Investment Tips - Burgundy - 21. February 2024

Musigny: Investing In Drouhin And One Of The World's Most Famous Vineyards

Combine Musigny with Drouhin and you get a renowned, classic Burgundy investment.

A Power House In Burgundy

In Burgundy, the name Drouhin is simply undeniable. With 93 hectares of vineyards and more than 100 years of history as a family business, Maison Joseph Drouhin is today an institution in Burgundy, representing both Burgundy's rich history and modern business practices.

In 1921, Maurice Drouhin acquired the first parcels of land for the family business, which at the time was not involved in wine production. The parcels belonged to what we nowadays know as Clos de Mouches and became the start of an impressive portfolio with parcels in no less than 164 appellations across most of Burgundy and even in Oregon, USA. In addition to a lot of Village and Premier Cru, Joseph Drouhin also owns parcels in some of the world's finest vineyards with no less than 23 Grand Cru's, including the most prestigious ones such as Bonnes-Mares, Chambertin, Corton-Charlemagne, Echezeaux and Grands-Echezeaux and of course Musigny.

Joseph Drouhin has succeeded on a grand scale in producing impressive wines across a large geographical area and across a wide range of complex terroirs, something few winemakers have achieved at the level that Joseph Drouhin has. Whether it is a Rully Rouge or Grand Cru from Cote de Nuits, Joseph Drouhin will stand the distance, and if you come across a bottle with that name on the label, you can be sure that it will perform brilliantly in its class.

This is all about Musigny, and while not even Joseph Drouhin can stand up to Madam Leroy, who has undeniably been Musigny's standard-bearer, here you get sublime Burgundy wine from a mythical vineyard with an entry level that is far more accessible - both for you as an investor now, but also for wine lovers of the future.

If you want to learn more about the extent of Drouhin's holdings, we recommend visiting Drouhin's interactive map, where you can explore all of the property's appellations yourself: See map here.

A Beautiful Musigny From Drouhin

Musigny is undoubtedly one of Drouhin's most prestigious wines, if you do not take the liberty of actually calling it the crown jewel.

But not only is it a unique wine from a mythical vineyard, Joseph Drouhin has also managed to push the quality steadily upwards over the past 20 years.

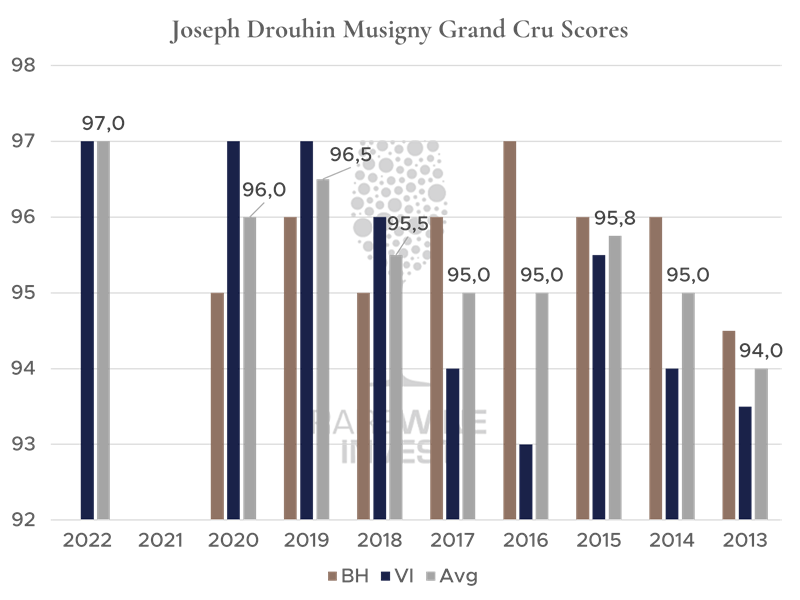

Below is a comparison of scores for Drouhin Musigny. Wine Advocate is excluded from this comparison, as 6/10 vintages have not been reviewed by that media. Below is the distribution of points for the last 10 vintages. All vintages before 2013 generally have lower scores than 2018 with the exception of 2010, which has the same average score.

BH: Burghound VI: Vinous AVG: Average

BH: Burghound VI: Vinous AVG: Average

The 2018 vintage scores an impressive 95-97 points from Vinous and 94-96 from Burghound, giving an average of 95.5 points - an average score that is just a whisker away from the benchmark vintage of 2015.

Drouhin has made the most of 2019, 2020 and 2022, but these vintages are also already trading at a higher price than 2018, with 2019, for example, currently valued at €1,150*, while 2018 is currently available for €950*.

2021 is not valued. Probably because production has been so limited that it is almost non-existent. Joseph Drouhin reported that among all their chardonnay, they lost 50-100% of yields, while pinot noir did slightly better. In fact, the combined production of Burgundy wine in 2021 was almost halved compared to 2018's 1.8 million hectolitres.

*Price ex. duty VAT and tax, in full cases and perfect condition

Prices Are Falling - Is Burgundy A Sinking Ship?

It is neither new nor a secret that over the past year, Burgundy prices have been falling - especially for the best and most expensive bottles. While columns could be written about the macroeconomic challenges at play here, there is one observation that is quite interesting:

While Liv-ex reported a -16.2% drop in the Burgundy 150* index for 2023, trading activity dropped only moderately. The Liv-ex 2023 report states that the total trade of Burgundy wine at Liv-ex in 2023, measured by value, was 24.0% of the total volume - a slight decrease from the all-time-high of 26.2% in 2022.

So what can be interpreted from this? The interest in Burgundy wine is still huge, although the demand is currently shifting to other types of Burgundy wine - typically slightly cheaper bottles from a fine wine perspective.

Burgundy thus continues to be a region where production/supply does not match a demand that clearly cannot be beaten - if the price of the most expensive wines falls and drags down the index, a lot of cheaper wine must be traded in order for the total trade measured by value not to fall more than 2.2 percentage points.

The fundamentals for Burgundy investing are unchanged and still in the investor's favour.

*RareWine Invest reported a -6.7% decline on average across all Burgundy wine under administration

Drouhin Gives A Lot Of Musigny For The Money

As we all know, there are many things that affect the pricing of a wine, but despite this, it is still interesting to look holistically at a vineyard like Musigny and relate it to the price of wines from other producers - and if we look at price/quality objectively, Drouhin gives a lot of Musigny for the money:

| 2018 Musigny | BH | VI | Price |

|---|---|---|---|

| Leroy | - | - | - |

| Georges de Vogue | 97 | 92 | € 1.950 |

| Georges Roumier | 97 | 95-97 | € 13.500 |

| Jacques Frederic Mugnier | - | 97 | € 1.290* |

| Jadot | 93-95 | 94-96 | € 2.046* |

| Faiveley | 94-97 | - | € 3.000 |

| Joseph Drouhin | 94-96 | 95-97 | € 950 |

Not only does Drouhin look like a strong supplier of Musigny from a value-for-money perspective, it has also been a stable investment. The 2010 vintage, which is the most comparable vintage to 2018, has seen average annual price increases of around 8% over the past five years, according to the asking prices on wine-searcher.com.

RareWine Invest's Opinion

Musigny exudes prestige, exclusivity, and Burgundian mystique - and it is not just value that has been attributed - the reputation is due to the character, characteristics and unique terroir of the vineyard, which is home to some of the world's best and most precious wines.

With Joseph Drouhin Musigny, you get a powerful combination that certainly belongs in the world's elite, but still appeals to a much wider audience than the greatest wines from here - if you want to taste good Musigny, Drouhin's is for many much more accessible than Roumiers or Leroy's.

The 2018 vintage is a great vintage, and all of the wine's characteristics speak strongly to the overall narrative of the Burgundy category's attractive investment prospects. While some classic regions are facing general challenges in disposing of the wine they produce, there is fundamentally less Burgundy wine being produced than is in demand - and the Liv-ex figures show that even war, disaster and economic uncertainty are not putting an end to interest in Burgundy wine. Interest has simply shifted to other wines in the category for a while.

Burgundy wines are currently highly priced, but given their underlying fundamentals, it is impossible to imagine a future where they will not become even more expensive.

Invest in 2018 Joseph Drouhin Musigny

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|

| 2018 Joseph Drouhin Musigny | 750 | OWC3/OWC6 | € 950 |