Investment Tips - Champagne - 14. July 2022

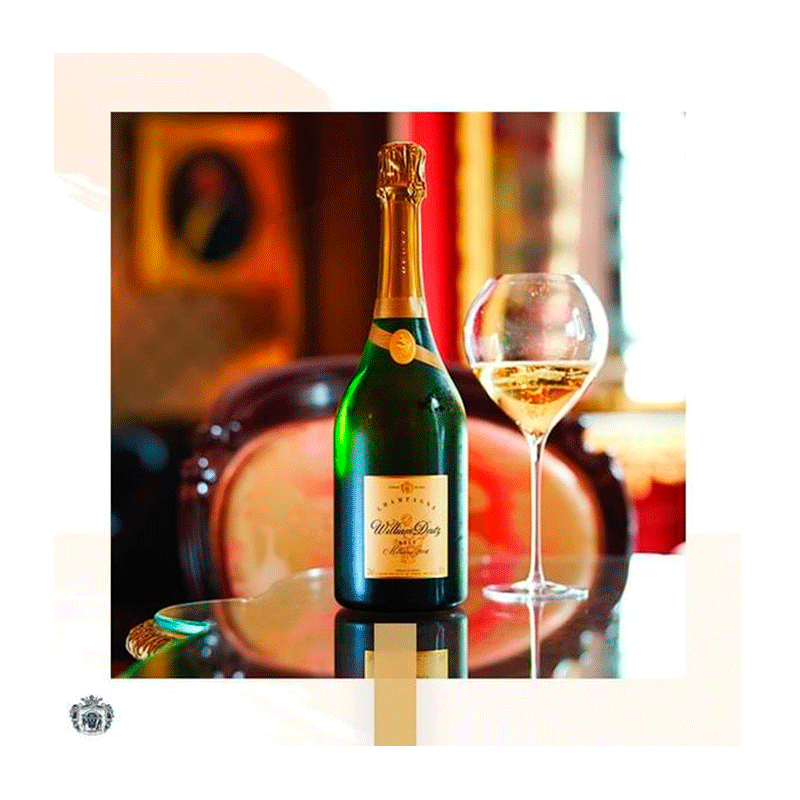

2013 Cuvée William Deutz - Prestige Cuvée At A Favorable Price

Richard Juhlin places 2013 among the house's best. Its predecessor has seen great returns, and the starting point is almost identical. Read more about the potential.

Deutz Cuvée William Deutz is a prestige cuvée, released only in the years when the quality is good. The 2013 vintage is the latest release from the house and the last time the world enjoyed a release was with their 2009 vintage. Of the new release, Richard Juhlin says: "One of the vintage's real hits."

And indeed, Richard Juhlin's refined taste buds and accompanying judgements will be consistent throughout the present investment tip. Indeed, he places the 2013 vintage among the best from the house. And right now, you can get it for the lowest price in the world based on information from wine-searcher.com.

Learn more about Champagne Deutz and see how it went last time we had William Deutz for investment. See also a comparison between Dom Pérignon, Cristal and William Deutz and assess the potential yourself.

The History Of Champagne Deutz

Cuvée William Deutz is a tribute to the strong and charismatic founder of Champagne Deutz. A wine of great character, based on the fundamental principles that have always characterised Deutz. A wine with a base of pinot noir, which is only released after approximately 10 years in the cellar. A wine where time has built up the quality to the very top.

Cuvée William Deutz has been the prestige cuvée of the house since the first vintage in 1961. Since then, other products have been added, but this is still considered the house prestige cuvée. Jean Marc Lallier is the latest member of the Deutz family to carry on the dynasty. He ensures that the style and quality are maintained at the high level that has characterised Deutz since its foundation in 1838. In the early 1990s, the Rouzeau family bought into Deutz - only to stabilise and reinforce the already immanent quality. The Rouzeau family also owns Louis Roederer and several other top wineries, ensuring financial stability and the foundation for the house to continue working on its own formidable identity.

The Founding Of The Deutz Dynasty

In 1838, William Deutz and Pierre-Hubert Geldermann founded what later became Champagne Deutz. From the beginning they built up good markets in Germany, England and France, while Deutz also helped to found the "Syndicat des Grandes Marques", which since 1882 has looked after the interests of the biggest and best houses in Champagne.

But times became difficult at the beginning of the 20th century. World War I, the depression and 2. World War also left their mark on Deutz. For a long time the family fought a hard battle for the family business as well as to keep the quality high.

Champagne Deutz Cuvée William Deutz

Champagne Deutz Cuvée William Deutz

The Turning Point Came With The Rouzeau Family's Contribution In 1993

Today, Deutz still owns almost 40 hectares of vineyards in Grand Cru classified villages. Furthermore, they source 80 % of their grapes from contracts with families they have traded with for generations. For the Deutz family, the quality of the grapes has always been a priority, so this collaboration is continuously nurtured throughout the year. The vast majority of grapes used for all wines in the range come from Grand Cru or Premier Cru vineyards. And this helps to ensure the high quality that is the hallmark of the prestige cuvée.

2013 Cuvée William Deutz: Favourable Entry To Investment In Prestige Champagne

The 2013 Cuvée William Deutz scores 96 Juhlin points and costs € 105*, which is the lowest price in the world according to wine-searcher.com.

Another interesting perspective is a comparison with some of the big players from Champagne. For comparison, the 2013 Cristal also scores 96 points from Richard Juhlin but is valued at € 235* by RareWine Invest.

2012 Moët & Chandon Dom Pèrignon (2012 is used for comparison as 2013 has not yet been released) also scores 96 points. This is rated by RareWine Invest at € 200*.

The world is obviously a bit more nuanced, but it is still interesting, from an investment perspective, that at Deutz you can get a prestige cuvée of comparable quality, at half the price compared to Dom Pérignon and Cristal.

Does that make Dom Pérignon and Cristal bad buys? Not at all. Does it testify to a heightened potential in Deutz? Absolutely.

* Per bottle ex. VAT and tax, in whole cases and perfect condition.

Great Returns On 2008 William Deutz

The first (and only) time we at RareWine Invest offered William Deutz for investment was back in April 2021. This was the 2008 vintage, which is universally known as a mythical vintage in Champagne. If you invested then, today you have achieved a return of 26 % - this in just over a year.

Juhlin also awarded the 2008 vintage 96 points. He did the same with fabulous vintage 1996, while vintage 1988 "only" got 93 points. According to wine-searcher.com, the minimum price of the 1996 William Deutz is currently € 246* (average price: € 461), while the minimum price of the 1988 Willian Deutz is € 644* (average price: € 648). And here, of course, it must be taken into account that these bottles did not cost € 105 in their young years.

So here we have a 2013 vintage, valued at the same level as the great vintages, but at a very attractive price. Moreover, the 2013 is still so new on the market that only Juhlin* has tasted it. So even if historical returns already testify to an underpriced prestige cuvée, scores from James Suckling, Vinous and Wine Advocate may add a potential upside to the 2013 William Deutz.

* Per bottle ex. VAT, in whole cases and perfect condition.

Rarewine Invest's Opinion

This is in fact a very classic example of a wine investment. The price is favourable and actually the lowest in the world. And the rating from Richard Juhlin places the 2013 William Deutz among the absolute best from the house - and indeed among great prestige cuvées like Cristal and Dom Pérignon.

With the 2008 vintage, we argued that here you could invest in one of the greatest Champagnes from Champagne Deutz of all time at the world's lowest price. And the returns on this one has proven our arguments valid. The same arguments apply here.

So, this is a cheap entry point to investing in prestige cuvées from one of Champagne's long-established houses, and on top of that it is the opportunity to get in early. We only have less than 500 bottles available, so as usual it is first come first served.

Invest in 2013 Deutz Cuvée William Deutz

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL. | PACKING | PRICE/BTL* |

|---|---|---|---|---|

| 2013 | 2013 Deutz Cuvée William Deutz | 750 ml. | OC6 | € 105 |