Investment Tips - Champagne - 17. March 2022

Latest release - great points for 2014 Cristal, and a Champagne drought dangerously close

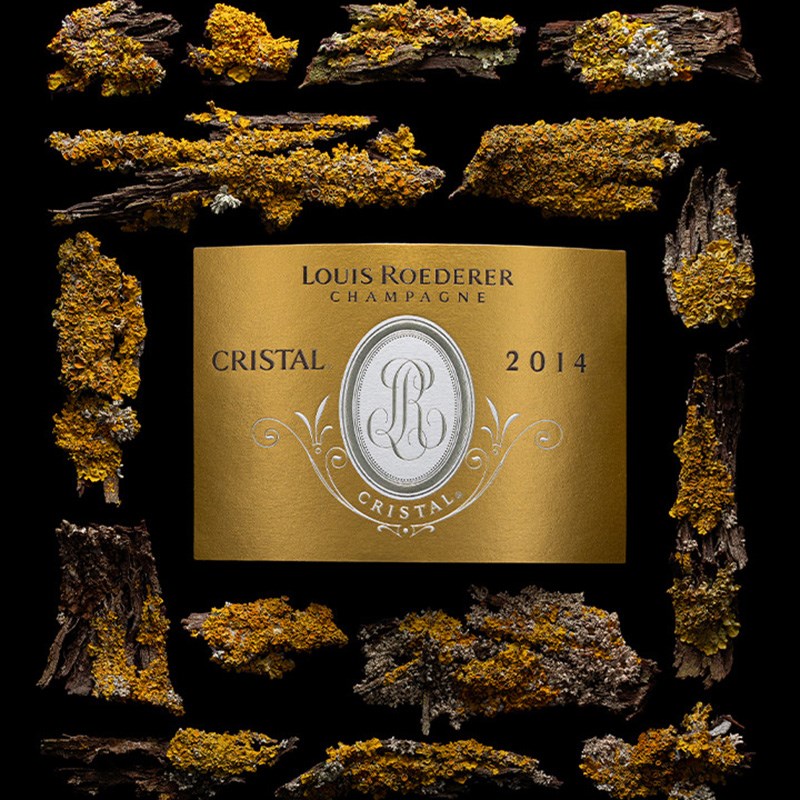

Quality, desire, and luxury in one Cristal bouillon cube. Invest in 2014 Cristal so you can deliver mature Champagne to future Champagne connoisseurs.

The world wants champagne. Especially Champagne from the world's best Champagne houses. Cristal is such a Champagne, and now you can invest in the brand new 2014 vintage, which gets great points from the world's most renowned wine critics.

This is the story of a prestige cuvée from one of the world's best Champagne houses, an approachable Champagne drought and a great history on Cristal returns.

Louis Roederer And Cristal

The iconic golden cellophane protects the precious drops from the sun's rays, and at the same time it has become synonymous with extravagance, luxury and bubbly quality.

For more than 100 years, Cristal has impressed the world's Champagne drinkers. In 1776, the house was founded under the name Dubois Pére et fils. However, the house got its current name when Louis Roederer inherited the house in 1833 - since then it has been in the family's famous Champagne hands.

Louis Roederer was a man of vision. He understood that vineyards were crucial to the Champagne, and so he acquired vineyards early on in the best locations in Champagne. This has given them full control over both quality and price development. Today, Louis Roederer owns 240 hectares of vineyards spread over more than 410 parcels.

Cristal is the house's prestige cuvée. Cristal is praised by many. Cristal is iconic. The level is constantly at the top.

Connotations: Premium, Desirable, And Exclusive

Cristal is produced from Roederer's best Grand Cru vineyards, and the production is always adapted to the vintage. This means that only when the vintage is good it can be included in Cristal.

It is probably why Cristal is sought after and why Cristal is always awarded high scores by the world's wine critics - and the 2014 Cristal is no exception. Wine Advocate awards 96 points, Vinous 98 points and James Suckling 97 points, giving an average score of 97 points.

By comparison, it is an average score identical to 2002 Cristal, which is a legendary vintage in Champagne.

Champagne guru Richard Juhlin has yet to give his verdict, but whatever it is, 2014 Cristal ranks among the best Champagnes.

2014 Cristal

2014 Cristal

+ 56,6 % On 2013 Cristal

On 2 July 2021, we for the first time offered investment in 2013 Cristal. Since then, the price of this has risen by 56.6 %. 2013 Cristal has received 97.3 points across the above four critics, which places it in terms of quality at almost the same level as this 2014 vintage.

To get a broader perspective on Cristal returns, it would be useful to look a little further back. According to Liv-ex, the last five Cristal vintages, which have been on the market for at least two years*, have produced an average return of 74.5%.

Furthermore, the last five vintages of Cristal, which have been on the market for at least five years**, have produced an average annual return of 13.7%.

*2012, 2008, 2009, 2007, 2006

**2007, 2006, 2005, 2004, 2002

Huge Consumption Reduces Supply Day By Day

Every year, the major Champagne houses send out several million bottles of Champagne. Indeed, Louis Roederer is said to produce more than three million bottles a year. Out of this million production, a few hundred thousand bottles of the best vintages become the house's prestige cuvée.

And even if it sounds like a lot, the champagne-hungry eyes of the whole world are on Cristal, among others, when the great vintages are released.

The majority of all Champagne is drunk young, but it actually has formidable ageing potential. The two components are particularly attractive from an investment perspective. If the wines are stored while the remaining quantities are consumed, the saved ones become even more desirable.

A mature Cristal is thus not something you can find just anywhere.

Champagne Drought Threatens

A pandemic shook the world and Champagne did not go free. Today, Champagne has become more difficult to find and, according to the Comité Interprofessionnel du Vin de Champagne (CIVC), demand for Champagne fell in 2020 in response to Covid. This meant that sales fell by 18 % measured by volume.

Fortunately, the pandemic's grip was loosened, and demand for the bubbling wine rebounded at the end of 2020. This trend continued into 2021, bringing record returns, but a new challenge emerged. The CIVC sets an annual limit on how much Champagne may be produced. In response to falling demand, they reduced Champagne production by 25 % in 2020 compared to 2019.

Reduced production and increasing demand through 2021 has created a massive imbalance between demand and supply. Add to this the fact that supply problems have hit pretty much everyone, so they can not just immediately increase production again. Gabe Barkley, CEO of the LMVH Group, predicts that reduced production could affect the market for many years to come.

Rarewine Invest's Opinion

Good Champagne is in high demand. That in itself is a good starting point for investing in Champagne. Another attractive starting point is to invest in a champagne with great scores and a strong brand behind it, which is the case with 2014 Cristal.

In addition, there is a major factor at play - namely the impending champagne drought. We do not yet know what impact this will have on the market, but according to the industry itself, volumes will be lower. At the same time, there is nothing to suggest that demand for champagne will fall. Quite the contrary.

Cristal is an old friend. Both within RareWine Invest, but also among the world's champagne lovers. That is why we have great confidence in the 2014 vintage. Just as we have had in its predecessors. Now you can invest in quality champagne, so the future can also enjoy mature champagne from one of the world's best champagne houses.

Invest in 2014 Cristal

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2014 | Cristal | 750 | OC6 | €225 |