Market Analysis - Champagne - 24. November 2022

Analysis: The Prospects In Champagne - Will The Corks Pop In The Future?

Champagne faces the difficult task of supplying future wine markets with sparkling drops.

If you are one of our loyal readers or have been an investor with us for some years, our focus on champagne as a category is not new to you. And in recent years, it certainly has not been boring to be exposed to the sparkling drops, while we have been happy to see our predictions play out in the real world.

See our previous market analysis here.

The year has barely passed, but already we dare to say that 2022 has been another strong year for Champagne, with impressive growth rates that many investors can enjoy due to our strong focus on this particular category.

When everyone was shouting about Bordeaux 10 and 15 years ago, we were looking toward Burgundy. While the rest of the wine world was waking up to Burgundy, we started to look even more at Champagne because of what we saw as great potential and untapped markets.

But what does the future look like for Champagne? What about the Chinese? The future supply? The production? The prices? We have taken a look at that below.

Background: Covid And Champagne

The strong performance of Champagne in recent years is partly due to some turbulent years for Champagne producers. Covid has caused trouble, but several elements have helped bring the Champagne market to where it is today. For example, in the summer of 2020, we reported that rising costs could drive up the price of Champagne, as the product's price has not kept pace with rising production costs. At the same time, the Covid epidemic brought supply difficulties, and shortages of something as basic as packaging made it difficult for producers to meet demand, leading to empty stocks at significant distributors.

Covid famously closed the world, and on-trade sales of Champagne inherently came to a standstill as restaurants, nightclubs, and bars closed. According to the Champagne Committee, demand by volume for Champagne fell by as much as 18 % in 2020.

However, the trend reversed in 2021: consumers could not spend money on, for example, travel and restaurant visits, government aid packages stimulated the economy, and sales of luxury goods to sweeten life in the Corona world exploded. The number of bottles sold rose to 322 million in 2021, a 32 % increase in 2020, when exports set a new record with as many as 180 million bottles shipped across France's borders - in a year that was, notably, partly plagued by shutdowns.

Sales are reported to have increased by +13.8 % in volume terms in the first half of 2022 compared to the same period in 2021, but we will know in a few months how Champagne sales fared in 2022. However, judging by early reports on demand and price increases in the secondary market, it seems likely that the Champagne Committee will report another record.

The Champagne Committee reported that Champagne sales in 2021 were € 5.5 billion.

Champagne Drought And Champagne Supply

The price increases of Champagne in recent years are, not surprisingly, driven by supply and demand. Demand, as described above, was initially low and subsequently massive. On top of this, from vintage 2013 onwards until vintage 20211, the permitted harvest yield in Champagne has been below the average permitted supply between the 2007 and 2022 vintages. This means that on top of high demand, there has been lower harvest yield and, therefore, lower stock levels for years.

For example, in the 2020 vintage, the authorized yield was as much as 23.6 % lower than the average since 2007, which has significantly impacted the ability of Champagne houses to bring non-vintage (NV) Champagne onto the market quickly. Product and storage requirements are loose for a non-vintage champagne. Therefore, under normal circumstances, NV champagne could be brought to the market quickly to meet part of the demand.

For the 2022 vintage, the authorized harvest yield was set at 12,000 kg/ha, which is the highest since the 2008 vintage (12,400 kg/ha) and represents +14.6 % compared to the average since 2007.

But what does this mean for future champagne investments? Vintage Champagne, as we know, must be left in fermentation for at least three years, while the great cuvées are often left for 8-10 years and sometimes even longer. In other words, there is a long time before this increased production will result in increased volumes on the market compared to now.

One consequence of this trend has become mainly concrete and topical at Moët Hennessy, where CEO Phillippe Schau told Bloomberg in an interview earlier this month that Moët is running out of Champagne and that 2022 will be a "fantastic" year for Champagne sales.

The apocalypse is hardly imminent, and I wonder if Moët can still find a case of Champagne or two in its warehouses. But the message and the numbers are unmistakable, and there is no quick and effective solution to the supply problem. A 14.3 % increase in yield in 2022 may sound like a lot, but even if that extra portion could hit the market tomorrow, it would be just a drop in the ocean. At the same time, yields cannot be increased indefinitely either. If this happens, there will be consequences for quality, and the exclusive brand of Champagne will be diluted.

Although the Champagne Committee seems to be taking the consequences of this development, Champagne is a supertanker that cannot be turned around overnight

1: Except for the 2018 vintage, which was 3.1 % above average.

Luxury Goods Sales In Times Of Crisis

With both geopolitical and economic turbulence in the world markets, investing in luxury goods can seem counterintuitive. After all, if the crisis hits, the economy stalls and people become poorer, surely no one will buy (and for wine and spirits, consume) luxury goods and thus help drive up prices? But is that really the case?

According to Milton Pedraza, CEO of the Luxury Institute (a company specialising in market analysis), luxury brands are often isolated from economic downturns1. The Pareto principle, also known as the 80/20 rule, also applies here, and Pedraza estimates luxury companies will feel economic downturn as 80 % of their customers are "nearly affluent", or partially wealthy, but that this group accounts for the smallest share of sales. On the contrary, the largest share of these companies' revenues depends on about 20 % of their customers - the "very rich" and the "ultra rich", two groups that are highly crisis-resistant. Therefore, crises and economic downturns rarely hit luxury companies as hard as other players. For example, it does not take much searching in the international media to find that low-cost chains such as Walmart, Gap and Target are reporting falling sales. In contrast, LVMH, for example, reported organic sales growth of +21 % in the first half of 2022 compared to the previous year1, while Hermes International (another luxury mastodon) was able to report 24 % growth in October2, compared to 2021, which was already a strong year.

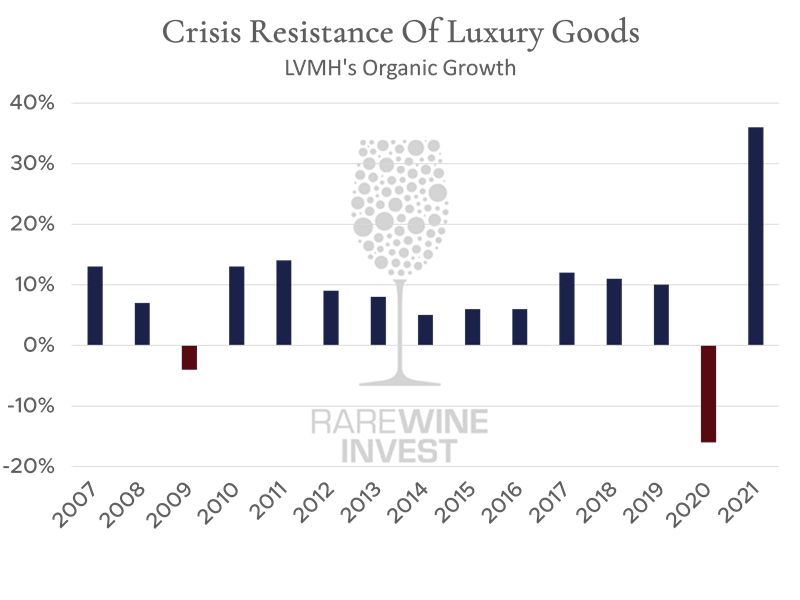

A good picture of the above is provided by a look at the organic year-on-year growth of LVMH, by far the luxury category's market leader:

Source: Bloomberg, LVMH Annual Reports

The strongest buyers are resistant but not immune to economic downturns, and so is LVMH. That said, the crises do not seem to hit hard. The financial crisis produced negative growth of a modest 4 %, and LVMH bounced back strongly the very next year. However, the Corona crisis hit the LVMH group harder, partly due to shutdowns which alone reduced the group's sales of wines and spirits by 15 %3. But what a rebound.

At the same time, it is relevant to look at the challenges markets are facing. For the Western world economy, inflation is the big headline. In the US, it is driven by demand and employment rate that is not easily shaken. In Europe, it is basically driven by the energy crisis and a troubled neighbourhood to the east. The only question is whether sales of luxury goods will be hit hard if we face an economic downturn. The above does not exactly suggest so.

3:https://www.lvmh.com/investors/profile/financial-indicators/#groupe

How Champagne Managed During the Financial Crisis

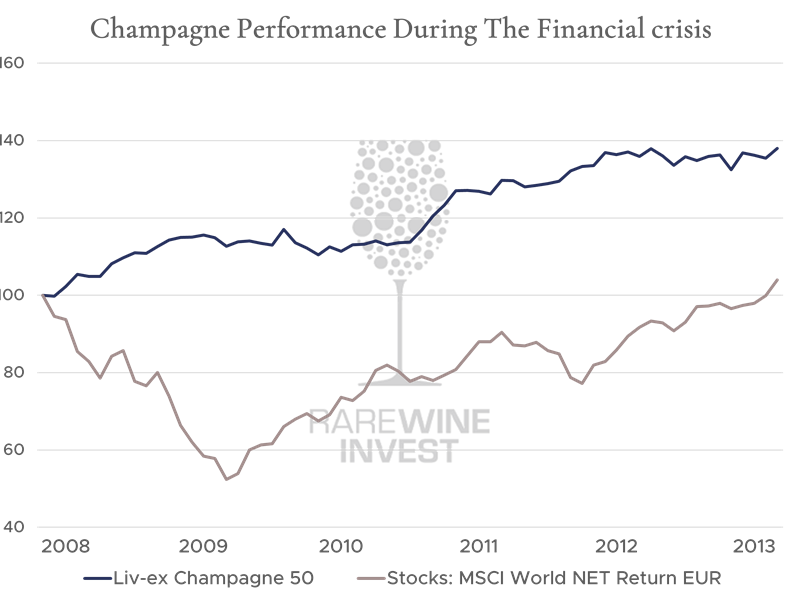

In extension of the above, it is also relevant to take a look at how Champagne prices specifically evolved during the Financial Crisis. Champagne prices, and thus demand, increased during the Financial Crisis, thus supporting the thesis that consumers of luxury products are not affected by the crisis to the same extent as the general consumer.

During the Financial Crisis, the Liv-ex index Champagne 50, which is the broadest way to track Champagne's performance in a historical perspective, performed brilliantly. While the stock market almost halved1 from November 2007 to April 2009 and only reached full recovery in spring 2013, the Champagne 50 rose by 38.0 % over the same period.

1:Based on MSCI World, NET Return, EUR

China Could Dramatically Increase Demand For Champagne

From the above perspective, there is no doubt that the demand for Champagne is enormous. But the Chinese can put even more pressure on demand. China is a vast untapped market that tends to look towards the West and aspire to Western lifestyle and luxury. First, Bordeaux was the go-to area, then Burgundy gained immense popularity, and one might wonder if Champagne could become even more significant, just like we see in the West?

The premise is there, but the expectations for the growth of China's wine market are even more interesting. According to the analysis and consulting firm GlobalData, the market for wine in China will almost double by 2026. In the analysis's forecast, the market will grow from $ 42 billion in 2021 to $ 72.2 billion in 2026, equating to an average annual growth of 11.5 %. Growth is forecast to be led by still wine, while the sparkling wine category is estimated to grow by 11.3 % on average per year to 2026.

Growth is expected to be driven by China's millennials and Gen Z1 as they gain purchasing power and become the wine drinkers of the future.

Champagne belongs to the luxury segment, and luxury is undoubtedly no stranger to the Chinese. According to US consultancy Bain & Company, Chinese consumers spent more than $ 73.6 billion on luxury products in 2021, up 36 % from 2020. Furthermore, it is estimated that in 2025 China will be the world's largest market for luxury products.

According to the Union des Maisons de Champagne2, China was just the 14th largest export market for Champagne in 2021, 93.8 % smaller than the US, which is reported as the largest - and only marginally larger than Denmark, for example.

After a few years of abnormal price trends in the Champagne category, it is hard to imagine the same trend continuing. Yet demand in the West seems in no way to be abating, while supply problems are by no means solved in the short term.

Champagne trade associations and producers seem to be taking several steps to ensure future supply, but it is hard to see how the supply will match demand in the shorter term. In the longer term, supply may increase, but fine wine developing countries, led by China, may again make it difficult for producers to keep up. If this happens, the market can only respond in one way, and that is, as we have seen in the last few years, with rising prices.

1:Millennials or Gen Y is the demographic cohort describing individuals born from the early 1980s to the early 2000s. Gen Z, or Zoomers, comes after Gen Y and describes those born in the late 1990s to early 2010s.

2: Also often referred to as "Grandes Marques," a trade association alá the Champagne Committee