Investment Tips - Burgundy - 18. April 2023

2020 Clos Des Lambrays - The Best Of This Millennium

A French luxury conglomerate raises the level and price of this iconic Burgundy producer. Nearly halved yield boosts Burgundy investment and sets the stage for the investor.

“Youthfully reserved, like many 2020s, this nonetheless stands out as the finest Clos des Lambrays of the 21st century—for now!” William Kelley, Wine Advocate

Few are privileged to be considered part of the Burgundy elite, but that is the case for Domaine des Lambrays, whose flagship wine Clos des Lambrays is available in this investment case. Even in the 2020 vintage, which is the subject of William Kelly's high praise above.

Domaine des Lambrays is an icon in Burgundy and the 2020 Clos des Lambrays is the best of this millennium. Burgundy investment has long been on the agenda at RareWine Invest, but at a time when demand for the best Burgundy wines is rising and supply is falling, Burgundy investment seems even more attractive. Read much more about the potential of 2020 Clos des Lambrays below.

Domaine Des Lambrays In Brief

Clos des Lambrays has officially existed since 1365, when it was first mentioned in official documents, and during the French Revolution the land was divided into several small parcels, only to be unified in 1868 when the negociant Louis Joly bought some parcels. Renée Cosson bought Clos des Lambrays in the 1930s but was not very successful. In fact, she only managed to produce good wine in the great vintages, much of which was given to her.

However, things changed when the Saier family bought Clos des Lambrays in the 1970s. In collaboration with winemaker Brouin, they replanted the vineyard and raised the quality considerably. So much so that in 1981 the vineyard was upgraded from Premier to Grand Cru. Again in 1996, the vineyard changed hands, but Brouin remained cellar master and winemaker. With him at the helm, Domaine des Lambrays was able to climb up the ladder to eventually place itself among the very top producers in Burgundy.

Domaine des Lambrays produces five wines, but there is no doubt that their absolute flagship wine is Clos des Lambrays. Clos des Lambrays is almost a monopoly vineyard, as Domaine des Lambrays owns 8 hectares out of the market's 8.84 hectares. From here, around 30,000 bottles are produced annually, but in the 2020 vintage, Mother Nature wanted it differently. Thus, the yield was down to 15 hectolitres per hectare, resulting in a production of only 17,000 bottles.

Domaine Des Lambrays Dressed In Luxury

In 2014, it was announced that the French luxury conglomerate LVMH (Louis Vuitton Moët Hennessy Group) was taking over Domaine des Lambrays and with it the branding and production of Clos des Lambrays. LVMH saw an opportunity to own an iconic Burgundian institution with an exceptional terroir that produces some of the best wine in Burgundy.

The LMVH Group is not just anyone. In addition to the brands included in their name, they are also behind luxury brands such as Dior, Belvedere, Tag Heuer and Krug. LMVH rhymes with business and lucrative investments. That is why they only enter into projects with inherent potential and great opportunities for growth. In other words, everything in LVMH's power is being done to advance Domaine des Lambrays - with the help of a massive marketing machine. As a result of the acquisition, it took only five years for the first price adjustment to be made.

The 2019 release of Clos des Lambrays was the first release under the leadership of manager and winemaker Jacques Devauges, who joined LVMH after leaving neighbouring Clos de Tart. He replaced Thierry Brouin, who had taken a well-deserved retirement. And the 2019 vintage became the first vintage to be released at a higher price.

And there are indications that Jacques Devauges has raised the already high level.

Burghound's Best Clos Des Lambrays Score - Ever...

... and the best score from Wine Advocate this millennium.

2020 Clos des Lambrays gets 95 points from Burgundy expert, Burghound. And it is the highest score a Clos des Lambrays has ever received from Burghound. Only the 2019 and 1949 vintages get the same score, and the 2021 vintage has so far only received a barrel score of 92-95.

Wine Advocate shares Burghound's enthusiasm and awards 2020 Clos des Lambrays 96 points, which is the highest a Clos des Lambrays has received from Wine Advocate this millennium.

Vinous has yet to give a barrel score of 95-97 points. If the final Vinous score is 95 points, it will be the best of this millennium, along with the 2019 vintage across scores from the three aforementioned critics.

If, on the other hand, it scores 96 points or more from Vinous, it will at a minimum land an average of 95.7 points across the critics. This will secure its place alone at the top as the best Clos des Lambrays of this millennium.

Clos Des Lambrays Performs As An Investment

We have to go all the way back to September 2020 before we were last able to offer Clos des Lambrays widely for investment. Back then, you had the opportunity to invest in vintage 2014 (93.7 AVG Points) and vintage 2016 (93.0 AVG Points). Had you invested then, today you would have realised returns of 60% and 84% respectively - in just 2.5 years.

And it is not only under the management of RareWine Invest that Clos des Lambrays performs. According to Liv-ex, the last ten vintages of Clos des Lambrays that have been on the market for at least five years** have yielded an average return of 85.3%.

**Vintage 2007-2016

Burgundy: Demand Rises - Supply Does Not

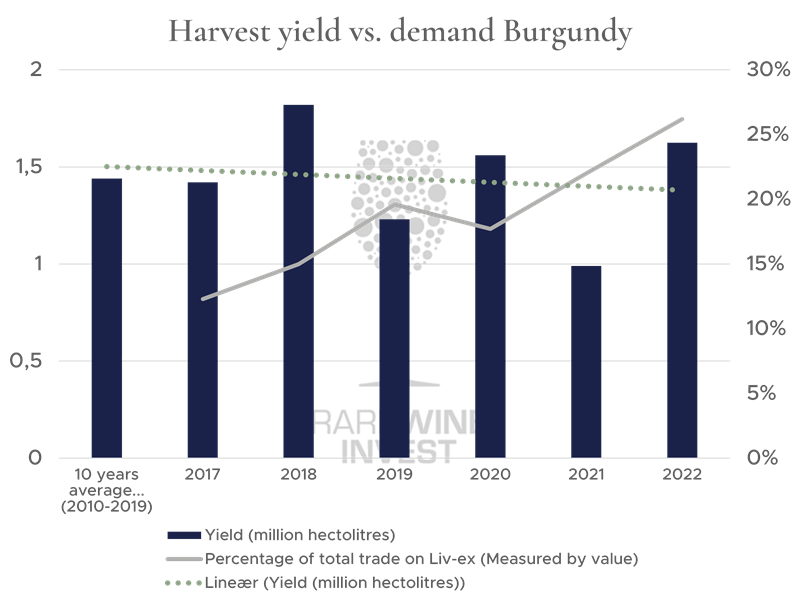

According to Liv-ex, the UK's answer to a wine exchange, demand for Burgundy has soared. It is reported that in 2010, the total share of Burgundy wine (by value) accounted for just 1% of all wines traded on Liv-ex. By 2022, Burgundy accounted for a whopping 26.2% of the value of all wines traded on Liv-ex. In comparison, the share of Bordeaux was 34.5% and Champagne 13.7% in 2022. In addition, the overall production in Burgundy has a steadily decreasing trend.

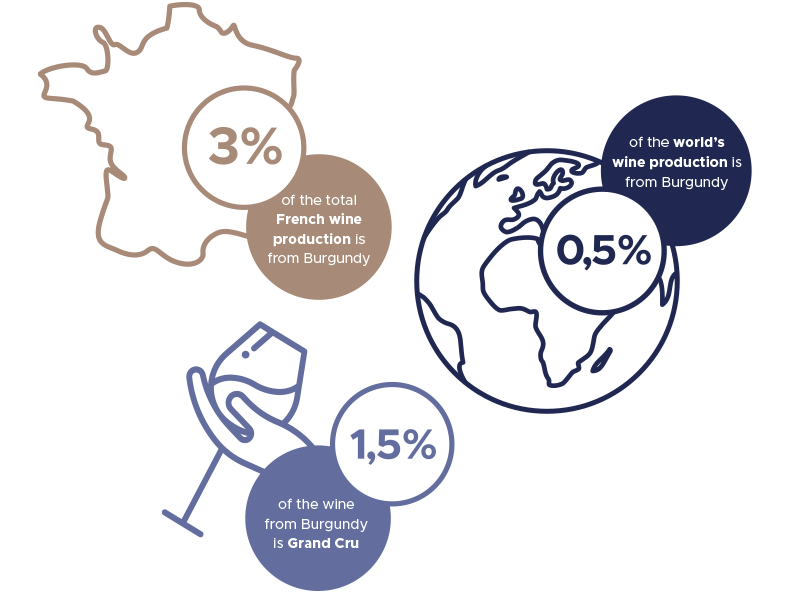

Burgundy wine accounts for only about 3% of total wine production in France and only 0.5% of total world production, and it cannot be increased immediately. The vineyards cannot or must not be expanded and legislation dictates maximum yields - yields that are never fully realised because producers choose to reduce yields to improve the quality of the grapes.

Harvest yields in Burgundy are generally low, and with the prospect of further declining yields in the future and steadily increasing demand, the stage is set for the wine investor.

RareWine Invest's opinion

With Lambrays, we are talking about an iconic Burgundy producer who, with a massive marketing apparatus behind them, can lift Domaine des Lambrays even higher than they already are. Furthermore, this is Burgundy Grand Cru, which is only becoming more and more sought after around the world - while the quantities of it show a declining trend due to, among other things, climate change.

2020 Clos des Lambrays is the best of this millennium and among the three best Clos des Lambrays Burghound has ever rated - and even here the yields are reduced compared to the usual production.

Clos des Lambrays has had great historical returns, and although LMVH has made the first price adjustment with the release of the 2019 vintage, Burgundy's best wines have many times before made a mockery of an alleged price ceiling.

In this investment tip, you have both the option of investing in regular format or magnum. We do not recommend one over the other. There are very few quantities available, so as always it is first come, first served.

Invest in 2020 Clos Des Lambrays

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2020 | 2020 Clos des Lambrays | 750 | OWC6 | € 550 |

| 2020 | 2020 Clos des Lambrays | 1500 | OWC3 | € 1.150 |