Investment Tips - Burgundy - 12. October 2023

Best Vinous-rated Méo-Camuzet Clos de Vougeot to date

A turbulent market has led to price corrections, offering investors favourable opportunities. Such an opportunity is here with the 2019 Méo-Camuzet Clos de Vougeot.

“Sculpted with Jean-Nicolas Méos finest chisel, this is a wonderful Clos de Vougeot”

– Neal Martin, Vinous about 2019 Méo-Camuzet Clos de Vougeot

Back in 2020, for the first and so far only time, we were able to offer Méo-Camuzet widely for investment, which says a lot about how much demand there is for Burgundy's best and how rare Méo-Camuzet is. 2019 Méo-Camuzet Clos de Vougeot is the best rated to date, which is not surprising when it is born in perhaps the best Burgundy vintage - ever. And the market situation even offers a favourable entry point for investment. Read more about the potential of the Burgundy icon here.

Méo-Camuzet: World-Renowned Domaine In The Hands Of Henri Jayer's Apprentice

For 120 years, four people have been at the forefront of the journey to turn Méo-Camuzet into a world-renowned wine producer that ranks among the top wines of Burgundy.

In the early 20th century, Etienne Camuzet founded what the world today knows as Méo-Camuzet. Etienne was a French member of parliament and mayor of Vosne-Romanée, but he also had a nose for winemaking. He selected and cultivated some of the region's finest parcels on some of the most sought-after vineyards in Burgundy today.

Etienne quickly built a good reputation, but despite this, he chose to rent out many of his parcels and the wines were sold to negociants. It was not until 1985, when a relative of Etienne's, Jean Méo, took over the domaine, that wine began to be produced under its own domaine name - Méo-Camuzet.

The last leases on Méo-Camuzet's parcels expired during the 1980s, which also meant that the legendary regional father Henri Jayer also gave up the parcels he had managed for Meó-Camuzet for 40 years. But it did not stop there. Henri Jayer remained an essential figure at Méo-Camuzet as he spent four years mentoring Jean's son, Jean-Nicolas Méo, who would take over the running of the family business.

The Jayer heritage is thus deeply rooted in Méo-Camuzet, where Jean-Nicolas Méo is responsible for ensuring the house's status as a top producer in Burgundy. A responsibility he fully lives up to.

2019 Clos de Vougeot Grand Cru

Clos de Vougeot is an iconic Grand Cru vineyard in Burgundy of approximately 50 hectares, from which many different producers are lucky enough to make wine - including Roumier, Coquard Loison-Fleurot, Leroy, and Méo-Camuzet.

Méo-Camuzet has just 3 hectares at Clos de Vougeot, meaning they can only produce a maximum of 14,800 bottles per vintage. But it is the rule rather than the exception in Burgundy that quality is much more important than quantity, so the maximum yield is rarely achieved. And even if it was, 14,800 would not satisfy a Burgundy-hungry wine market.

The Best Vinous-Rated Méo-Camuzet Clos De Vougeot Ever

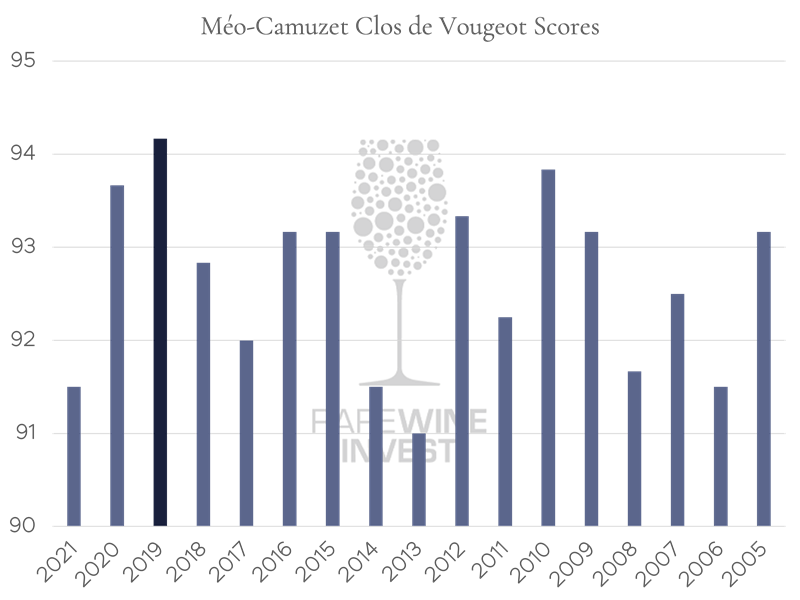

Méo-Camuzet has been consistently tasted and rated by Vinous, Burghound and Wine Advocate since the 2005 vintage, and a score across the three critics is illustrated below for all vintages. The chart also shows that Méo-Camuzet's Clos de Vougeot delivers a consistently great level - although 2019 ranks as the best-rated ever.

It is worth noting that only a few of the scores awarded are final bottle scores - i.e. scores of the wine once it has been bottled. The vast majority have received a so-called barrel score, where the wine is scored while still in the barrel, and this really just emphasises how rare Clos de Vougeot from Méo Camuzet is.

2019 Méo-Camuzet Clos de Vougeot receives 91-94 points from Burghound, 95-97 points from Vinous, and 93-95 points from Wine Advocate. This is the highest score than Clos de Vougeot from Méo-Camuzet has ever received from Vinous.

The fact that 2019 Méo-Camuzet gets great ratings is not a surprise. It comes from the 2019 vintage in Burgundy, which is described as the best vintage ever - comparable to the legendary 1865 vintage. According to the Wine Advocate's Vintage Chart, the 2019 vintage in Cote de Nuits is "extraordinary", which is also the highest categorisation of vintages.

The 2019 releases thus reflect an extremely high level of Burgundy, which naturally leads to an extremely high demand.

Read more in the article: 2019 Burgundy - "Best vintage since 1865"

Comparable Vintages: How They Perform

Because Méo-Camuzet Clos de Vougeot is rare upon release, it is also a rarity at RareWine Invest. Both the 2015 and 2016 Méo-Camuzet Clos de Vougeot have been under the management of RareWine Invest, and because they are in the slipstream of the 2019 vintage's great points layer, it is logical to look at their performance.

Since January 2021, the 2015 Méo-Camuzet under the management of RareWine Invest has given an average annual return of 14%. In the same period, the 2016 Méo-Camuzet Clos de Vougeot has given an average annual return of 18%. Across the three critics above, both the 2015 and 2016 vintages score 93.2 points.

The same price trend is evident when looking at the price development at Wine-searcher.com. Since the release of the 2015 and 2016 Méo-Camuzet Clos de Vougeot vintages, respectively, the price trend has been steadily upwards. Thus, prices have increased on average 13% per year for 2016 Méo-Camuzet, while the figure is 12% for 2015.

In addition, it will be important to look at the price trends of 2010, which has been on the market for several years, and which in terms of quality is placed between the 2019 vintage and 2015+2016. 2010 Méo-Camuzet Clos de Vougeot, scores 93.8 points across the above three critics, and since release it has seen a price trend of 10% on average per year over the past 10 years according to wine-searcher.com.

Méo-Camuzet thus performs well across vintages.

Changing Supply And Demand Dynamics: What Does This Mean?

It is no longer news that 2023 has brought price corrections due to inflation, the interest rate regime and the war in Ukraine. The world is unsettled and as a result, supply and demand dynamics have changed. By July 2023, the Burgundy 150 index had fallen by 10.3%, although we only have to go back two weeks before Burgundy accounted for 22.1% of total Liv-ex trading by value. However, market sentiment is currently leaning in favour of buyers, and this case is testament to that.

The most recent valuation of the 2019 Méo-Camuzet Clos de Vougeot at our trading house, RareWine Trading, was €350*, but here too, price corrections are a reality. Therefore, you can now invest in the top Vinous-rated Méo-Camuzet at €335*, which is a favourable entry point for investing in Burgundy grand cru.

*ex customs VAT and duty. In full boxes and perfect condition.

And What About Climate Change?

In recent years, Burgundy has more or less guaranteed price increases, massive demand and an extremely limited supply. Even if price corrections are momentarily a reality, the other two facts still stand. And unfortunately, climate change will reduce supply even more in the future.

We have covered this before in the article: 2021 Burgundy - rarity is a given.

Climate change is happening right now. Night frosts in April. Massive hailstorms. Warm winters. Early ripening of grapes. Weather is more extreme and more unpredictable. Several wine regions are investigating the use of new grape varieties that can cope with the new climate, while others are experimenting with more resilient clones.

The end of wine may not be imminent, but wine regions as we know them today face a major future challenge with an unpredictable climate enemy.

And that only makes the existing Burgundy wines even more desirable.

Rarewine Invest's Opinion

Here we are dealing with an iconic Burgundy producer that is rarely offered for investment - simply because the supply is limited. Here we are also dealing with an iconic vineyard in Burgundy. And we are dealing with a vintage that excites Vinous, which is why it can place itself at the top of the podium. It has even been on the market for a few years, so the already sparse quantities have probably already been reduced.

Comparable vintages have performed well - both in the short and long term. Add to this the fact that the market situation right now offers a favourable investment entry point for 2019 Méo Camuzet Clos de Vougeot.

Climate change has already shown its face and no one knows what the world's wine production will look like in five and ten years. What we do know is what the quality of Burgundy is like now, and this 2019 Méo-Camuzet is a fine example of some of the best. Getting your hands on a Burgundy Grand Cru is an achievement in itself. When it says 2019 on the label, however, it's even more difficult. Here, too, quantities are extremely small, which is why it is, as always, first come, first served.

Invest in 2019 Méo-Camuzet Clos de Vougeot

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2019 | Méo-Camuzet Clos de Vougeot | 750 | OC6 | € 335 |