Investment Tips - Italy - 8. June 2023

2015 Biondi-Santi Brunello Di Montalcino: Best Riserva In Monumental Vintage

Italy outperforms the broad market and Biondi-Santi is one of the really exciting producers in this category.

Biondi-Santi is one of Brunello di Montalcino's most famous, most recognized and most respected producers. The house's top wine is their Brunello di Montalcino Riserva, which is only produced in the absolute best vintages and only in approx. 15,000 bottles when it finally happens, which in other words means that with the new 2016 vintage only approx. 165,000 bottles in this millennium!

Biondi-Santi has the name, they have the story and they have the product. Biondi-Santi can become big - really big.

Find out why below.

The World's First Brunello

It is rare that a wine style/category can be traced back to a single man. However, this is the case with Brunello di Montalcino, which was created by Clemente Santi in the mid-1800s. The grape was sangiovese and the name became Brunello, with reference to the brownish color. For those interested in wine, the history of Biondi-Santi is rich and interesting to delve into, even though this investment tip is primarily for commercial purposes. If you want to delve into the history of Biondi-Santi, you can do so in our in-depth portrait here: Biondi-Santi – The epicenter of the iconic Brunello di Montalcino

The Best Of The Best

Biondi-Santi is widely recognized as the house behind some of the best Brunello di Montalcino. At Biondi-Santi, the flagship is their Brunello di Montalcino, which can therefore be considered the best of the best.

The 2015 vintage, which has recently been replaced by the 2016 vintage as the newest vintage, has been awarded towering scores by the most important critics:

- Wine Advocate: 98+

- Vinous: 97

- James Suckling: 97

This gives an average of 97.3 points, which is only marginally surpassed by the 2016 vintage with 97.7 points on average*.

Unsurprisingly, Biondi-Santi has produced exceptional wine from these two benchmark vintages, which will no doubt be vintages wine lovers will seek out and return to whenever possible.

*Points for year 2016: WA: 99 VI: 96 JS: 98

Wine Advocate: Unconditionally The Best Brunello Di Montalcino Riserva From The Entire 2015 Vintage

Wine Advocate, started by Robert Parker, can rightly be considered the overall most influential wine media in the world. Wine Advocate has tasted and rated 58 Brunello di Montalcino Riserva wines from the 2015 vintage. In this tasting, Biondi-Santis Riserva has landed alone at the top with its 98+ points, closely followed by Canalicchio di Sopra, Fuligni and Poggio di Sotto whose Riservas are the only three who have got 98 points.

If we do the same exercise with vintage 2016, Poggio di Sotto's Riserva has received 100 points, while Biondi-Santis is the only one out of the 79 evaluated wines to have received 99 points.

For Vinous, Le Potazzine's Brunello di Montalcino Riserva vintage 2015 tops with 99 points, closely followed by Biondi-Santi’s with 97 points. No wines here have received 98 points.

This manifests not only that the 2015 Biondi-Santi Brunello di Montalcino Riserva is, according to Wine Advocate, the greatest Riserva from this monumental vintage, but also that Biondi-Santi belongs at the very top.

How has Biondi-Santi Riserva Performed?

In October 2022, we had the pleasure of offering this wine for investment for the first time. Back then it cost €400*, which it still does today. This is not surprising, since a wine of this nature, a little "inflow" should be expected - however, it would be strange that the price of this particular one should not change.

According to Liv-ex, the last 10 vintages that have been on the market for a minimum of five years have, over the past five years, yielded an average return of 65.5%, which corresponds to 10.6% in average annual return during the period.

This in itself can be characterized as a good case, but the future for Biondi-Santi looks extremely exciting.

*Price per bottle, ex. customs, tax, and VAT, in complete boxes and in perfect condition

Brand Power And An Owner With Will And Resources

In 2020, Biondi-Santi managed to enter Liv-ex's Power 100 list, which is an attempt at a holistic inventory of the world's most sought-after wines, measured on various parameters such as price development, turnover in value and volume, overall brand value, etc. In the latest list from 2022, however, Biondi-Santi has dropped out of the top 100, which should not be seen as a danger signal – Biondi-Santi is flanked by producers such as Solaia, Emmanuel Rouget, Beychevelle and Clos de Tart, who were also pushed out of the top 100 in the 2022 list. Being on the list and lying right on the border just proves that the producer plays in the finest league - not only with the wine connoisseur's recognition, but also in a commercial perspective.

In addition, the family-owned consortium, EPI, took over the majority of shares in Biondi-Santi in 2016. In addition to ownership of several luxury-related brands, EPI also owns Charles Heidsick Champagne, Piper-Heidsick Champagne, Rare Champagne, Chateau La Verreie, the Rhone merchant Tardieu-Laurent and others. But most importantly; EPI is managed by 45-year-old Christopher Descours, who has taken over from his grandfather who created the group. Christopher Descours has a past in the financial world, and he's hungry. Read more about EPI here.

A sign that there is a will to push Biondi-Santi forward and that Biondi-Santi "is something" was also shown when the Italian men's national football team celebrated their European Championship Cup victory in 2021. Here, among many good Italian alternatives, Biondi-Santi was served.

The Italian Wines Are Attractive And Crisis-Resistant

As we have previously reported, the tumultuous conditions on the world market caused by war in Europe and sharp interest rate increases have also affected wine prices. Some wines have experienced minor corrections, while some stagnate. But if we look at the past year, the Italian wines have actually outperformed the wider market quite considerably.

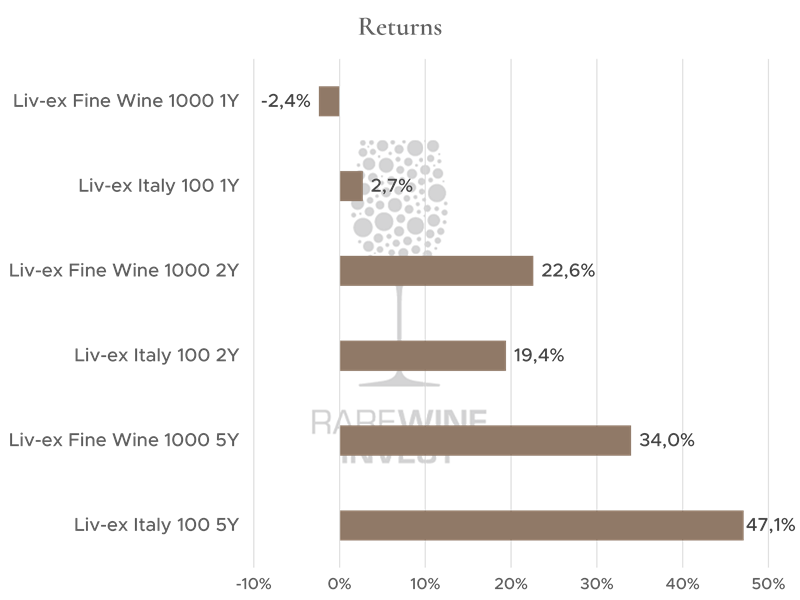

But Italian wine has not only been a defensive category that performs well in stormy weather. In the following diagram, you can see returns on Liv-ex's index Italy 100 and the broad Fine Wine 1000 in one, two and five years:

Source: Liv-ex

Source: Liv-ex

If you want to read more about what the future looks like for investment in Italian wine and not least see how they have performed in difficult times, you can read more in our in-depth analysis: Investing in Italian wine: What does the future look like?

RareWine Invest’s Opinion

Biondi-Santi has a long and rich history, but only in the last 10-15 years has it really set out in the overtaking lane on its way to the top. EPI, which owns Biondi-Santi, has both the will and the strength to push Biondi-Santi to the forefront.

The historical returns confirm the case, while the great potential lies in the future. We have long advocated investment in Italian wine – here we are dealing with the ultimate Brunello di Montalcino from one of the greatest Brunello vintages in history.

In addition, you still have the opportunity to enter before the price has moved. Now vintage 2016 has taken over as the latest vintage on the market and all factors are thus present for the price to rise.

Biondi-Santi has the name, they has the story and they have the product – now there is only one path for Biondi-Santi, and that is towards the stars.

Invest In The 2015 Biondi-Santi Brunello Di Montalcino Riserva

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2015 | Biondi-Santi Brunello di Montalcino Riserva | 750 | OWC3 | € 400 |