Investment Tips - Bordeaux - 21. December 2023

2015 Petrus | Wine Perfection With 2 X 100 Points

Bordeaux is back, and price corrections offer favourable investment opportunities for one of the world's most iconic wines.

“But, with the devil in all the many details that are involved in the pursuit of wine perfection, if anyone has that devil by the horns, it is this incredibly talented young winemaker.”,

- Wine Advocate

The talented young winemaker referred to here is the winemaker behind the iconic Petrus. And the quote comes from Wine Advocate's review of the 2015 Petrus, which with its 100 points represents wine perfection. Petrus is a bucket list wine for all connoisseurs, and the 2015 vintage represents some of the best Petrus of this millennium.

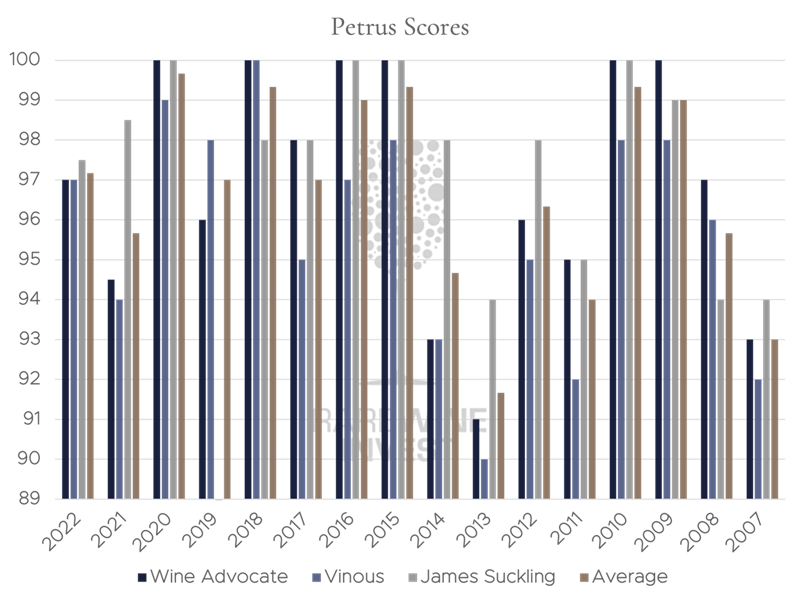

Petrus has been awarded 100 points 12 times by Wine Advocate, which just cements how cool Petrus actually is. But it is rare that two wine critics award perfect three-digit scores to the same wine. That is the case with the 2015 Petrus.

At the same time, the current market offers an extremely interesting opportunity for wine investors... Read more here.

Bordeaux Is Back

At this point, no one can doubt that various factors worldwide have created a turbulent market. And this has meant that we are currently in the midst of a correction in the world of wine as well. Liv-ex has recently published their famous Power 100 list, which chronologically lists the 100 wine brands that have performed best in the past year in terms of trade value and traded volume, among other things.

This year's report highlights "Flight to Quality", which refers to when an investor begins to shift their asset allocation away from risky investments and into safer ones - for example, from stocks to bonds. In the world of wine, this means that more collectors shifted their focus towards high-quality wines - either in terms of brand or vintage. It also means that Bordeaux is the region with the most new Liv-ex Power-100 representatives on the 2023 list.

And according to Liv-ex, Bordeaux is the natural winner here. It represents the least risky market there is. It is the most well understood and collectors know what to expect from Bordeaux wines.

2015 Petrus - 2 X 100 Points

2015 Petrus - 2 X 100 Points

Petrus - A Lighthouse In Pomerol. An Icon Around The World

When it comes to Bordeaux, Pomerol, in particular, plays a big part in acting as an arena for some of the area's - indeed, the world's - absolute best wines. Pomerol is home to Le Pin, Chateau Latour and Petrus. And especially the latter has conquered the whole world. And even though our recommendation at RareWine Invest rarely includes Bordeaux wines, there are always exceptions.

Petrus is one such exception.

Although Petrus' roots stretch back to 1750, when Château Gazin sold some vineyards to the estate, it was not until 1878 that Petrus and Pomerol really came into the limelight, when Petrus refined itself to gold status at the World Exhibition in Paris.

Until 1929, the property belonged to the Arnaud family, but they decided to sell Petrus to Madame Edmond Loubat. She was already the owner of smaller properties in Pomerol and Libourne's finest restaurant. Around the end of the Second World War, Loubat entered into an agreement with Jean-Pierre Moueix to assist with the distribution and production of the wines.

Loubat was not only a quality-conscious winemaker; she was also exceptionally visionary. She firmly believed that Petrus possessed the qualities required to belong to the elite of France's wines - and she wanted to prove it to the world. At the coronation of Queen Elizabeth II, she even sent a case of Petrus to Buckingham Palace, which is said to have greatly impressed the monarch.

After Madame Loubat's passing, her niece briefly took over management of the property, but in 1964, Moueix became the owner of Petrus. If the Moueix name sounds familiar, it may well be because Christian Moueix (son of Jean-Pierre) later founded the world-famous Dominus Estate in Napa Valley. The Moueix family still owns the majority of Petrus, although in 2016 they sold 20% of the property to Colombian investor Alejandro Santo Domingo for the considerable sum of 200 million euros.

Today, Petrus is one of the world's most coveted wine brands. The reason for this is their consistently high-quality wines. In addition, only around 30,000 bottles of Petrus are produced per vintage. And 30,000 bottles do not do the job in a Petrus-hungry market.

2015 Petrus: 2x Triple Digits Cement Perfection

Although Petrus has achieved star status due to consistently high quality, there are vintages that stand out from the rest. And one such vintage is 2015. Wine Advocate awards 100 points, as does Vinous. James Suckling awards 98+ points, so the final score across the three critics' ratings is 99.3 points.

In this millennium, it lands on the same high level as the 2010 and 2018 vintages, although the small '+' from James Suckling places the 2015 a whisker ahead of the others. 2020 takes the top spot on the podium. However, it is worth noting that both Antonio Galloni and Neal Martin from Vinous have tasted and rated 2020 Petrus at the same time. Galloni scores 100 points, while Martin scores 98 points. The top spot on the podium above is therefore based on the 100 points, while the podium spot would go to 2015 if the 98 points dominated.

Top of the podium or not, it is an absolute rarity for a wine to receive two triple-digit scores. And with a drinking window (Wine Advocate) of 2024-2058, the 2015 Petrus has a very long life ahead of it, which is why wine lovers will also be able to enjoy its quality in 30 years - if there is any left.

Price Corrections Offer A Unique Investment Opportunity

The reason Bordeaux does not often make it into our investment recommendations has nothing to do with quality. There is extremely high quality in Bordeaux, but prices have also matched the high quality for a long time. The great Bordeaux wines do not have the reputation of being the biggest price rockets, but as the first section of this article also reports, Bordeaux is synonymous with stability - even in times of crisis.

Price corrections have been the headline in the wine market lately, and this is obviously reflected in the data. According to Liv-ex, the last ten vintages* of Petrus, which have been on the market for five years, have returned an average of 28% over the last five years. The alert reader will note that this is not a remarkable return. But in fact, this return merely reflects the temporary situation in the wine market we have seen in recent months - a so-called bump in the road.

Back in September, the return on the same wines equalled 40.8%, which corresponds to an average annual return of 7%. In the long term, which is always the time horizon we recommend for investing, Petrus shows stability. And the current returns should not be taken as representative of Petrus in general - but on the other hand, the price corrections offer a favourable entry point for investment.

Back in October 2023, 2015, Petrus was valued at €4,100 by RareWine Trading. However, price corrections have meant that your price right now is €3,800. Furthermore, the cheapest offer for 2015 Petrus on wine-searcher.com right now is 14% higher than the price you get here.

Add to this the fact that both the 2009 and 2010 Petrus have had a slightly longer time on the market, and they both receive 100 points from Wine Advocate, while the 2009 has to settle for 99 points from Vinous, which means that across the scores from the three critics, it is just behind both the 2010 and 2015 Petrus. According to wine-searcher.com, the average price of 2010 Petrus has increased 84% in ten years, while the figure for 2009 Petrus is 80%.

Petrus thus enters the Bordeaux stability narrative.

*Vintage 2008-2017

RareWine Invest's Opinion

It is rare that we are able to offer Petrus for investment at all, and when a vintage is flanked by no less than 2 x 100-point ratings, there is more than usual demand for the existing volumes. Petrus is just that iconic - and only 4 investors have the opportunity to secure the minimum investment in the iconic 2015 Petrus vintage.

100 points never go out of fashion, especially when accompanied by a bucket list brand like Petrus. The drinking window here also requires many, many years of ageing, so future wine lovers and wine investors can also enjoy the 2 x 100 points.

Bordeaux is proving resilient in times of crisis and Petrus is one of Bordeaux's most iconic wines. The question is how long the 2015 Petrus will continue to be available in the market. If you believe in one of the greatest icons of Bordeaux and believe that the world market will turn around, this is the wine for you. We expect this rare opportunity to be in high demand, so as always, it is first come, first served.

Invest In 2015 Petrus

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2015 | Petrus | 750 | OWC3 | € 3,800 |