Investment Tips - Burgundy - 10. February 2023

2015 Vogue Musigny: +23.5% In A Year And A Half, But Potential Lies Ahead

In a market of increasing demand and decreasing supply, Vogues Musigny looks like one of the big winners of the future.

Welcome Back, Comte Georges De Vogue.

Vogue and the domain's great wines are always a delightful reunion, and it is not without reason that we have made our way here several times over the past few years. Domaine de Comtes de Vogue is not just a highly respected and recognised Burgundy producer with a history going back more than 500 years. No, Vogue is synonymous with sublime wine and is a supplier of great wine from some of Burgundy's most famous vineyards.

In addition to a handful of Village and Premier Cru wines, Vogue also produces a Les Amoureuses Premier Cru and a Bonnes-Mares Grand Cru. But the icing on the cake must still be the domain's Musigny Grand Cru. In fact, Vogue is the largest landowner at Musigny, and this means, among other things, that Vogue delivers Musigny that is far from unattainable for the world's wine lovers, as several other Musigny's otherwise are. And it is precisely from here that we must delve into the investment potential.

Great wine, mythical vineyard, benchmark vintage and not least some really exciting prospects for the wine investor.

You can read more about Vogue in our previous articles right here.

Demand Goes Up While Supply Goes Down

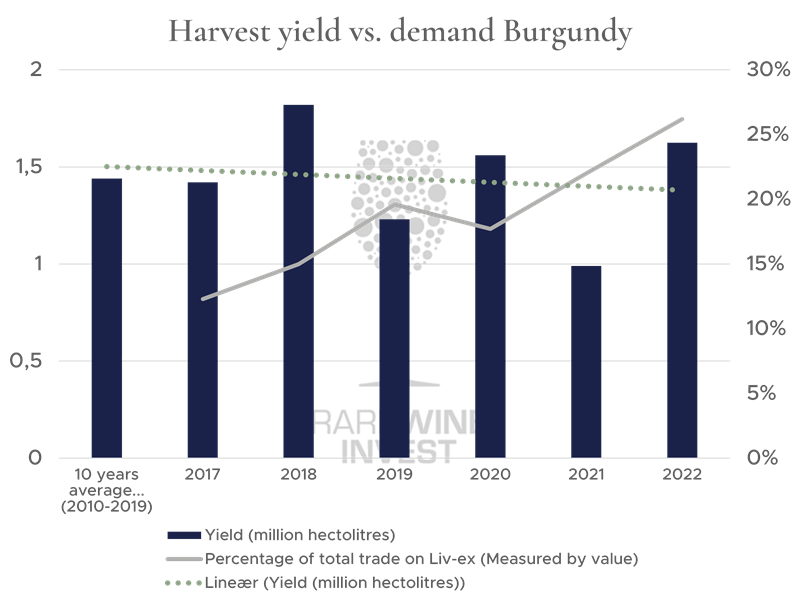

Before the spotlight turns towards Vogues Musigny, it might be a good idea to get the whole basic premise of Burgundy investing in place. The price increases here are driven by simple supply and demand theory. Demand for Burgundy wine is growing, while supply cannot increase - the vineyards are the size they are, and they cannot and may not be expanded. At the same time, the classifications dictate how much yield each individual vineyard can achieve. The only way the market can respond to this imbalance between supply and demand is therefore by increasing prices.

But we are not just dealing with increasing demand and constant production. In fact, production is decreasing:

The above is to some extent just a snapshot, but all indications are that this is a development that the wine world will have to get used to. Climate change, the move to biodynamic production and a general focus on quality rather than quantity are some of the reasons why supply has been steadily declining in recent years - and there is no sign that any of these circumstances are about to change.

2015 Vogue Musigny Vieilles Vignes

For the Francophile Burgundy enthusiast, 2015 is neither just a number nor a year. 2015 is one of those vintages in recent times that is highlighted when identifying something extra good in Burgundy. While there may be challenges in comparing apples to pears and bananas, 2015 in Burgundy is equivalent to, for instance, 2002 or 2008 in Champagne or 2016 for Piedmont and Tuscany.

This is no different at Vogue, where Burghound has rewarded their 2015 Musigny with 97 points. Wine Advocate gives 96+ points, while Vinous lands on 94 points.

This gives an average score of 95.7 points, which since the 2010 vintage has only been surpassed twice, on wines rated by all three critics*. However, this does not change the sublime quality of the 2015 vintage, and the designation as 2015 Burgundy is also maintained.

The greatness of the vintage is also revealed in the rating of the drinking window, which by the way, according to Wine Advocate, is not even entered yet. In fact, the optimal drinking window is estimated to be almost 40 years (2027-2065), whereas the 2010 vintage, which has higher scores, is estimated to be only 20 years old.

By the way, it can be mentioned that Burghound has only given more than 97 points to a Vogue Musigny three times: Vintage 1919, 1949 and 2005.

2015 will undoubtedly be a flagship vintage for Vogue Musigny in the future.

*2012: 97,3 2010: 96,5

Historical Returns On Comte Georges de Vogue Musigny

According to Liv-ex, the last 10 vintages of Vogue Musigny that have been on the market for a minimum of five years*, over the last five years, have produced an average return of 56.6%, which corresponds to an average annual return of 9.4%.

In June 2021, 2015 Vogue Musigny was available for the first time via an investment tip. If you had invested back then, you could have enjoyed a 23.5% return today.

Now it is back, and despite solid price increases, there is a good reason for this: The future potential is not considered any less - as said, the wine has not even reached its optimal maturity.

*2006-2015

RareWine Invest's Opinion

2015 Vogue Musigny - as mentioned in the introduction, this is about great wine, mythical vineyard and a benchmark vintage. Vogue Musigny is certainly and unquestionably exclusive wine. It is top shelf and among the elite - in Burgundy and therefore the world.

But even if the above is true and the price tag certainly seems fierce to most, Vogue Musigny offers wine lovers everywhere an access to drinking Musigny - something that is far from being either a given or a human right. To put this in perspective, a similar wine (only from Domaine Leroy) recently sold for €80,000* a bottle. The investment price of the 2015 Vogue Musigny here is €1,050*.

Overall, this is an investment in a category where supply is steadily reducing while demand only seems to be increasing. But more importantly - this is an investment in being able to offer future wine lovers an opportunity to drink Musigny from a fabulous producer and great vintage.

All criteria for a strong and classic Burgundy investment are thus represented in this investment case.

Note: Only a few bottles available

Invest in 2015 Comte Georges de Vogue Musigny Vieilles Vignes

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | Number of bottles available | PRICE/BTL.* |

|---|---|---|---|---|---|

| 2015 | Vogue Musigny Vv | 750 | OW3 | 21 | € 1.050 |

| 2015 | Vogue Musigny Vv | 750 | OW6 | 18 | € 1.050 |