Investment Tips - Champagne - 3. March 2023

News: 2014 Bollinger La Grande Année Rosé Available For Investment

Two rating records: now you can step early into the case with Bollinger's pink prestige cuvée and an exciting future for the rosé category.

Bollinger - More Than James Bond Champagne

Anyone who barely knows their way around the Champagne universe will know that there are many jewels to choose from, and each one shines more brightly and beautifully than the other. If you dig a little deeper, it soon becomes clear that the little things differentiate one great house from another. In the long run, these little things have created the proud heritage and sought-after products.

This is no different when it comes to legendary Bollinger. If you look closely, Bollinger is much more than James Bond Champagne, which the modern Champagne lover will probably associate with the brand.

Since 1829, Champagne Bollinger has produced exceptional wines in a powerful, refined, and complex style. But despite the long and rich tradition, the adventure took off only in the mid-20th century.

Behind every great man, there is a strong woman, and when World War I veteran and fighter pilot hero Jacques Bollinger died in 1941, Elisabeth "Lily" Bollinger took over. Lily Bollinger, as the Champagne world has come to know her, brought hope back to Bollinger after some tough war years. She began a post-war offensive by traveling the globe promoting Champagne Bollinger with her charismatic charm.

Bollinger is particularly distinguished by its own 179 hectares of vineyards, of which 85% are either Premier or Grand Cru classified. The Pinot Noir grape, which is described as the backbone of Bollinger's identity, predominates here. Pinot Noir is a complex and fragile grape. As a result, Wine Advocate probably describes Bollinger's vineyards as some of the region's most well-maintained compared to the other great estates.

Champagne is not just Champagne; Bollinger is not considered one of the great and respected Champagne estates without good reason.

2014 La Grande Année Rosé Receives Highest Scores Ever

Bollinger's prestige cuvée is called La Grande Année and refers to the most excellent Champagne vintages, to which Bollinger pertinently limits the releases. In other words, La Grande Année is the flagship cuvée of the house, but for even more exclusivity, it is also produced in an extremely limited rosé edition. Almost a year ago, the latest edition of this was released - and it is just that Champagne you now have the opportunity to invest in.

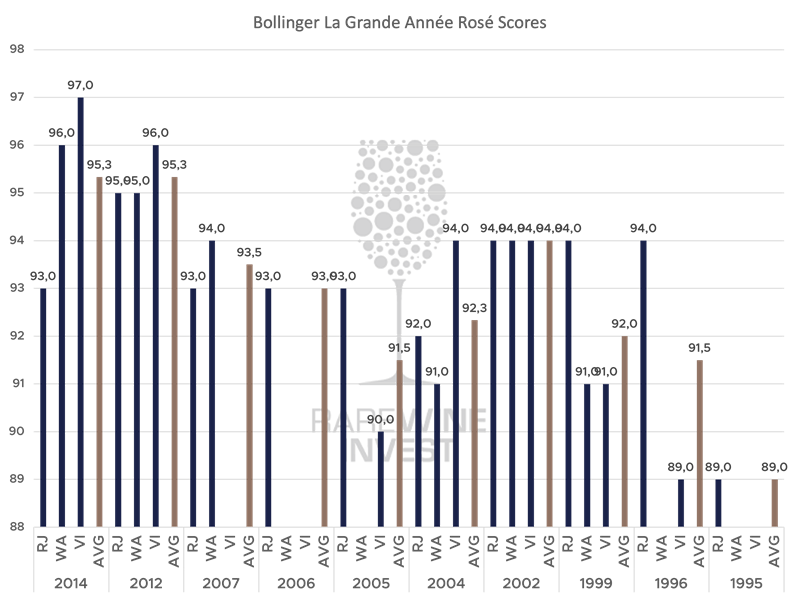

The 2014 vintage scored 97 points from Vinous, the highest a Grande Année Rosé has ever received from one of the most influential critics. At the same time, it received 96 points from Wine Advocate, the highest score Wine Advocate has ever given this rosé Champagne.

There is only one flaw in the joy - Richard Juhlin seems in the above perspective to judge the 2014 vintage very harshly, with 93 points. Deserved or not, disagreements like this only support the critics' subjective approach, integrity, and independence.

The conclusion is nevertheless clear: With the two rating records mentioned above and an average score of 95.3 points, the 2014 Bollinger Grande Année Rosé ranks as the highest scoring ever, along with the 2012 vintage.

Dive into the scores below.

RJ: Richard Juhlin WA: Wine Advocate VI: Vinous AVG: Average

RJ: Richard Juhlin WA: Wine Advocate VI: Vinous AVG: Average

Limited Additional Price: Attractive Price Difference Between 2014 Grande Année And 2014 Grande Année Rosé

In October last year, the UK wine exchange, Liv-ex, studied the price difference between white Champagne and its pink counterpart - a so-called "rosé premium." The study looked at the six most traded 2008 Champagnes* and found a clear trend in the price difference. Among the six**, there was an average rosé premium of as much as 58.5%.

The price difference is mainly because rosé Champagne is more challenging to produce, and that production is usually significantly lower.

Right now, you can invest in the 2014 Bollinger La Grande Année Rosé with a rosé premium of just 12.5%, compared to the white 2014.

*The 2008 vintage is not directly comparable to the 2014 vintage, but the regular and rosé editions have a 2008 premium included in the respective prices. The difference between white and rosé is thus valid.

**Cristal, La Grand Dame, Dom Pérignon, Pol Roger Brut, Comtes de Champagne and Belle Epoque

The Future Of Rosé?

In Burgundy, for example, red wines are the main price drivers, while white wines are more of a niche category with much-untapped potential. Compared to the reds, the potential is mainly based on limited production. In Champagne, the situation is similar between white and pink Champagnes.

Rosé Champagne is a specialized product category with rocket potential when the world's wine drinkers get aware of the category. The crucial question here, of course, is: will the world's wine drinkers do so?

There are undoubtedly strong forces working to bring them to that point. In February, Bloomberg reported that the Moët Hennessy group (LVMH) had acquired Provence-based Chateau Minuty in a venture into luxury rosé. According to LVMH CEO Philippe Schaus, Provence is to rosé what Champagne is to sparkling wine, and the rosé category, in particular, is being heavily promoted.

LVMH is not the only one going big in this category, though: in 2019, Chanel Group did the same trick with Domaine de l'Ile. In 2020, Cos d'Estournel owner Michel Reybier and NBA star Tony Parker bought Château La Mascaronne. Finally, spirits giant Pernod-Richard entered the rosé market last year by acquiring Château Sainte Marguerite - all high-profile rosé producers.

Rosé is thus on the agenda of some vast players, and it is hard to imagine that the efforts made in the rosé category will not also affect rosé Champagne. If you like rosé, there is a good chance you will also be interested in the bubbly version, and here rosé Champagne is just the Rolls Royce of rosé.

Just A Small Increase In Demand Will Have A Big Impact

The production of rosé Champagne is so limited that demand does not need to be pushed very much before quantities become seriously scarce:

More than 80% of global sparkling wine production in 2017 was white, while just 15% was rosé. Around 2% was sparkling red wine. The world's largest producer of sparkling wine was, and still is today, Italy. This means that once the share of Italian and other French sparkling rosé wines is subtracted, the total production of rosé Champagne is minimal.

Historic Returns On Bollinger La Grande Année Rosé

The historical returns on Bollinger La Grande Année Rosé show that this category has not yet taken off - at least not at Bollinger.

Over the past five years, according to Liv-ex, the last 10 vintages of La Grande Année Rosé that have been on the market for at least five years* have given an average return of 60.8%, which is significantly below the market.

First, it is essential to remember that over these vintages, something has seriously changed in quality, as shown in the above diagram. But this is also a testimony that there is an attractive potential in this category and at Bollinger specifically.

The investment price here is €130* per bottle, which seems far too little - given the nature of the product and how the pricing in much of the wine market has behaved in recent years.

*2007, 2006, 2005, 2004, 2002, 2000, 1999, 1996, 1995, 1990

RareWine Invest's Opinion

Champagne is an attractive category, whether for consumption or investment, but to add an extra layer of luxurious exclusivity, look towards the pink pendants.

Bollinger released their 2014 vintage last year in both white and rosé, but it has simply been impossible to find the rosé version at prices we could justify for investment purposes.

For the first time, you can enter this rosé Champagne case, one that has made two rating records and is undeniably one of the two best rosé Champagnes Bollinger has ever released.

With rosé Champagne, the great potential lies in the minimal production, where demand does not have to be pushed much before the scarcity becomes even more evident. Add to that the fact that some of the world's most extensive wine and spirits players are investing in the pink drops, which is hard to imagine will not affect the rosé Champagne category either.

With an investment price of €130 per bottle*, you are investing right now at the lowest price in the world, according to wine-searcher.com. It seems like a cliché, but there is every indication that this price will be one we look back on in five years, as we do with so many wines today, and think: "I'm surprised it did not cost more."

Invest In 2014 Bollinger La Grande Année Rosé

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2014 | Bollinger La Grande Année Rosé | 750 | OC6 | € 130 |