Investment Tips - Whisky - 3. March 2021

Invest In The New Bowmore 30 YO 1989 At A Price Far Below The Market Price

The interest in the best and rarest single malt whiskys is growing. Invest in a release of only 2,580 bottles and get the best possible starting point for your investment.

Investment In Rare Whisky: Bowmore 30 YO 1989

The best single malt whiskys are extremely interesting investment assets, but there is a long way between the interesting cases, when it comes to both being able to find the right bottles to an attractive price. This is essential, since this is the the right conditions for a good invesment. These premises are met with Bowmore's latest limited edition release, which gives the whisky investor a strong case with the following characteristics:

Get an overview of the case below and dive into each argument further down in the article.

- An opportunity to invest in Bowmore's rare single malt whisky - only 2,580 bottles released worldwide.

- New release - purchase early and be involved from the very beginning

- Opportunity to buy significantly below market price (market price € 2,300-2,500)

- Historically, whisky is the strongest performing asset - 564% price increase in 10 years

- The whisky industry is future-proofed by recruiting new whisky lovers

Invest In Rare Whisky From Bowmore

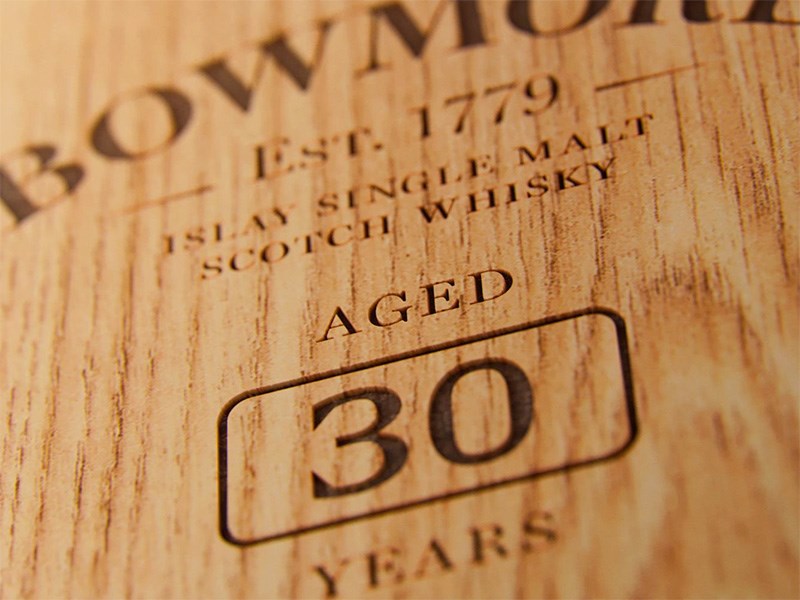

Bowmore is among Islay's iconic whisky distilleries and is the guarantor of some of the finest single malt whiskys in the world. Bowmore was founded in 1779 by the merchant John P. Simson, and is today standing in a strong position due to his own long and proud legacy, but also takes advantage of the Erdington Beam Suntory - a not so insignificant player when it comes to the spirit world.

Today, Beam Suntory is behind some of the world's absolutely leading whisky brands, such as Macallan, Bowmore, Toki and Highland Park, but also a wide range of less prestigious, but quite large brands *.

Beam Suntory are masters of first-class single malt whisky, and through Bowmore, they were ready in the autumn of 2020 with their latest limited edition - more specifically Bowmore 30 YO 1989 **.

This release, which was distilled in 1989, is of course cask strenght and has only been released in 2,580 samples worldwide. A quantity that, despite the short time on the market, already seems to have shrunk considerably.

* The Famous Grouse, Jim Beam, Maker’s Mark, Hibiki, Bols and Galliano just to name a few

** There may be inconsistency regarding how this whisky is given up - some refer to the distillation year (1989) while others to the release year (2020).

Bowmore 30 YO was distilled in 1989 and bottled in 2020

Bowmore 30 YO was distilled in 1989 and bottled in 2020

Get Early Involved With Bowmore

Bowmore 30 YO 1989 allows you to acquire early, before the market has the opportunity to react with price increases, in other words, to be involved right from the beginning. Furthermore, even now you have the opportunity to buy well below the market price - Indicative price of Bowmore is £ 2,000, which corresponds to approx. € 2,300. At the same time, on wine-searcher.com a price indication, which is closer to about € 2,500 is witnessed, while an auction on Whisky Auctioneer at the time of writing shows a binding bid of £ 2,200 (without knockdown fee etc.) and is likely to go up.

Now you have the opportunity to get invovled from the beginning and even at a price of just €2,000 per bottle.

Whisky Is An Attractive Investment Asset: + 564% In 10 Years

Excerpt from previous article: Invest In Rare Drops From The Port Ellen Cult Distillery - 40 YO 9 Rogue Casks

Whisky as an investment category is gaining more and more attention, especially driven by an increased interest and demand for the best single malt whiskys for consumption, but also as collectibles, and is by several lengths the category among collectibles that has risen the most in price the last 10 years. According to Frank Knight, a globally recognized consulting firm, the price of rare whisky has risen by 564% * over the past 10 years, which equates to an average annual return of more than 20%.

The whiskys that see the biggest price increases and are the subject of the greatest interest are most often the oldest and finest single malt whiskys, often in extremely limited quantities from release or later in supply.

* Frank Knight The Wealth Report 2020 - The Knight Frank Rare Whiskey 100 Index (KFRW100), which is based on 100 of the most coveted whiskeys and concrete hammer prices from the UK.

Bowmore 30 YO 1989 comes in a beautiful gift box that appeals to both the whisky collector and the whisky drinker

Bowmore 30 YO 1989 comes in a beautiful gift box that appeals to both the whisky collector and the whisky drinker

The Whisky Industry Is Future-Proofed By Recruiting New Whisky Lovers - So Is Your Investment

Necessity is the mother of invention, and while many of the world's inventions have arisen based on need, the same rule often applies when it comes to reinvention. And when you look around the world at some of the brands that have survived the test of time, from Mercedes to McDonald's to Madonna, reinventing yourself seems to be the key to lasting success.

This also makes itself relevant when it comes to Scotch single malt whisky. The traditional clientele of this category is aging and it is necessary to attract new followers. This means that whisky producers to a greater extent must modernize and streamline their brands, and at the same time communicate in new ways in order to also be able to attract a younger audience - a strategy that in many ways seems to bear fruit. An article by The Drinks Business describes how this transformation is well underway. Here, Maria Ropero ‐ Ortiz, senior brand manager for Glenfiddich (the world's best-selling single malt Scotch whisky), argues that “Consumer perceptions of single malt whisky have been shifting over the past few years as more people enter the category. (…) Single malt newcomers today tend to be younger, aged between 25 and 35 years old, a sign of the younger demographic becoming more attracted (…). ”.

In other words, single malt (scotch) whisky, as a category, is undergoing a transformation that, in parallel with the increase in demand for the best and rarest bottles, is also attracting new whisky lovers from a younger segment. This will help the category stay current and feed the continued success.

RareWine Invest's Opinion

With the above arguments in mind, you now have the opportunity to invest in a strong whisky case early on, based on a re-release of a 30 year old cask strength single malt whisky from an iconic distillery, with a spirits mastodon behind it and at a price well below the market price - ensuring an extremely strong starting point for your investment.

Invest In Bowmore 30YO 1989

Contact us using the contact form at the bottom of the page to find out more about your investment opportunities or to order the wines directly using the form.

| Distillation | Whisky | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 1989 | Bowmore 30 YO | 700 | OWC/GB1 | € 2.000 |