Investment Tips - Champagne - 27. April 2023

Invest In 2008 Dom Pérignon Rosé

Prophecy - Rosé Champagne can be one of the best price performers around. 2008 Dom Pérignon is also among the best. Read more about it here.

“The 2008 Dom Pérignon Rosé is magnificent” Antonio Galloni

And 'magnificent' is certainly appropriate for this investment tip. Magnificent Champagne house. Prominent ownership with magnificent growth results - even in times of economic crisis. Magnificent vintage in Champagne, and a magnificent rosé that does not deviate from its origins.

Add to this the fact that this investment tip presents a well-founded prediction, and it reinforces the investment potential of rosé Champagne as a category. Read the potential of 2008 Dom Pérignon Rosé below.

Dom Pérignon - A Benedictine Monk Revolutionised Champagne

Dom Pierre Pérignon resonates with quality, success, and revolution on the streets of Champagne. Dom Pierre Pérignon revolutionised the way champagne is made - and it is certainly thanks to him that Dom Pérignon is considered one of the world's leading Champagne houses.

The house's prestige cuvée first hit the market in 1936 with the 1921 vintage. And in 1971, the Shah of Iran was celebrating the Persian Empire's 2 500th anniversary, so he ordered a Rosé Champagne from Dom Pérignon many years in advance. And so, 1959 became the house's first Rosé vintage. Since then, 25 vintages of Rosé have been released - and only from the very best vintages.

Today, Dom Pérignon is owned by the LVMH Group, which clearly saw huge growth potential in the historic Champagne house. Recently, according to Bloomberg, the luxury conglomerate's market value has surpassed $500 billion, making it the first European company to reach that milestone - largely due to a strengthening euro and booming luxury goods sales in China.

"LVMH and its French luxury rivals are to the European stock market what Big Tech has been to the US: Dominant businesses whose growth holds up even as the economy waxes and wanes", says Bloomberg. Being in the fold of a successful luxury giant that keeps its growth unchallenged in times of economic crisis certainly does not diminish the greatness and investment potential of Dom Pérignon.

Read much more about the prestigious champagne house in the article: Dom Pérignon - The Monk, The Legend & The Wine.

2008 Dom Pérignon Rosé - Among The Very Best

The 2008 vintage in Champagne has earned the status of one of the great benchmark vintages, due to essential weather conditions that resulted in sublime champagnes across the Champagne houses. And this 2008 Dom Pérignon Rosé does not deviate from its benchmark status.

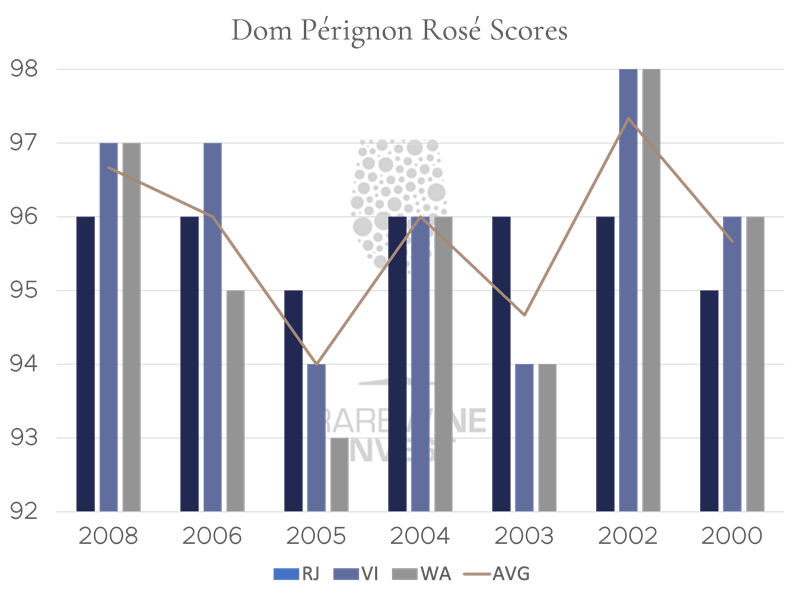

With 96 points from Juhlin, 97+ points from Vinous and 97+ points from Wine Advocate, the 2008 Dom Pérignon ranks as one of the absolute best Rosé Champagnes the house has ever released. Only just surpassed by the 2002 vintage, which received 97.3 points across scores from the same critics, compared to the 2008's 96.7 points.

We have to go all the way back to 1969 and 1962 to find a higher average score of 97 points and 97.5 points respectively, although these two vintages were only rated by Juhlin and Vinous.

Add to this the fact that the 2008 vintage in Champagne is described by Liv-ex as an "on" vintage. They describe that by default there should not be an "on" or "off" vintage in Champagne, because the champagne houses historically only release vintage Champagnes in the best vintages.

But here Liv-ex further points out that more and more buyers and investors are entering the champagne market and demanding the best. And this demand is of course centred on the most critically acclaimed vintages, which are therefore referred to as an "on" vintage - and this leads to higher demand and thus price increases. And when it comes to Rosé Champagne, supply is just much more limited than for regular champagne.

In 2019, for example, only 15.4 million bottles of Rosé Champagne were produced, representing only 5 % of total Champagne production.

Returns On Dom Pérignon Rosé

Over the last five years, according to Liv-ex, the last 10 vintages* of Dom Pérignon Rosé that have been on the market for at least five years have returned an average of 60.6%, giving an average annual return of 9.9% - and it certainly has been successful, although Rosé Champagnes have yet to match the performance of regular Champagnes.

According to Liv-ex, the Rosé Champagne market will grow at a slower pace than regular Champagne. This is mainly due to the fact that Rosé Champagne is produced in much smaller quantities and requires more effort in production, resulting in a so-called Rosé premium, which means that the average price of Rosé Champagne is generally higher than regular Champagne.

"However, as this market segment evolves this lack of liquidity, if it is coupled with rising demand, could one day make rosé champagnes some of the best price performers around", says Liv-ex.

And why is that? Because Rosé Champagne is a specialised and "upgraded" product in an already luxurious category where the best and finest bottles are already in high demand.

*2006, 2005, 2004, 2003, 2002, 2000, 1998, 1996, 1995 and 1993.

2008 Dom Pérignon Rosé

2008 Dom Pérignon Rosé

Investing In Rosé Champagne - What Does The Future Hold?

The above section outlines some very basic catalysts for price appreciation - an imbalance between supply and demand. Rosé Champagne remains a niche category, and if it is to truly fulfil Liv-ex's prediction above, it will require the world's spotlight to be directed towards the pink bubbles of Champagne.

And there are indications that big players are betting on the pink drops. In February, Bloomberg reported that LVMH has acquired Chateau Minuty from Provence - precisely to focus on luxury Rosé. Phillippe Schaus, CEO of LVMH, says that Provence is to Rosé what Champagne is to sparkling wine. LVMH is betting big on the Rosé category.

Furthermore, in 2019 the Chanel Group bought Domaine de l'Ile with the same argument, and in 2020 Michel Reybier (owner of Cos d'Estournel) together with NBA star Tony Parker bought Château La Mascaronne. Finally, Pernod-Richard bought Château Sainte Marguerite last year. With high-profile Rosé producers being bought up, it is clear that powerful forces are working to put Rosé on the agenda - with a vision of growth, of course: and Rosé Champagne has the distinction of being the ultimate in the Rosé category. It simply does not get more luxurious than that.

RareWine Invest's Opinion

Dom Pérignon is one of the world's greatest Champagne houses. And the 2008 vintage is one of the greatest vintages in Champagne - ever. This Rosé release does not deviate from its origins and ranks among the house's absolute best Rosé releases to date. And with LVMH backing it up and showing excellent promise, there is nothing to suggest that Dom Pérignon will become less well known in the future - quite the contrary.

The historical returns are quite acceptable, but it is probably in the future that the greatest Rosé potential will be realised. Especially if the Liv-ex prophecy about the Rosé Champagne's future status as the best price performer is realised.

And it would take a very small increase in interest in Rosé Champagne to kick-start a more pronounced shortage of Rosé Champagne, which is already extremely scarce. There is every indication that the big luxury giants have smelled the rosé fuse.

2008 Dom Pérignon Rosé represents an "on" vintage in Champagne, and according to Liv-ex, it comes with a demand. Champagne lovers and investors will probably continue to demand what is today a niche Champagne from a benchmark vintage in the future.

Invest In 2008 Dom Pérignon Rosé

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2008 | Dom Pérignon Rosé | 750 | OC6 | € 350 |