Investment Tips - Champagne - 20. September 2023

Buyer's Advantage: 2004 Krug Vintage For Investment

A magical bottle at the top of the hierarchy. Price corrections means 2004 Krug Vintage at a discount, offering a unique investment opportunity. Read more here.

“Reader who can find it, should not hesitate, as it is a magical bottle”, Antonio Galloni om 2004 Krug Vintage

The magical 2004 Krug Vintage represents the finest Krug Vintage among the last 10 releases. It also represents great historical returns - delivered alongside its nine predecessors. And this is precisely why the 2004 Krug Vintage (and all Krug Vintage in general) is offered for investment through RareWine Invest.

In this case, however, there is also a relevant fact that offers the investor a unique approach to investing - and that is the market situation, which in many cases speaks to the buyer's advantage. The price of this 2004 Krug Vintage is currently favourable for the investor.

Krug: A Dynastic Champagne Empire

Today, the Krug Champagne House is a powerful symbol of unrivalled quality and continuous innovation. The house was founded by Joseph Krug in 1843 and upon his death in 1866, his son Paul Krug brought the house into the Champagne elite and established its base in Reims.

Since then, Krug has continued to build on its legacy of expertise and passion. Under the leadership of Joseph Krug II, the house survived World War I and flourished with iconic vintages such as 1926 and 1928. Brothers Henri and Remi Krug brought innovation and expansion to the company, introducing the first rosé Champagne, and acquiring prestigious parcels, including Clos du Mesnil.

For decades, the Krug family has managed the legacy with an absolute commitment to quality and close relationships with other Champagne producers. Their commitment to the purity and astonishing quality of Champagne remains unchanged.

In 1999, Krug gained prominent ownership with LVMH (Louis Vuitton Moët Hennesy) at the reins, and they intentionally chose to keep the Krug family close by. LVMH is also behind brands such as Château Cheval-Blanc, Château d'Yquem, Clos des Lambrays, and Newton Vineyards. And in the spirits industry, they also have a strong presence with Glenmorangie, Belvedere, and Ardbeg. Of course, ownership means that the marketing muscles at Krug have reached new heights in this millennium.

Read the full story of Krug here: Krug Champagne - The Story Of A Complete Symphony Orchestra And Inherited Perfect Champagne Spirit

2004 Krug Vintage: Almost Unbeaten In 10 Vintages

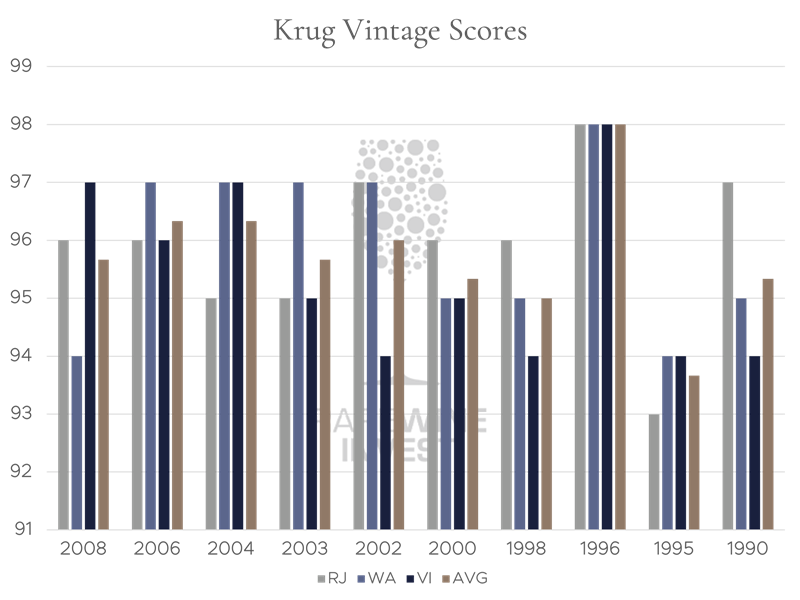

When it comes to Krug Vintage, there are no bad vintages, as the scores of the ten most recent releases below testify. The 2004 Krug Vintage scores 95 points from Richard Juhlin, 97 points from Wine Advocate and 97+ points from Vinous, giving an average of 96.3 points across the three recognised critics.

In the last 10 releases, this score has only been surpassed by the benchmark vintage 1996, which is why the 2004 Krug Vintage is rated better than both the 2002 and 2008, which like the 1996 has also been given benchmark status. The attentive reader will of course see that the 2006 Krug Vintage also scores 96.3 points across the scores from the three critics - but the chart does not include the + that Vinous also assigns to its rating, which is why the 2004 is just slightly better.

So even though there are no bad vintages, the 2004 Krug vintage still stands out very favourably.

Guaranteed quality. A guarantor of returns? How Krug has performed

Krug is an investment favourite - regardless of vintage. This is of course due to consistently high quality, but it is also because Krug Vintage has historically performed well. According to the UK wine exchange Liv-ex, the last 10 vintages* that have been on the market for at least five years have yielded an average return of 89.6%.

Furthermore, if we look at the 2004 Krug Vintage, its price has increased 75% since it was first offered for investment through RareWine Invest in July 2019. This equates to an average annual return of 15%.

And while this growth already seems impressive, the 1990 Krug Vintage, to take just one example, currently costs €750** - more than twice as much as this higher quality 2004 Krug Vintage. This is also entirely consistent with Liv-ex data from August 2023, where their "fair-value" method (used to determine the relationship between price and quality) presents that Krug Vintage tends to increase in price over time - and that 1990 Krug is a strong example of this.

Add to this the fact that, according to Wine Advocate, the 2004 Krug Vintage entered its drinking window in 2018, which is open until 2050. Plenty of time for price increases.

*Vintage 2004, 2003, 2002, 2000, 1998, 1996, 1995, 1990, 1989 and 1988.

**Ex. Duty, tax, and VAT, in full boxes and perfect condition.

Krug With A Discount: Can This Be True?

According to wine-searcher.com, the cheapest offer for 2004 Krug Vintage at the time of writing is €315*, and from this perspective, the investment price in this article is the cheapest.

Add to this the fact that 2023 has brought some price corrections, partly because inflation, the interest rate regime, and war have reduced purchasing power and appetite for now. As a result, supply and demand dynamics have changed. According to Liv-ex, the Champagne 50 index has seen a 10.4% decline in the first half of 2023, although Champagne is also the most traded wine in both value and volume over the same period. However, market sentiment is currently leaning towards the buyers' advantage.

The above is taken from our recently published analysis of the wine market, and you can read more here: Analyzing The Fine Wine Market: Navigating Value And Realities

The price corrections provide some attractive buying opportunities for the wine connoisseur and wine investor. In March 2023, the 2004 Krug Vintage was valued at €350*, but due to market conditions, you can now invest in it at an 11% discount compared to the spring. The same fact is also presented by Liv-ex, which presents the current prices of 2006, 2004, 2003 and 2000 Krug Vintage as good opportunities for buyers. The market thus offers a cheap entry point to great Champagne: And here is one of them.

*Ex. Duty, tax, and VAT, in full cases and perfect condition.

RareWine Invest's Opinion

Even if the price were still €350, we would offer the 2004 Krug Vintage for investment. And we would do so because we continue to believe in Krug due to brand power, LVMH's muscle in the art of marketing, and the historically strong returns Krug has consistently presented.

The market is turbulent right now, and it offers a cheaper entry point for investing in top Champagne like the 2004 Krug Vintage. The market has been turbulent before, which is why we lean back on the facts of the past with the conviction that there is stability ahead. If you already have 2004 Krug Vintage in your portfolio, you can leave it safely in stock while the price level stabilises again. 2004 Krug Vintage has a long life ahead of it. The quality has long since been cemented, and the price of 1990 Krug Vintage has shown what the price of Krug Vintage with age can be.

Without hesitation, we would again recommend the 2004 Krug Vintage for investment at € 350. Thus, the reduced price is currently a particularly attractive option.

Invest In 2004 Krug Vintage

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2004 | Krug Vintage | 750 | OC6 | € 310 |