Investment Tips - Champagne - 5. October 2021

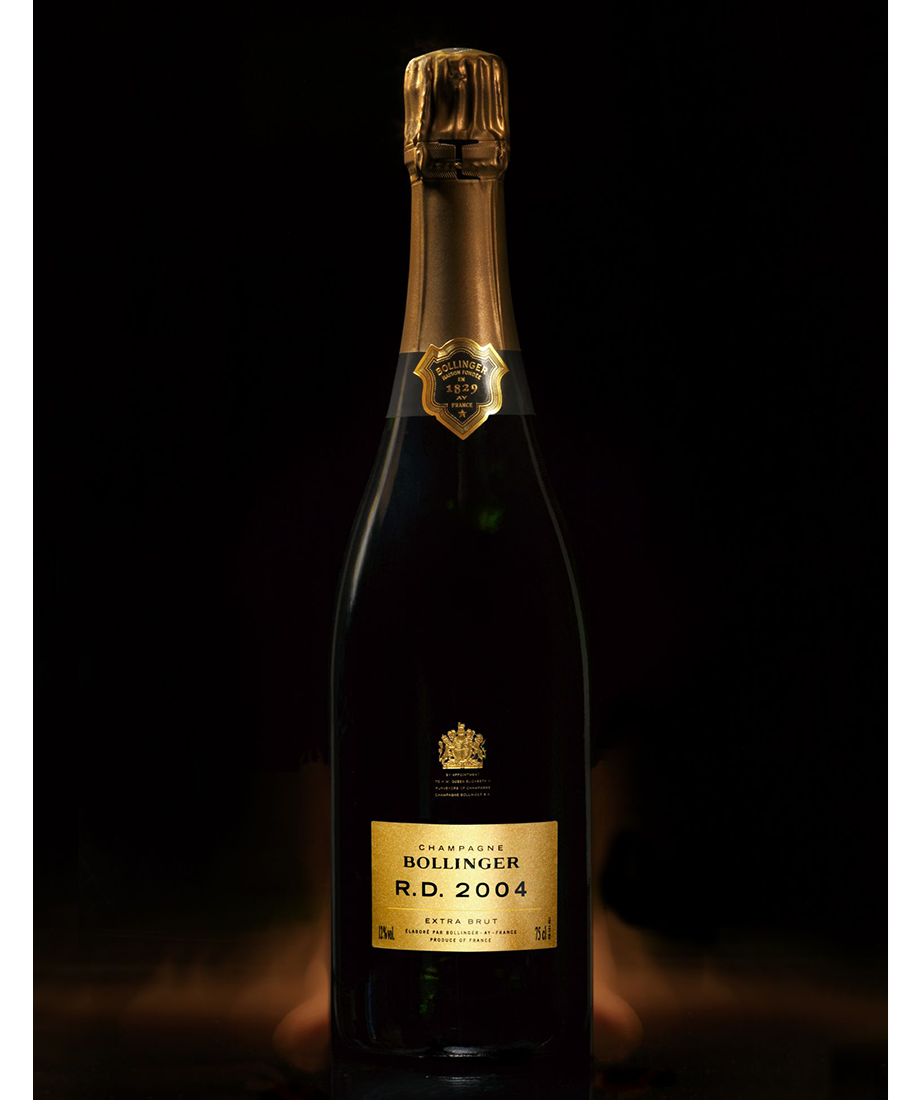

Bond Fever And Exclusive R.D. From Bollinger: Invest In High-Ranking 2004 Vintage

The 2004 vintage has recently been re-evaluated. The price is unsustainably low. James Bond fever is high. Only 30,000 bottles per vintage. R.D. is real Bollinger potential.

Global Bond Fever: Bollinger For Investment

The world is buzzing with Bond fever these days, which is why the Agent 007 campaign is in the spotlight. Who would not want to follow in James Bond's fantastic footsteps and drink Bollinger R.D. or add it to their wine portfolio?

It's no joke that one of the world's most prestigious and important, albeit fictional, men of the world is synonymous with Bollinger. And Bollinger is one of Champagne's finest producers.

R.D. is Bollinger's exclusive range of late disgorged vintage Champagne. The 2007 vintage is the most recent release, but right now you can secure its predecessor – the 2004 vintage. The 2004 vintage was rated a full two points higher than the initial score this summer by Champagne guru Richard Juhlin, there is only produced approx. 30.000 bottles and has an unsustainably low price compared to the three years younger 2007 vintage - as long as this last...

Lily Bollinger Gave The House Its Fame

In 1585 the Champagne house Bollinger was born, but it was only when Hennequin de Villermont, Paul Levieux Renaudin and Jacques Bollinger founded the house Renaudin Bollinger in 1829 that the Bollinger name was really established.

Things really took off when one of Jacques Bollinger's descendants married Emily Law de Lauritson (Lily Bollinger), who took over the business after her husband's death in 1941. With a special talent for promotion, she managed to spread the word about Bollinger worldwide.

In particular, Bollinger's vintage Champagne Grande Année, the single-plot vineyard Champagne V.V.F (Vieilles Vignes Françaises) and the late disgorged prestige cuvée Bollinger R.D. (Récemment Dégorgé) lifts the Champagne house to the top.

This investment tip is about the 2004 Bollinger R.D., and with an almost freshly written review by Richard Juhlin, it ranks among the absolute best from the house.

High Scores Emphasize Investment Potential

The table below shows that the 2004 vintage, with an average of 96 points across the three most significant wine critics, Richard Juhlin, Wine Advocate and Vinous, is second only to the 2007 vintage. This score comes on top of Richard Juhlin tasting the 2004 vintage again in July this year and upping his initial score of 94 points to 96 points. Juhlin has tasted 24 different vintages of Bollinger R.D., and only three times has he awarded 96 points or more. These were the 1979 vintage with 96 points, the 1973 vintage with 97 points and the 2004 vintage with 96 points.

Furthermore, Wine Advocate awards a full 97 points to the 2004 vintage, which places it on a par with the 2007 vintage: In the absolute top.

| Bollinger RD | RJ | WA | VI | Avg. |

|---|---|---|---|---|

| 2007 | 95 | 97 | 97 | 96,3 |

| 2004 | 96 | 97 | 95 | 96,0 |

| 2002 | 94 | 92 | 95 | 93,7 |

| 1997 | 93 | 94 | 95 | 94,0 |

| 1996 | 96 | - | 96 | - |

| 1995 | 95 | - | 91 | - |

| 1990 | 93 | 98 | 94 | 95,0 |

Back in March 2021 RareWine Invest offered 2007 Bollinger R.D. for investment. At the time, Juhlin had rated the 2004 vintage at 94 points, but the new tasting in July 2021 underlines that Bollinger benefits from ageing. At the same time, it is worth noting that whether we look in the broad perspective, across all three critics, or solely at the Champagne guru Juhlin's assessment, the 2004 vintage belongs to the absolute elite.

Limited Quantities Of Exclusive Bollinger R.D.

Most Champagne houses are hesitant to give figures on how large their Champagne productions are from vintage to vintage. Bollinger is no exception. However, Bollinger cellar master Gilles Descôtes told Decanter in 2018 that Bollinger accounts for less than 1 % of all Champagne produced, and R.D. accounts for less than 1 % of the Bollinger production.

Reportedly, 300 million bottles of Champagne are produced annually. This means that Bollinger produces about 3 million bottles of which only 30,000 bottles are Bollinger R.D. per released vintage.

Whether the total annual Champagne production is one hundred percent equal to the above, we cannot know for sure. However, we can only trust the words of Descôtes. This shows that Bollinger R.D. is produced only in extremely limited quantities.

R.D. is real Bollinger potential.

R.D. is real Bollinger potential.

How Bollinger R.D. Has Performed At Rarewine Invest

In March 2021, RareWine Invest offered 2007 Bollinger R.D. for investment at € 120. Today it is valued at € 135, giving a growth of +12.5 %.

This means that the 2007 vintage today costs almost the same as the 2004 vintage at € 140. Because the 2004 vintage has roughly the same score across critics as the 2007 vintage, but have matured for three years more, the minimal price difference will make the 2004 vintage a more attractive choice for the world's Champagne lovers.

It is also important to consider Champagne trends. Because if Champagne prices and the market behave as we know it, the demand for the 2004 vintage will increase. And high demand implies rising prices until the price gap between 2004 and 2007 will again become too large and 2007 will start to catch up with 2004 in terms of price. 2004

In addition, there is an imbalance between supply and demand, as the 2004 vintage has been on the market three years longer than the 2007. Consumption has undeniably eaten into the already scarce quantities of 2004. All of which is to the investor's advantage.

Rarewine Invest's Opinion

Supported by a James Bond brand, there is no limit to how popular a product can become. Such is the case with exclusive Bollinger R.D., and here we are dealing with Champagne that is not only popular - but a vintage that gets fantastic scores, and that underpins the quality.

Moreover, both Wine Advocate and Champagne King Richard Juhlin are enthusiastic about this vintage, and that clearly highlights the investment potential.

The assumption of a limited supply, supported by the opinions of Descôtes, as well as the fact that the demand for Champagne is increasing, also creates a favorable imbalance between supply and demand. Especially when it comes to investment.

Here is your unique opportunity to invest in the golden drops of a fabulous vintage. And with the past returns on 2007 Bollinger managed by RareWine Invest in mind, and the situation as it looks now, it bodes well for the 2004 vintage as well.

Here you can invest in both regular and magnum bottles. Moreover, this is likely the last time we will see 2004 Bollinger R.D. in quantities.

Invest In 2004 Bollinger R.D.

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2004 | Bollinger R.D. | 750 | OC3 | € 140 |

| 2004 | Bollinger R.D. Magnum | 1.500 | OC3 | € 310 |