Investment Tips - Champagne - 16. February 2023

2002 Krug Vintage: Benchmark Vintage And +91% In Five Years.

Power-100 brand - Krug resonates high quality, high demand, and sweet music in an investor ear. If you believe in arguably the world's best Champagne house, read on.

”Ultra-elegant, soft, seductively hovering caressing character with a healthy sting beneath the surface as usual with Krug. Layer on layer constructed in a sophisticated and detailed way”

- Richard Juhlin

The quote comes from Richard Juhlin's description of the 2002 Krug Vintage, which is available in this investment tip. And it is indeed very indicative of what this investment tip is all about. Juhlin awards it 97 points, which places it among Juhlin's favourites of the Krug Vintage Champagnes.

But Juhlin also points out a practice at Krug. A sophisticated practice. A seductive practice. A caressing practice. That is why the essence of this investment tip is also the investment in Krug - regardless of vintage. For a decade, Krug has officially established itself among the world's greatest wine power brands. And Krug Vintage has achieved great historical returns. 2002 Krug Vintage is certainly no exception. Read about the potential below.

King Krug - Among The World's Most Sought-After Champagne Houses

In 1843, the Krug Champagne House was founded in Reims by Joseph Krug - the uncrowned king of vintage Champagne. Joseph Krug's dedication to the art of Champagne and his unstoppable diligence created a strong foundation on which the house successfully stands today.

Joseph Krug was driven by the idea that the true essence of Champagne is the pleasure itself. And so, his vision became to offer the very best Champagne every year - regardless of the annual climate variations involved. And so, it was done.

But while the foundations are solid, the house is certainly not resting on its laurels. The quality of the house's Champagnes has been constantly refined, and in 1999 LVMH Group, arguably the world's strongest luxury retail conglomerate, took ownership of the almighty Krug - and of course they did so because they spotted a blossoming business potential. They have kept the Krug family very close to maintain the very special Champagne spirit the house has possessed since Joseph Krug started it all.

Krug has it all. They have a strong immanent tradition of Champagne craftsmanship. They have massive marketing muscle behind them, and they are among the world's very greatest Champagne houses - whether it comes to their Non-Vintage Grande Cuvée, their Vintage Brut, or the iconic Single-Vineyard Champagnes Clos du Mesnil or Clos d'Ambonnay.

The world's wine lovers want Krug. Whatever the edition. Whatever the vintage.

In the mood for more Krug? Read our portrait of the house here: Krug Champagne - The Story Of A Complete Symphony Orchestra And Inherited Perfect Champagne Spirit

Power Krug. Power 100

Every year Liv-ex releases its famous power 100 list of the best performing wine producers of the past year. The rankings are based on various parameters, of which trade value, trade volume and price development of the individual producer are of high importance.

The Power 100 list for 2022 features nine Champagne brands, and Liv-ex points out that Champagne is a new force in the secondary market, which is really starting to break out with high levels of trade, strong price trends and an increasing number of brands slowly qualifying for inclusion on the illustrious list. But for now, only nine brands are represented among the 100, with Krug in the top 10.

Of the last 10 Power 100 lists, Krug has been on nine of them - twice in the top 10 (2019 & 2022). So, Krug has long established its worth at the top of the wine list, and a top-10 finish just underlines that fact. In the top-10 you will also find Domaine Leroy, Louis Roederer, Dom Pérignon and Domaine de la Romanée-Conti.

Note: Only 2002 Krug Vintage Magnum comes with a gift box.

Note: Only 2002 Krug Vintage Magnum comes with a gift box.

Consistent Quality Is The Key To Krug's Success

Of course, Krug has not achieved worldwide hype and demand by building castles in the sky. No, their success is rooted in consistently high quality. The 2002 vintage, available in this investment tip, also excels.

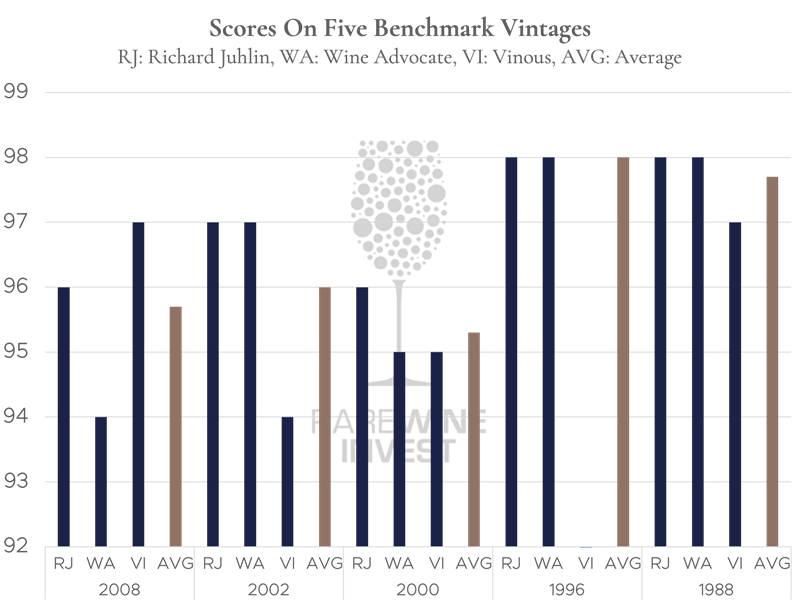

Firstly, it stands out for having originated in a benchmark vintage in Champagne, which is a stamp of quality in itself. And secondly, in terms of quality, it is well placed in the middle of the last five benchmark vintages with 97 points from Richard Juhlin, 97 points from Wine Advocate and 94 points from Vinous. Below you can see how the points breakdown looks for the last five benchmark vintages. And even the "worst" performers. Add to that the 2004 and 2006 vintages, which are not designated under the category below, both received an average score of 96.3 across the same critics. James Suckling is also impressed by 2002 Krug Vintage and awards it 100 points. However, he has not rated the other benchmark vintages, so it does not make sense to include him in the chart below.

Consistent quality is the key to Krug's success.

Vinous scores on vintages 1988-2002 are tasted and evaluated based on magnum format.

Vinous scores on vintages 1988-2002 are tasted and evaluated based on magnum format.

Krug Vintage Performance At RWI

Krug is a welcomed returning visitor at RareWine Invest, partly because of the above facts. Krug Vintage has even guaranteed great returns. All Krug Vintage under management by RareWine Invest since 31 December 2017* has yielded an average return of 91%. The 2002 Krug Vintage on Magnum has also risen 90% in just two years.

Krug is always welcome, because it has built-in quality and demand - and historical returns show that Krug performs. Time after time.

*Vintages 2004, 2003, 2002, 2000, 1998, 1996, 1995 in regular format, whole cases and perfect condition and vintages 2002, 1996, 1995 on magnum in perfect condition.

Why invest in Champagne?

At RareWine Invest we have recently looked at Champagne and the analysis is particularly relevant now that Champagne is on the agenda, but also relevant in a world that is economically uncertain.

First, Champagne sales are reported to be up in the first half of 2022 compared to the previous year, and the Champagne Committee is expected to announce record sales for 2022. The massive demand has even resulted in Moët running out of Champagne.

Add to this the fact that demand and supply difficulties in 2022 have resulted in the Champagne Committee raising the allowable harvest for 2022 - the challenge is simply that the great Champagnes are aged for 10 years, so it will be a long time before this has any real effect.

Furthermore, Chinese affluent, Western-oriented millennials and Gen Z's are expected to double the size of the wine market in China in particular by 2026 - a China, incidentally, that is expected to be the world's largest market for luxury products by 2025.

In other words, the supply and demand for Champagne are not matching up at all. Not now, and not in the future - something the Champagne investor can take advantage of.

Read the full analysis here: Analysis: The Prospects In Champagne - Will The Corks Pop In The Future?

RareWine Invest's Opinion

This is a classic investment case with benchmark sprinkles. Krug has long proven that they are among the world's best Champagne houses, as their almost consistent ranking on the notorious Power 100 list nicely substantiates. And the top-10 ranking also shows that Krug is widely traded worldwide.

The supply of Champagne is diminishing, but demand is not. And certainly not the demand for the world's best Champagnes. Historic returns on Krug Vintage underline the house's dominance. This is an investment in vintage Champagne with great scores from a benchmark vintage. But this is also an investment in the Krug Champagne brand.

This option offers both 2002 Krug Vintage in regular and Magnum format. We do not favor one over the other as it is a matter of temperament. Both formats have delivered historically great returns.

Invest in 2002 Krug Vintage

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2002 | Krug Vintage Brut | 750 | OC6 | € 525 |

| 2002 | Krug Vintage Brut | 1500 | OC1/GB | € 1.350 |