Investment Tips - Champagne - 17. December 2019

Comtes de Champagne At An Especially Attractive Price

Taittinger is the biggest champagne house on family hands, but despite proud tradition, their prestige cuvée is probably the most underrated in Champagne...

Update 24 September 2020: Better Timing For Investment Than Ever Before

What Has Happened Since The Last Investment Opportunity?

The very short answer is "almost nothing" - and that is exactly what makes the case more interesting than ever before. The price has largely not moved since the last time we issued investment tips on this Champagne.

If you are among the many who invested in the 2007 Comtes de Champagne last time, your patience is now finally rewarded with a new vintage that is just around the corner - and at the same time you have the opportunity to supplement your first investment at no significant extra cost.

We often see that the price of a given Champagne begins to rise as the quantities available in the market fall, which usually coincides with the Champagne house approaching the release of its next vintage and thus has roughly sold out of the previous vintage . This means that it can be difficult to identify the perfect time for investment, but it is basically about how long you dare to wait to invest. In this case, it has been possible to wait an unusually long time, which means that you can now invest in the 2007 Comtes de Champagne at almost the same price as last year, even though the 2008 vintage is just around the corner - an unusually attractive situation!

Legendary Top Vintage At The Door

Taittinger is one of the very few houses that have not yet released their pprestige cuvée from the 2008 vintage, but we are closer than ever. The official release will take place during October. Nevertheless, 2008 Comtes de Champagne is already traded on the professional markets for approx. € 135 / btl. This means that the 2008 vintage is currently trading at almost double price compared to the 2007 vintage, which despite the quality difference is completely unsustainable. Either one is too expensive or the other is too cheap - and since Champagnes of this format rarely fall in price as much as it takes to correct this bias, the 2007 vintage seems to be too cheap .

What else the imminent release of the 2008 vintage is going to do for the 2007 vintage and Taittinger, and the Comtes de Champagne in general, we can only guess, but one thing is for sure: The timing of investment in the 2007 Comtes de Champagne is simply perfect!

You can now invest in 2007 Comtes de Champagne at only € 73*. Contact us through the form at the end of this article if you want to invest or want to learn more about this investment case.

The Champagne House On Family Hands

The history of the Taittinger Champagne House is, on the one hand, a fantastic story like all the others in Champagne, and at the same time as unique. Jaques Fourneaux founded the house in 1734, making Taittinger one of the absolute oldest champagne houses today. In the early years the Benedictine monks were the most important partner for Fourneaux as they owned the finest vineyards in the region at that time.

Revolutions and wars raged, the power of the church was marginalized and society, in general, changed completely - but Taittinger persisted, although this particular name first came into existence in 1932. Here Pierre Taittinger bought the house and was in charge of the operation until his son Francois Taittinger took over in 1945.

2005 was a fateful year for Champagne Taittinger, as the family accepted an offer from a private American investment fund and sold the entire Champagne house. The entire industry was in shock and it was feared that such a coorporation, without any connection to the culture of Champagne, would undermine the market with a skewed focus on profit and quality. As a result, Pierre-Emmanuel Taittinger, in collaboration with the French bank, Crédit Agricole, bought Taittinger back after less than a year in May 2006. It secured the Taittinger family control over the house and has made Taittinger one of the few champagne houses that still today is family owned.

To this day, Taittinger is among the largest and most prestigious champagne houses and has 288 acres of vineyards, which is enough to meet almost half their needs to produce the approximately 20 million bottles of champagne produced per year. Taittinger continues to have relations with the Benedictine monks, as Taittinger today stores their champagne in the cellars under St. Nicaise Monastery, also used to store wine by the monks. The basements are said to have a capacity of up to 22 million bottles.

When looking at Taitinger from an investment perspective, one must look at the house's prestige cuvée, Comtes de Champagne, as we are dealing with what can easily be one of the most underrated prestige cuvettes in all of Champagne. It offers great investment potential which you can read more about below.

Big Potential: Comtes Is Bypassing Other Top Champagnes

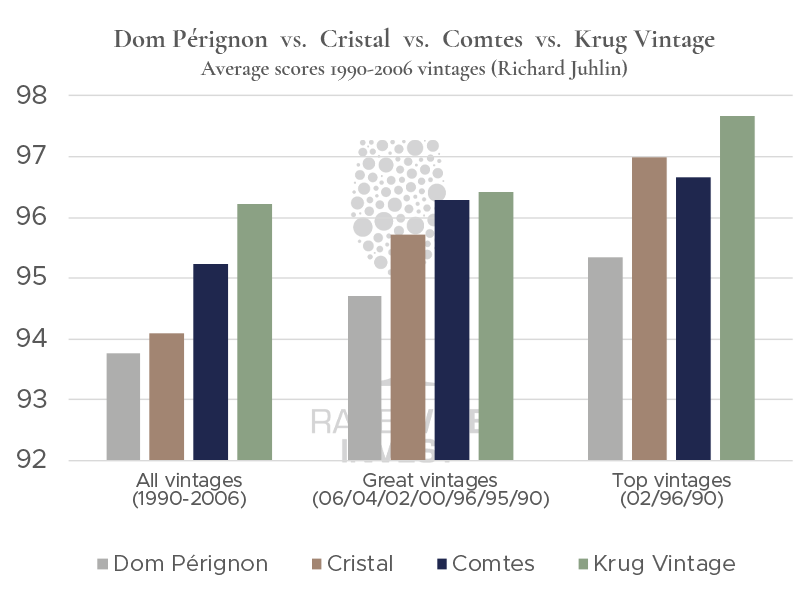

Taitinger's prestige cuvée, Comtes de Champagne, is probably the most underrated prestige cuvée in Champagne and there is a big upside in that. The argument that it is undervalued is to be found in the price vs. quality relationship. In the chart below, the quality across all vintages from 1990-2006 has been compared including Dom Pérignon, Cristal, Comtes de Champagne and Krug Vintage:

The chart clearly shows that the Comtes de Champagne in all vintages and in the better vintages is both Dom Pérignon and Cristal superior, and at the same time it can be an equal competitor in the absolute top vintages.

Richard Juhlin, who is one of the absolute greatest wine critics in the world, with a specialty in champagne, has unfortunately not given any ratings for the exact vintage 2007 that this investment tip is about. To compare, it can be said that Antonio Galloni from Vionus has given the 2007 Comtes de Champagne 96 points which is 0.8 points higher than the average for Juhlins points across all the vintages.

The fact that Comtes de Champagne scores so high, especially in compared to Dom Pérignon and Cristal, may come as a surprise to many, but it is in fact the price that is particularly interesting here: With a price of just € 70 per bottle for a champagne that so convincingly beats both Cristal and Dom Pérignon across all vintages since 1990, the Comtes de Champagne looks a particularly attractive option.

A Solid, Patient Investment

Comtes de Champagne has historically delivered good returns to investors. See the returns across all vintages of Taitinger's 1990-2006 prestige cuvée:

| Period | 2 years* | 5 years** |

|---|---|---|

| Average return | 36,00% | 82,93% |

| Average annual return over the period | 16,62% | 12,84% |

The returns are not to be mistaken, but something that is particularly important to note here is that it is primarily the older vintages that have delivered the greatest return, which contributes to raising the average. What, on the other hand, looks like a rock-solid trend, is that the mature vintages are seeing great rise in price. In other words, this is a patient, long-term investment, but with a solid potential.

Buy, Drink And Forget - Next Vintage...

This is very much the mindset when it comes to champagne. Bottles are bought and drunk and given the large quantity of the large cuvées, it is not something that many thoughts are put in to. Before you look around, the next vintage is available, and the same process is repeated. What many people forget is to save for the future so that one can also enjoy perfect and mature champagnes from the big houses in the years to come. This is true for Dom Pérignon and Cristal, for example, but perhaps even more so for Taittinger's Comtes de Champagne, because why store a "cheap" champagne? The consequence of this is often seen in the form of price increases on the older mature vintages, as the supply of these can be very limited due to the buying, drinking and forgetting mentality. Although the young vintages of the Comtes de Champagne are not difficult find, our experience is that the vintages are extremely attractive, which the above section of historical returns also supports.

Can The 2008 Vintage Pull The Price Up?

As one of the few major champagne houses, Taittinger has not yet released their prestige cuvée from the vintage 2008. Because of that the investment potential in vintage 2007 of Comtes de Champagne rises. Expectations for Taittinger’s vintage 2008 of Comtes de Champagne are high, as are all other releases of the legendary vintage. The same is expected of the price, and should it follow the examples from the other 2008 releases, this will also be record high.

If Taittinger releases the 2008 Comtes de Champagne at a record high, this could very well have positive effect on the price of the surrounding vintages, including the vintage 2007. An example of this mechanism was seen when Louis Roederer released their 2008 Cristal. The release happened in April 2018, but as early as October, just half a year later, the price of Cristal from vintage 2006, 2007 and 2009 had all increased by more than 30% as an immediate consequence of the vintage 2008.

If the vintage 2008 Comtes de Champagne is released at a record price, there is also an upside in the surrounding vintages. Taittinger is expected to release the 2008 Comtes de Champagne in 2020.

Best Price In The Market

If you invest through Rare Wine Invest, you can now invest in the 2007 Comtes de Champagne for just € 70 per bottle, which is the best price in the market. In fact, this price is approx. 10% below the recommended retail price, which adds further potential. At the same time, this is the opportunity to invest in large volume, despite the vintage approaching the last chapter before the story of the vintage 2007 becomes the story of the vintage 2008.

Rare Wine Invest's Opinion

Comtes de Champagne is a simple investment case: invest in a prestige cuvée from one of the large houses, in towering quality, but at an extremely attractive price. The Comtes de Champagne relationship between price and quality is at the heart of the matter: Compare the quality of respectively Dom Pérignon, Cristal and Comtes de Champagne, it is clear that Taittinger delivers a very high level that clearly outperforms the other two across the vintages since 1990.

Add to this that only one half of the price is paid for a 2007 Comtes de Champagne, compared to a Cristal. Although Cristal and Dom Pérignon must be considered stronger brands than Comtes de Champagne, one should not underestimate Taittinger. Today, Taittinger is the largest champagne house that remains in the hands of the family, with a strong focus on quality and Champagne culture.

The above compared to a business that produces around 20 million bottles of champagne a year, there is no doubt that Taittinger, and not least Comtes de Champagne is among the greatest.

Take advantage of the opportunity for a patient, solid investment, at the market's absolute lowest price, at a time when vintage 2007 is entering its final chapter, and at the same time get a potential upside in Taittinger's yet to release Comtes de Champagne in vintage 2008.

…And don't forget the value saving today's top champagne for future champagne drinkers. If you save, there may well be occasion to celebrate in the future.

Invest in 2007 Taittinger Comtes de Champagne

| Vintage | Wine | VOL | Packing | Qty | Price* |

|---|---|---|---|---|---|

| 2007 | Comtes de Champagne | 750 | OC6 | 600 | € 70 |