Investment Tips - Burgundy - 21. March 2023

White Burgundy Supreme: Invest In 2020 Bouchard Montrachet

Excellent historical returns cement quality – put the potential lies ahead. A luxury mastodont sees potential in Bouchard – if you do the same, you should read on.

Marvelous Montrachet – Home of The Best Whites In The World

The Montrachet vineyard is known to be the world’s best vineyard for Chardonnay. Montrachet is both mythical and exclusive, and to have Montrachet in your glass is a rarity granted the privileged. No mediocre producers operate on Montrachet, yet some stand out – slightly better than the rest. These include Domaine Leflaive, Ramonet, Domaine de la Romanée-Conti, and Bouchard Pere et Fils, the latter’s Montrachet being the protagonist of this investment tip – 2020 Bouchard Montrachet.

On Montrachet Bouchard Pere et Fils owns 0,89 hectares, and the in 2020 the yield of Bouchard Montrachet was only 4.500 bottles making this an extremely low production. Extremely low and extremely sought after.

This is an investment in a solid Burgundy institution with strong marketing forces behind it. It is also an investment in white Burgundy as a category - a category that has yet to achieve the returns of its red counterpart. And this is where the potential really lies.

Bouchard Pere et Fils – a power legacy built of experience

In 1731 Michel Bouchard laid the foundations for what should become one of Cote d’Ors biggest vineyard owners – Bouchard Pere & Fils. Since then, the domain has built up a formidable reputation in Burgundy - and in the entire world of wine - through continuous quality.

Every year, the British wine exchange Liv-ex publishes its famous Power 100 list, which presents the 100 most powerful brands on the wine market of the past year - in numerical order. The positions are awarded according to the most traded wines in terms of both volume and value. For the past 10 years, Bouchard Pere et Fils has been on the Power 100 list 9 out of 10 times with a recent ranking at Liv-ex power 100 2022 at number 20. This only emphasises the inherent quality within Bouchard and the demand for one of Burgundy's major players.

With Bouchard Montrachet High Quality Is A Given

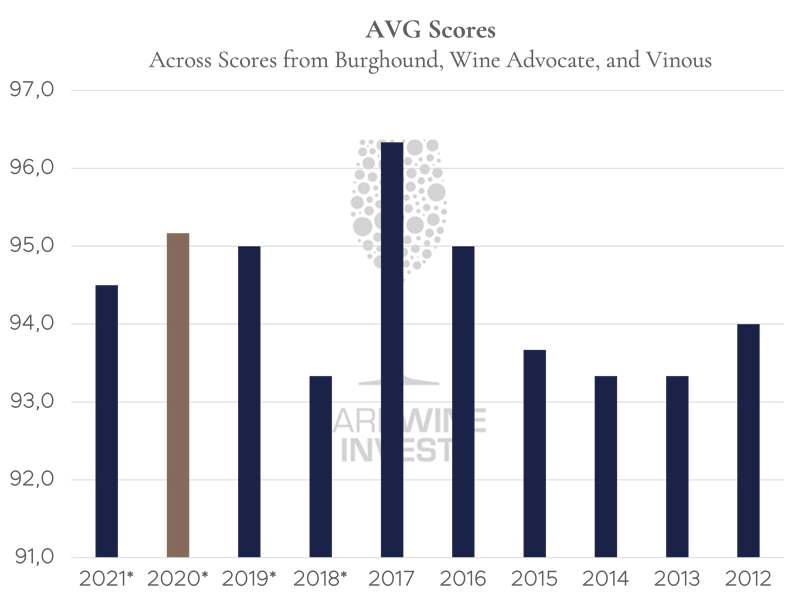

When it comes to Bouchard's Montrachet, there is not much variation in quality from vintage to vintage. It is consistently high, as the chart below also shows. The 2020 vintage has only received barrel scores from Burghound (94-97), Wine Advocate (95-97) and Vinous (93-95), but the average scores of these places the vintage at the top of the last ten vintages, surpassed only by the 2017 vintage - and whether the final scores are at the top or bottom of the barrel score range, 2020 Bouchard Montrachet will still be representative of Bouchard's extremely high quality.

*Some or all scores within this vintage is barrelscores.

*Some or all scores within this vintage is barrelscores.

The Future Potential of Bouchard

For almost 270 years, Bouchard Pere et Fils was family owned, but in 1995 the Henriot family bought the domain making Bouchard a dynasty under Maisons & Domaines Henriot, which also includes Champagne Henriot, Bouchard Pere & Fils, Domaine William Fevre (largest grand cru landowner in Chablis) and Beaux Freres (American wine producer located in Oregon).

In September 2022 however it became a fact, that the French private equity fund and luxury mastodont Artémis acquired a majority stake in Maisons & Domaines Henriot, adding Henriot, Bouchard and Fevre to a portfolio that includes Chateau Latour and Clos de Tart.

Artémis seeks to by compagnies with growth and development potential with the purpose of making profit and keeping shareholders happy. It is expected of Artems to provide capital, know-how and a gigantic marketing machine to Maisons & Domaines Henriot and therefore also Buchard. It is a journey you can now join.

2020 Bouchard Pere et Fils Montrachet

2020 Bouchard Pere et Fils Montrachet

Buchard Pere et Fils: The Future Potential Of The Whites

According to Liv-ex, the last 10 vintages* of Buchard Pere et Fils Montrachet that have been on the market for at least five years have returned an average of 65,4 % over the last five years, which corresponds to an average annual return of 10,5 %.

That is a very nice development, but it is not comparable to the return on red Burgundy wines, and there is potential in that. Take for example the Burgundy 150 index, which is a sub-index of the Liv-ex Fine Wine 1000. Burgundy 150 has given an annualised 5-year return of 14,1%. If the white wines are excluded from the index, the Burgundy 150 has given an annualised 5-year return of 17.5 %. The price of red Burgundy wines has thus risen more sharply than white wines.

Demand for white Burgundies is on the rise. Consumers are beginning to realise that white Burgundy offers high quality in limited quantities. Generally speaking, the price increases have not been as strong for white Burgundy as for red Burgundy, and this is where the investment potential lies.

So, although Bouchard Montrachet has already yielded excellent returns, the potential lies in the future.

Furthermore, the 2020 vintage is a precursor to the disastrous 2021 vintage in Burgundy in terms of yield. Quantities are reduced in both Côte de Beaune and Côte de Nuits, although producers in Côte de Beaune have reported losses of up to 80 per cent - particularly for Chardonnay. Bouchard’s 2021 Montrachet has halved in yield. This means that release prices are significantly increased for the upcoming vintage, and it also means that the consumer is looking for value in previous vintages.

*2007-2016

RareWine Invest’s Opinion

This is a classic Burgundy investment with double dispute. Bouchard is a solid institution in Burgundy, continuously offering high quality wines, and this 2020 Bouchard Montrachet is no exception.

Furthermore, Montrachet is the absolute crown jewel - not only for Bouchard, but for the entire white Burgundy category. So here we have a strong producer, sought-after vineyard, and extremely scarce supply. A supply that, incidentally, will not increase with the upcoming 2021 vintage.

One dispute comes with Artemis as the new primarily owner of the domain. They have spotted a potential and they are looking to make a profit. In favour of the investor. The second dispute comes with the unrealised potential of the white Burgundies, based on returns. Bouchard Montrachet has not yet achieved the same returns as the red wines of Burgundy 150.

This is your opportunity to buy into Bouchard Montrachet while quantities last and while the white Burgundy returns are still in the slipstream of the reds.

Invest In 2020 Bouchard Pere Et Fils Montrachet

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2020 | Bouchard Pere et Fils Montrachet | 750 | OC/OWC6 | € 775 |