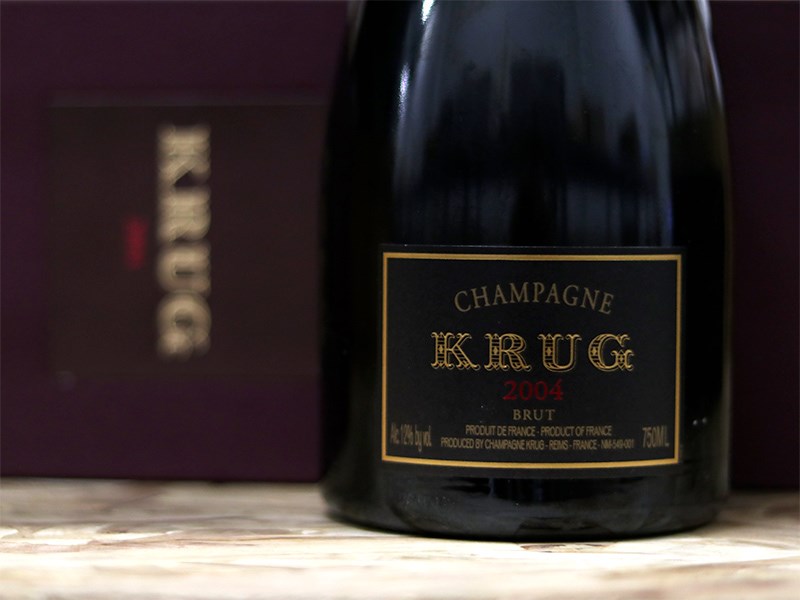

2004 Krug Vintage

2004 Krug Vintage

In the Shadow of Cristal and Dom Pérignon - but only for a little longer

While we have experienced price increases for many of the large champagnes during the last 12 months, Krug has, in contrast to the usual practice, been the exception. However, this is not a coincidence, and the reason for the lack of price increases is probably to be found in Krug’s being amongst those that have not yet released their 2008 vintage. Krug has in fact not released a new vintage for almost two years. During this time, Dom Pérignon and Cristal’s releases of the 2008 vintage has attracted much attention with a level of hype that has never before been seen in the champagne world. A hype that has led to significant price increases in the surrounding secondary vintages and a hype that has not so far been seen for Krug.

Krug 2004 - a Mission

2004 Krug Vintage has a great potential, which can be divided into three stages. Three stages that, just like the Saturn V rocket’s three stages, take over successively and can give renewable buoyancy to 2004 Krug Vintage for many years in the future.

Stage 1: Low Price and soon to be Sold Out

2004 is right now the least expensive Krug Vintage on the market and is also substantially better rated than the closest competitor, 2003 vintage. That 2003 is more expensive than 2004 should probably be attributed to precisely the fact that 2003 was sold out some time ago directly from Krug.

| WINE | SCORE* |

|---|---|

| 2004 Krug Vintage | 96.3 |

| 2003 Krug Vintage | 95 |

On top of this, there will be a second upside in the early release of 2006 Krug Vintage that is expected to be more expensive than both the 2003 and 2004 vintages. This could affect prices positively for the Krug Vintage vintages that are priced lower than the forthcoming 2006 Krug Vintage. Add to this Krug’s reporting that the 2004 vintage is sold out that, as mentioned previously, should be the starting signal for price increases.

Stage 2: Everyone is waiting for the 2008 Vintage

For the last year, the champagne scene has been dominated by one spectacular 2008 release after the other - the legendary vintage from all the best producers that has been keenly awaited by the world's champagne connoisseurs. Everything has merged into a higher unity with one soaring score after the other, and prices have in record time been traded up to an unprecedented high level.

Although some of the most prominent names such as Dom Pérignon and Cristal have already released their 2008s, we are still eagerly awaiting the great 2008 releases of Salon Cuvée "S", Pommery Cuvée Louise, Bollinger RD and perhaps the most important: Krug Vintage.

There is no doubt that the past few years have shown how much the world has been keenly awaiting the great 2008 champagnes and, not least, the price that champagne drinkers are willing to pay for a legendary vintage. Krug is expected to release their 2008 Krug Vintage in 2021/2022 and will thus be one of the last of the big houses to release the monumental vintage. Therefore, it looks as though Krug Vintage will be the grand finale of the 2008 bonanza, a show that actually started with the release of 2008 Cristal and has been the most spectacular in the history of Champagne.

2008 Krug Vintage will in itself be attractive when it comes, but right now the prospect of this release gives a large potential upside to the 2004 Krug Vintage. The forthcoming 2008-release WILL put Krug on the front burner and direct all attention towards Krug and what could be the best Krug vintage ever. At that time, the 2004 Krug will have been replaced by both the 2006 and 2007 vintages, and it will be difficult to obtain large quantities. With a predictable increasing price level for the future releases as the release of vintage 2008 approaches, we also expect increasing prices across the board for Krug Vintage and, when the 2008 vintage hits the market, the 2004 vintage will be an attractive alternative to the 2008 vintage. If the price of the 2008 vintage at that time is € 400, it is by no means unrealistic to expect that the 2004 vintage will be traded at a price of over € 350.

2004 Krug Vintage with a gift box - price per bottle €

2004 Krug Vintage with a gift box - price per bottle €

Stage 3: A Champagne Explosion

The UK has historically been Champagne’s most important export market as well as being the second largest champagne market after France, while the United States and Japan respectively are in third and fourth place.

The interest in champagne is, however, experiencing explosive growth in the new champagne markets that include some of the world's largest economies and, with annual increases in champagne exports to large markets such as China, Hong Kong, and Russia of over 10% per year, champagne has a huge unresolved potential.

Although the traditional champagne markets are still very active, it is, however, equally interesting to see what is happening in the champagne development markets that provide extremely attractive indications through strong growth measured in terms of value in 2018:

Growth in Champagne Exports from 2017 to 2018

| COUNTRY | VALUE INCREASE* |

|---|---|

| Hong Kong**: | +14% |

| China: | +12% |

| Russia: | +10% |

*Source: Champagne Committee. Read more here: Champagne sales creep to new record in 2018

**Hong Kong is the centre of the South Asian wine trade and sales on this market are indicative for the whole of south-east Asia.

Although the market for champagne in these new markets is relatively limited compared with established markets, the trend is unmistakable and, with two-figure growth rates in some of the world's largest economies, it looks as though there will be a new golden age of champagne.

Hong Kong is Asia's wine-heart from which wine-trends spread out, and it can, therefore, be argued that growth in champagne sales here is an indication of the mood in the whole of south-east Asia.

China fell in love with Bordeaux in the 80s and has, during the last 10 years, discovered Burgundy, and all indications are that Champagne will be the next Chinese-French love story.

Russia is also interesting, and the contrast-filled country houses a large group of people with considerable purchasing power and a bent toward extravagance and luxury.

These figures are not unknown to the LVMH Group that currently invests billions in the marketing of their luxury products and they will do their utmost to ensure that Krug will be as strong as possible in these new markets.

Ongoing Consumption provides fair winds for Price increases

We have a considerable focus on champagne, and we have particularly high expectations for Krug. Champagne is on the rise and, although we are not close to seeing the same popularity of the sparkling droplets as we see with Burgundy and Bordeaux wines, we expect that it is here that the most sound investments can be found in the future.

Besides, there is not the same tradition for storing champagne and, with considerable ongoing consumption at restaurants, nightclubs, on better airlines and in private homes the world over; there is very much talk of a product where the supply decreases for every day that passes.

Clear evidence that champagne is drunk and disappears faster than most other wines is seen in that 10 years after the release of a Bordeaux 1st cru, it is probable that less than 25% of the production has disappeared. With champagne, it is just the opposite, and a good guess is that 10 years after the release of a champagne prestige cuvée, under 25% of the production remains that has not yet been drunk.

In practice, champagne often disappears before champagne lovers, collectors and investors discover that it is gone, which also applies in particular to the best champagnes from the biggest houses that are consumed both daily and at parties.

Rare Wine Invest’s Opinion

In general, we strongly recommend Krug, but right now we see increased potential in the 2004 vintage of the mighty Krug Vintage in particular.

Krug Vintage is the absolute best prestige cuvée on a level with the legendary Salon, but still enjoys the benefits of being from a large house with a huge marketing machine behind it with the capacity to increase the demand for Krug in particular.

The transition between the 2004 and 2006 vintages provides perfect timing for investors to exploit an optimum between price and supply before the 2006 vintage hits the market and provides Krug with an opportunity to raise the price.

The lack of price increases means that the price of Krug has decreased relative to Dom Pérignon and Cristal during the last 12 months and, in that light, Krug is right now unusually cheap. Krug Vintage is a classic investment wine, and is, in the current situation, an obvious investment with a sound potential.

The best potential is nevertheless assessed to lie with the forthcoming release of 2008 Krug Vintage that is likely to be the grand finale of the spectacular 2008 bonanza that will raise the prices of all newer vintages of Krug

Climb aboard Krug's version of Saturn V and invest in 2004 Krug Vintage

2004 Krug vintages are right now only available in a limited quantity and are, therefore, sold on a first-come, first-served basis.

| VINTAGE | WINE | VOL. | PACKING | QUANTITY | PRICE* |

|---|---|---|---|---|---|

| 2004 | Krug Vintage Brut | 0.75 | OC6 | 180 | € 177.50 |

Maximum order: 60 bottles

Minimum order: 18 bottles