Investment Tips - Champagne - 8. September 2022

Opportunities for investment in 2008 Dom Pérignon are diminishing

The 2008 Champagnes dominate the trade on the secondary market. Invest in the 2008 Dom Pérignon, whose price does not match the towering quality. Learn more here.

Expectations were already high years before the 2008 Champagnes were released on the world market. Yet most of the prestige cuvées from this near-perfect vintage have impressed. Sky-high points and sky-high demand have been central to the benchmark vintage, and it is, thankfully, not yet too late to invest in 2008 Champagne of the highest order. But the opportunities are only getting fewer.

Here, however, is one of those opportunities and even on one of the most sought after. 2008 Dom Pérignon, which besides placing itself at the top of the podium also seems too low priced compared to the other 2008 champagnes - quality considered.

Read on to find out how the 2008 Dom Pérignon has performed in terms of price, how it fares among the competition, and what the future holds.

Legendary Monk And Luxury Concern In Lucrative Union

A monk named Dom Pierre Pérignon sowed the seeds of what the world today considers one of the best Champagne houses in the world. He was revolutionary in his way of making Champagne, which is why his name and legacy have achieved legendary status both in Champagne and around the world.

The house's prestige cuvée of the same name first appeared on the market in 1936 with their 1921 vintage, and the quality has been steadfast up through the ages - release after release.

This undeniable quality is probably why the LVMH Group today has taken ownership of Dom Pérignon, which is synonymous with both luxury and extravagance. Therefore the image of the Champagne House fits perfectly into the luxury conglomerate's portfolio, which also includes Krug, Clos des Lambrays.

LVMH Group is doing the monk justice and adding distribution and marketing power to a Champagne house that delivers Champagne the world demands.

2008 Dom Pérignon

2008 Dom Pérignon

“Unquestionably The Finest Dom Pérignon Of The Decade”

William Kelley from Wine Advocate is behind the quote above, where he puts into words his opinion of the 2008 Dom Pérignon. He acknowledges the praise with 96 points, and actual this rating is from August 2022. The fresh score surpasses the last rating from Kelley of the same wine which was 95+. Such an upgrade of a rating augers very well for the saving potential.

Richard Juhlin awards 97 points, and he has not awarded that to a Dom Pérignon since the 1976 vintage. Vinous tops, awarding a full 98 points, putting it on par with the 2002 vintage. This brings the 2008 Dom Pérignon to 97 points across the three critics - the highest score ever. A similar level is found most recently in the 1964 vintage where the average score is also 97 points, although there is no score from Wine Advocate.

Price Vs. Quality In The Year Of Miracles

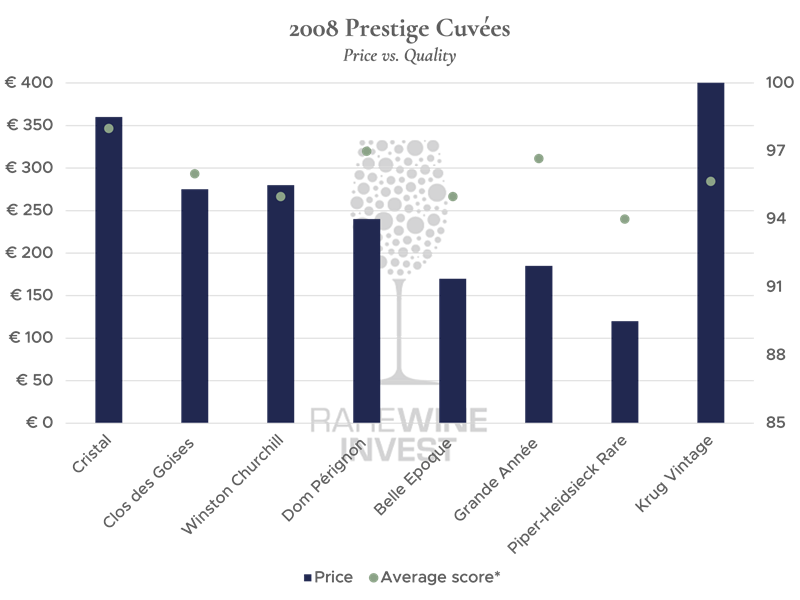

2008 has already entered the history books as a benchmark vintage in Champagne, which is why all prestige cuvées from this vintage in principle attract the attention of the world's wine lovers and investors. But beyond this, an additional buy signal has emerged if you look at price vs. quality. This is visualised below across the prestige cuvées RareWine Invest has previously covered.

The table above shows that the price/quality ratio of 2008 Dom Pérignon does not match at all. Especially considering that in terms of quality it can only be surpassed by the 2008 Cristal, but in terms of price it ranks fifth among the eight Champagnes here.

But while scores are generally high for the 2008 Champagnes, there are of course other factors that play into pricing, for example brand value, demand, hype, and marketing forces. These elements can all be linked to Dom Pérignon and, combined with the fact that the 2008 vintage simply seems too cheap in relation to quality and peer releases, this is a clear buy signal.

Redundant But Certainly Relevant: "2008 Vintage Leads Champagne Trade In 2022"

If you invested the first time RareWine Invest offered 2008 Dom Pérignon for investment (January 2019), you have today achieved a return of 84.6 %. Therefore, an obvious question would be whether price increases are still in sight. The table above is one indication. And demand is the next.

According to Liv-ex, the 2008 vintage dominates the Champagne trade in the secondary market. And in May 2022, 2008 Champagnes were the most traded vintage. Add to that the fact that the 2008 vintage has been the most traded in 2022, accounting for a whopping 18 % of the total Champagne trade.

The 2008 Champagnes can therefore take much of the credit for the Champagne 50 sub-index rising 50.6 % over the past year. And in one year, the price of 2008 Dom Pérignon has risen 56 %, according to Liv-ex.

There is thus no evidence that the 2008 hype is slowing down.

But will the 2008 vintage continue to top the list of most traded vintages? Not likely. Volumes are steadily disappearing from the market, and as new vintages take over, the old legends are becoming harder and harder to find - and historically, this is where price rises tend to start.

Rarewine Invest's Opinion

Expectations for the 2008 Champagnes are still sky high. Since the release, other vintage Champagnes have been added, and 2008 Dom Pérignon still stands out as the best. And there will always be demand for the world's best, even if the volumes will not remain available.

Therefore, this is a perfect opportunity to secure investment-worthy volumes for your portfolio. Before the market is vacuumed. Before the price is expected to continue upwards.

History has cemented time and time again that the biggest price rises are seen in the long term. 2008 Dom Pérignon is still young and the great short term returns have given it a great start and only underlined the massive demand.

Dom Pérignon is not just anyone. The 2008 vintage is not just any vintage. LVMH Group is not just anybody.

We expect great interest in this one, so as always it is first come, first served.

Invest in 2008 Dom Pérignon

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2008 | Dom Pérignon | 750 | OC6 | € 240 |