Investment Tips - Other - 6. March 2020

Napa Valley's Dominus: 100 Parker Points And Solid Returns

Invest in 2015 and 2016 Dominus and get a strong investment potential, a huge Napa brand and 100 Parker points at a very attractive price

Welcome to Napa Valley

Napa Valley - the hotbed of some of the world's most bombastic and powerful wines. Based on the bordeaux-inspired wines, the great producers reign, together contributing to growing prestige of the American wines and their great global recognition. Top producers Opus One, Screaming Eagle, Harlan Estate and Dominus Estate all have their share of the credit for Napa Valley establishing a renowned name on in the world of wine. Now you have the opportunity to invest in Dominus, which with the most recently vintage seriously shows soome muscles!

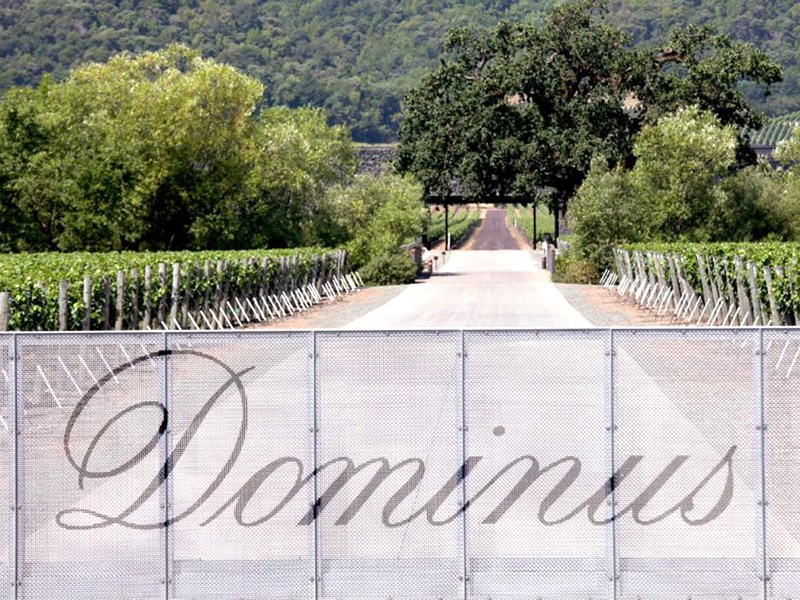

Entrance to Dominus Estate, Napa Valley, California

Entrance to Dominus Estate, Napa Valley, California

From Petrus To Dominus

In the late 1960s, a young French man with a daily life as a student at the University of California, fell in love with the enchanting Napa Valley and the region's enticing wines. Nevertheless, after graduation, the young man had to return to France in the 1970s. He was here to run the family's wine house. The name of the young man is Christian Moueix and the family's wine house is the iconic Chateau Petrus.

However, Christian Moueix's love for the Californian wine district lasted and when in 1982 he was given the opportunity to enter into a partnership to produce wine at the historic Napanuuk vineyard, he seized the opportunity. Napanuuk was famous for being the source of the fruits for some of Napa Valley's finest wines of the 1940s and throughout the '50s and' 60s. When Moueixs was given the opportunity to become sole owner in 1995, he seized the opportunity and the American adventure that would end up tying Petrus with one of the greatest American wines was a reality.

The house was named 'Dominus Estate' which in Latin refers to 'master of property' - the name was chosen when Christian Moueix wanted to emphasize his commitment to the area. A commitment that has been fulfilled with the house's wines, which today belong to the Napa Valley’s, and thus the United States’, greatest - and perhaps only surpassed by Opus One in terms of recognition and brand.

Top Points At Spot Price

Dominus is one of the names of the American wine scene that has the greatest recognition. The brand is great, and the quality is terrific. The latest vintage of the house's first wine, 2016 Dominus, was awarded with the perfect 100 points from Robert Parker's Wine Advocate. So did vintage 2015, which allows Dominus Estate to boast of no less than four perfect 100 point scores from Wine Advocate since the 2010 vintage.

The same applies for both Harlan Estate and Screaming Eagle. While a bottle of Screaming Eagle easily costs € 2,500* and a bottle of Harlan Estate will cost up to € 1,000*, you are now only to pay € 210 per bottle of 2016 Dominus and 225 for the 2015 Dominus*. Not only is this in itself a bargain, it is also probably the cheapest 100-point wine from Napa Valley's 2016 vintage. This, together with Dominus' strong brand, means that the 2015 and 2016 Dominus may be a highly sought-after wine in the future and an obvious choice for a huge audience with preferences towards the bombastic American wines - both inside and outside the United States.

But if Dominus really is among the absolute greatest American wines, why doesn’t it cost more, could you be tempted to ask? And this is an appropriate question indeed. But the fact is that this is just the price as of today, and by this Dominus, and especially in the two recent vintages og 2015 of 2016, you get extremely amounts of value and investment potential for the price. Opus One which can rightly be regarded as the absolute greatest American wine brand a price of € 300 per bottle is also quite normal.

* Price per bottle in perfect condition, in whole cases of a regular vintage, without duty, VAT and taxes

The 2016 Dominus comes in original wooden cases of six bottles - also called OWC6

The 2016 Dominus comes in original wooden cases of six bottles - also called OWC6

Solid Returns For Dominus Investors

Dominus' big brand and critically acclaimed quality have also in recent years affected the prices. Looking at the past 15 vintages of Dominus' top wine, which have been on the market for at least two years, prices have risen more than 18% on average over the past two years. This means an average annual return of 8.7%*.

Just as we often see it in the wine world, the older vintages also deliver the highest returns here, while being more moderate with the younger ones. At the same time, this is a testament to the great potential of the young wines as the maturation of the wine increases and the supply decreases. Another interesting observation is that some of the highest returns among the past 15 vintages are from before Dominus Estate began collecting 100 points reviews. Bearing this in mind, the investment potential seems to be lucrative by the fact that the 2015 and 2016 vintages is a 100 point wine, while the previous top-yielding vintages were "only" rewarded 87-95 Parker points.

* Based on data from the British wine exchange Liv-ex

Wildfire, Mega Production And Dominus Estate

When it comes to wine, the good investment can sometimes be tied to limited production and a rule of thumb is that the smaller the production, the greater the investment potential - a rule that applies in particular to Burgundy. But, as in so many other cases, there are true exceptions anyway: We recommend investment in selected Italian and American wines, which are often not as limited in production as it is known from Burgundy. Instead, there are other characteristics that apply, such as, for example, highly sought-after brands, exceptional quality or something else. If you look among the absolute best wines from the Napa Valley, for example, Opus One produces 300,000 bottles of wine in a regular vintage, while at the other end of the scale, Screaming Eagle produces maybe as little as 20.000 bottles, which is also reflected in the significantly higher price (easily 10 times more expensive than Dominus, for example). Dominus' production is at an interesting level where the production of the latest vintage (2016) of the house's top wine is 66,000 bottles, which despite this being a normal level, seems low compared to the extremely attractive price.

In addition, much of California in 2017 was ravaged by heavy wildfires. A disaster that has also affected Napa Valley's wine production, where, for example, Screaming Eagle has already revealed that Screaming Eagle will not be producing a 2017 vintage due to smoke damage to the grapes. It is difficult to determine the exact consequences of the wildfires from a wine perspective, but over 20,000 ha in wine-producing Napa Valley municipalities were affected while even more may be affected by smoke damage. One thing is certain, though: The 2017 vintage in the Napa Valley will generally be adversely affected by the wildfires and can therefore be subject to increased demand for the other vintages, including the 2015 and 2016 Dominus.

66,000 bottles of 2016 Dominus were produced, which in the American perspective is a relatively limited production

66,000 bottles of 2016 Dominus were produced, which in the American perspective is a relatively limited production

RareWine Invest’s Opinion

Dominus is arguably one of the greatest and best-known American wine brands, perhaps surpassed only by Opus One when it comes to recognizability and wide appeal. The attractive award gives Dominus an enormous audience, and while Americans are largely patriotic and have a great fondness for their own wines, American top wines also enjoy tremendous popularity in the rest of the world.

This vintage’s 100 Parker points will make this vintage a very attractive choice, both now and in the future, and considering that some of Dominus' wines that have risen most in price in recent years are wines with significantly fewer points, it will be interesting to follow Dominus' young top vintages in the future. The foundation for solid price rises is perfectly in place.

Add to this the uncertainty about Napa Valley's 2017 vintage, which largely may prove to be more or less limited, may create even greater demand towards the existing wines from previous vintages.

Invest in Dominus and get wine from one of Napa Valley's most sought-after producers - wine of excellent quality and in a US perspective produced in relatively limited quantities that have at the same time proven the ability to deliver solid returns – and this even in vintages with significantly fewer points than Dominus' 2015 and 2016 vintages carrying the perfect 100 Parker points!

This is your opportunity to choose the bargain of the 2016 vintage or only pay € 15 extra per bottle of the 2015 vintage to get a wine that is one year further in its lifecycle.

Invest In 2015 and 2016 Dominus

| Vintage | Wine | VOL. | Qty | Price* |

|---|---|---|---|---|

| 2015 | Dominus | 750 | OWC6 | € 225 |

| 2016 | Dominus | 750 | OWC6 | € 210 |