Market Analysis - 24. January 2023

+22.5 %: How wine investment performed in 2022

Wine investors can celebrate a record year for wine investment

With a new year comes time for introspection. The books are closed, and the past year will be reflected upon, laying the foundations for the year to come.

2022 was indeed an eventful year - indeed more than enough, one might be tempted to say. After several years with Covid-19 as the dominant headline, the pandemic slipped into the background. On 24 February, Ukraine was invaded by Russia - war on the European continent - and the world order was instantly changed. In addition to major human tragedies, the war has been a major contributor to the energy crisis in Europe, while the world's largest economy is struggling with a labour market crisis. China, the great engine of economic growth in the East, has lost momentum and the economy is weakening, partly as a result of strict Covid management and massive social shutdowns.

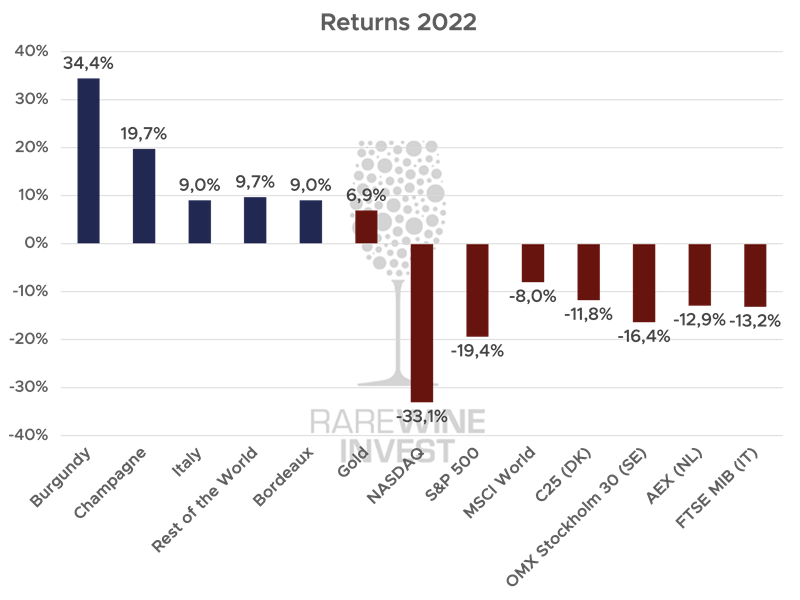

The above are just some of the major drivers that, with inflation galloping and interest rates soaring, have created uncertainty and nervousness in financial markets - with massive declines in stock markets as a consequence.

The wine market has been a different story. Wine has shown minimal correlation to the stock market, delivering record returns to investors across all categories, who can enjoy strong returns and an asset that is stable and solid despite ripples and high waters in financial markets.

Across all categories, wine under management by RareWine Invest is up +22.5 % in 2022.

This is what happened to the wine investors at RareWine Invest in 2022:

Realised Investments In 2022

When it comes to investment, it is common practice to report on unrealised returns. The above is an example, and it represents the increases investors experienced when the books for 2022 were closed - but there have also been realised returns. In 2022, 1,115 positions were sold, giving investors an average return of 88%. On average, these positions have been held for approximately three years.

Burgundy Shows Once Again That Wine Prices Have No Ceiling

The wines from Burgundy have once again shown why our main focus is in this category. The fundamentals of high quality, low supply and towering demand must be credited as the main reasons why Burgundy is cementing itself as the most rewarding category for wine investment.

The high point of the category is (without parallel) the phenomenon of Domaine Arnoux Lachaux, where prices across the entire product portfolio have exploded and in several cases increased tenfold, but in all cases have seen triple-digit growth rates. The reason for this must be found in a sudden and extreme popularity due to exceptional quality at a price that was unheard of. This spread like wildfire in the wine world, with sharp price rises as a result.

Looking beyond the massive presence of Lachauxs wines at the top of this year's Burgundy returns, it is also a number of prominent and well-known names that account for the biggest increases - including Domaine Leroy, Domaine de la Romanée-Conti, Domaine Armand Rousseau, Domaine Georges Roumier and Domaine Dujac. Another interesting observation is that white wine is also well represented at the top. This is the case for the top wines from Domaine Leflaive and virtually all the wines from Domaine d'Auvenay, which, like the wines from Domaine Leroy, are produced by Madame Lalou Bize-Leroy.

At the other end of the scale, no single position stands out, with just 3 % of all Burgundy positions yielding negative returns in 2022, with just under half of these yielding between 0% and -5%.

The price of Burgundy under management of RareWine Invest has risen by an average of 34.4 % in 2022.

Corks Popped Again For Champagne Investors

Champagne has historically been seen as the wine world's government bond, with moderate, ongoing price rises and a severe degree of stability dominating. In both 2021 and 2022, however, this has been put to shame. For the second year in a row, the Champagne category is delivering double-digit returns.

Despite downturns in the HORESTA segment caused by the Corona pandemic, Champagne exports from 2020 to 2021 have increased by 32%, while sales in 2022 are also expected to have been record high.

Combined with logistical challenges stemming from the covid crisis, as well as sharply reduced inventories at producers and distributors, this demand has provided a preview of what the wine world may very well be facing; a world where the scarcity of good Champagne is more prevalent than ever before.

At the top of the list in terms of increases, Jacques Selosse is massively represented. Jacques Selosse is the epitome of extremely rare Champagne, with the majority of their vintage Champagne producing triple-digit returns in 2022. In addition to Selosse, the top tier is dominated by the largest houses. Bollinger is massively represented with their V.V.F, while everything Louis Roederer (vintage/Cristal/rosé) is up 14.5 % on average.

Krug has averaged 15.3 % (Vintage/Single Marks/Grand Cuvée), Salon is up 14.6 % on average, and all regular Dom Pérignon is up 11 % on average for 2022.

Only 4 % of all Champagne positions have resulted in negative returns for 2022, with a third of these returning between 0 % and -5 %.

The price of Champagne under management of RareWine Invest is up 19.7 % on average for 2022.

Italian Wine Delivers Stability And Solid Returns

It is hardly news that our focus on Italian wines has increased significantly in recent years. The reason is simple: the quality is sublime, while the price seems unsustainably low compared to their French counterparts. The price is rising steadily, while the premise seems to be unchanged, except for the fact that the rest of the wine world is also paying more attention to them.

The positive winds in the wine market have thus also rubbed off on Italian wines, with Tuscany and Piedmont not surprisingly dominating. Sassicaia continues to be the inevitable headline and thus also sits heavily at the top of the category with an average return of 18.5 % across vintages. The rest of the top tier is a mixed bag of super Tuscans, with even affordable wines like Brunello from Fuligni and Barolo from Cavallotto also making their mark.

In 2022, 11.5 % of Italian positions returned negative, with around two-thirds returning between 0 % and -5 %.

The price of Italian wine under management of RareWine Invest has increased on average 9.0 % in 2022.

Rest Of The World - Best Of The Rest

The Rest of the World category is the slightly more arbitrary category, containing what does not fit neatly into other boxes. Thus, the category includes Rhône, whisky, American wine and a small selection of German and Spanish wines as well as Australian Penfolds. This category therefore also broadly embraces what might be called passion investments led by investors, together with positions that have the character of risk spreaders for larger portfolios.

Of the sub-categories we are most focused on and see great future potential for, Napa Valley and whisky weigh the heaviest, up 5.9 % and 7.8 % respectively on average in 2022. Among all Napa Valley and whiskey positions, 9.3 % have produced negative returns, with half of these producing between 0 % and -5 %.

The Price Of All Rest Of The World Under Management of RareWine Invest Has Risen 9.7 % On Average In 2022.

Good Old Bordeaux Still Showing Teeth

Bordeaux - the classic category for wine investment, which in this perspective has painfully evolved into a risky affair due to producers' stubborn insistence and increase of high release prices that reflect neither demand nor consumption.

In our view, this has been the Bordeaux complex for years, which is why we have also from our earliest recommendations been extremely cautious about the amount of Bordeaux in portfolios.

Having said all that, it is also necessary to add that great wine still comes out of Bordeaux, and that some of the world's most legendary wines come from this very place. Likewise, old love does not just die either, and 2022's wine market boom has also rubbed off on Bordeaux's performance.

At the top of the category in 2022, we unsurprisingly find a high representation of Petrus, but also positions of Cheval Blanc, Lynch Bages, Haut Brion and Margaux - largely driven by attractive en-primeur purchases.

Despite a good year for Bordeaux, our recommendation remains clear: Bordeaux should be considered as a risk spreader in larger portfolios or as a passion investment.

22.3 % of the total number of Bordeaux positions produced negative returns in 2022, with around a third of these yielding between 0 % and -5 %.

The price of all Bordeaux positions under management of RareWine Invest increased by 9.0 % on average in 2022.

RareWine Invest's Opinion

At RareWine Invest we have always communicated that wine is a long-term investment asset. With growth rates of around 20 % for the second year in a row across categories, it can be tempting to look at wine from a different short-term investment perspective. However, it is worth remembering that the very premises of wine investing remain unchanged - and so do our continued recommendations.

We are pleased and proud that in 2021 and 2022 a large number of investors have been able to realise exceptional returns, which in many cases have been reinvested in new positions. Likewise, many new wine investors have joined from around the world, but from a historical perspective the wine market remains unchanged.

Wine remains a physically unleveraged product with low volatility. Historically, wine has shown great resilience in the face of, for example, inflation and recession. Market mechanisms are driven by consumption in the face of highly constrained supply and huge demand. Supply is challenged by climate change and demand is increasing in line with population growth, rising living standards and continued growth in the number of affluent people globally.

Neither emerging markets in India nor China have caused the price increases of recent years. But their time will come.

Looking beyond the snapshot, there is also no evidence to suggest that wine is suddenly particularly suitable for short-term investment. Whatever has happened in 2021, 2022 and whatever happens in 2023, it is still in the long run that wine investment truly shines.