Investment Tips - Champagne - 18. April 2024

2012 Cristal Magnum | 98 Points And Favourable Price

Iconic Champagne in magnum format - it does not get much more exclusive than that. Meanwhile, positive trends in the market are moving... Read more here.

”The 2012 is one of the most opulent, flamboyant recent Cristals”,

- Antonio Galloni, Vinous (December 2023)

Cristal: Cool. Cristal with 98 points: fantastic. Cristal with 98 points and even in magnum: It does not get more exclusive than that. And here you even get the opportunity to add iconic Champagne to your portfolio at a price 10% lower than just six months ago.

Because the Champagne category has also felt the uncertainty in the wine market over the past year, causing prices to take a dive. However, compared to how much the Champagne category has risen in recent years, this is just a bump in the road, giving investors a favourable opportunity to supplement or start their portfolio with iconic Champagne - a little cheaper than before.

And while no one knows when normality will return, positive trends are beginning to emerge in the wine world. Read much more here.

Louis Roederer Cristal - Iconic And Extravagant Champagne

There are many marvellous stories from the world of wine - stories of great châteaux, dedicated monks and craftsmanship that have cultivated the world's best vineyards generation after generation. But there are stories that are almost unbelievable - and such is the story of Cristal Champagne - one of the world's most iconic Champagnes.

"Is it strange to demand almost utopian luxury when you call the Winter Palace home? Well, that was certainly what Tsar Alexander II of Russia did when he visited Louis Roederer in 1876 with a desire for the best Champagne the world had yet seen.

Few say no to a Tsar. Especially when the Tsar is already an enthusiastic Champagne drinker. And so began the production of Cristal - one of the best Champagnes in the world."

The above is from our article: The Myth Of Cristal: Crystal Clear, Exclusive And Tamper-Proof

Cristal was thus realised as the result of a Tsar's desire for perfect Champagne - and so it was. Even today, Cristal still delivers Champagne of the highest calibre. A collector's item. An extravagant Champagne for consumption. And this 2012 does not deviate from the reputation of Champagne.

2012 Cristal | Opulent, Flamboyant And Two Points From Perfection

When it comes to Louis Roederer's Cristal, it is almost redundant to talk scores. Because Cristal receives great ratings from the world's leading critics - vintage after vintage. And yes, Cristal is only released in vintages where Louis Roederer finds the quality to be high enough, which we can only conclude has always been the case when a Cristal has been released.

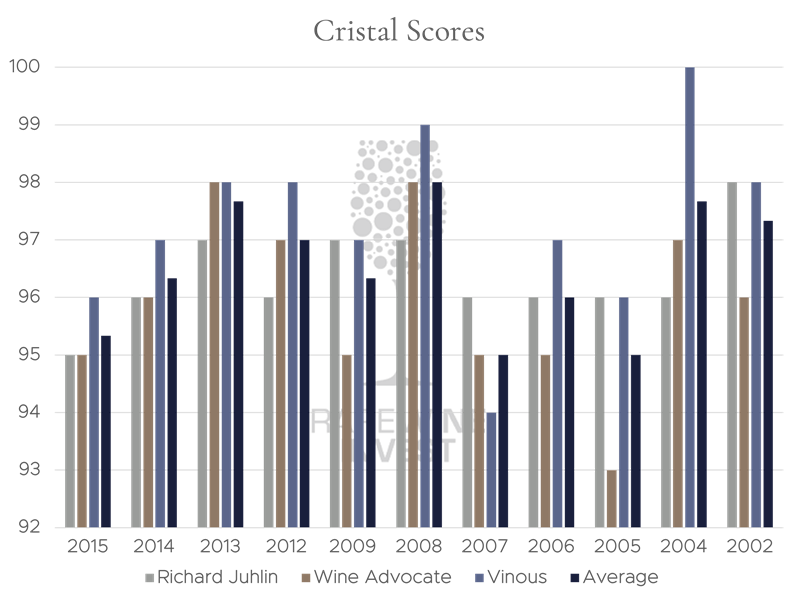

2012 Cristal has received 96 points from Richard Juhlin, 97 points from Wine Advocate and 98 points from Vinous. And even though these ratings are great, it is not quite enough for a top position among vintages such as 2008 and 2002 - but enough to cement that Cristal is absolutely sublime - regardless of vintage. And there are very few wines that can boast 98 points.

In comparison, a 2002 Cristal on magnum currently costs €800*, while the price of the 2008 vintage on magnum is €900*. The price of the 2012 Cristal on magnum is €525*, so you are getting a lot of value for money considering that the 2012 is almost on the same high level as both 2008 and 2002.

*ex customs, VAT and tax. In full cases and perfect condition.

Why Magnum?

Champagne is synonymous with celebration. With luxury. With extravagance. And what better way to celebrate than with Champagne? Well, it would have to be a big bottle of Champagne. And while magnum-sized Champagne is just a little bit cooler, the large format also comes with features that you, as a wine investor, can benefit from - features that come at a premium.

Champagne in magnum bottles is often left on the lees for two to three years longer and is therefore disgorged later than the regular 0.75 litre bottles - this results in a higher quality product than the same vintage of Champagne in 0.75 litre bottles.

Although magnums are double the size of regular 0.75 litre bottles, the amount of oxygen in the bottle is not much higher. For the magnum bottle, this inherently means that twice the amount of Champagne is exposed to the same amount of oxygen as a regular bottle. This contributes to better ageing and increased storage potential for the Champagne, which is extremely relevant when talking about top Champagne with investment potential.

Champagne Price Corrections Offer Favourable Entry For The Investor

Inflation and war in Europe have also affected the wine market, with the Champagne category taking a hit. After two consecutive years of steeply rising prices in Champagne, the global situation has resulted in price corrections and a drop of 11.15% in 2023.

"In isolation, this trend for Champagne may be a cause for concern, but when you consider that Champagne has seen an increase of almost 50% over the last three years, there is no need to panic. Despite the current downturn, the best Champagnes still seem cheap compared to the best Burgundy or Bordeaux wines, leaving plenty of room for growth in the long term - especially driven by the huge consumption."

The above is from our January 2024 wine market analysis, and the huge consumption of Champagne remains relevant. Liv-ex revealed with their Power-100 list 2023 that Champagne dominates the top-selling wines in 2023 in terms of trade volume - this is due to the region's high liquidity and universal appeal to both collectors and consumers. Thus, Champagne continues to be enjoyed across the globe.

And now for the favourable entry: In October 2023, we had the 2012 Cristal Magnum under administration for the first time, and the price was €575. However, price corrections have meant that the price of the 2012 Cristal Magnum has dropped by €50.

If you believe the market will regain its strength, you get a favourable head start on your investment.

When Is The Right Time To Invest In Champagne?

Unfortunately, no one has a clear answer to that question. But our investment premise remains unchanged, even though the market has been, and to some extent still is, turbulent.

According to Liv-ex, Champagne prices on the secondary market have seen a lot of movement in recent years. At the end of February 2024, the Champagne 50, which tracks the price development of the most recent vintages of the 13 most traded champagnes, was 50.2% higher than it was five years ago, while the story of the last 16 months is quite different.

The same index reached its peak in October 2022 - after rising 42.7% in the previous 12 months. Since then, it has fallen every month. However, in February 2024, the Champagne 50 index saw its first increase in 16 months. Add to this that the same scenario is playing out for the Liv-ex Fine Wine 100, which in March rose 0.4% - its first increase in 12 months.

The first positive trends are starting to emerge.

RareWine Invest's Opinion

Although the above increases are not in themselves a conversion from bear to bull, they are the first positive signs in months. It could be an indication that the bottom may have been reached, making this the perfect time to buy before the market regains its footing and starts rising again.

According to Wine Advocate, the drinking window for 2012 Cristal is 2022-2050 for the regular format. For magnums, it is significantly longer - ditto the investment horizon. So there is time for the market to regain strength - ditto the price.

Cristal is a welcome return to RareWine Invest, and of course it is there because of its inherent quality. Besides, the world will always demand 98 points - especially when the format is magnum. We still believe in the Champagne category. Even though it has taken a downturn, the prices are nowhere near those we see in Burgundy or Bordeaux, for example.

And Cristal is among the world's greatest Champagnes.

Invest in 2012 Cristal Magnum

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2012 | Cristal Magnum | 1,500 | OC/OWC1 | € 525 |