Investment Tips - Whisky - 18. November 2022

Massive Growth In The Whisky Category: Talisker Delivers Cheap Top Whisky And The Whisky Investment Of The Future

The whisky market is predicted to see solid future growth, while current free trade negotiations between the UK and India could make single malt scotch a scarce commodity.

High quality single malt whisky at a lower price point is one of the exciting whisky investments of the future that only very few are thinking about today. At the same time, the global whisky market faces solid future growth rates and attractive opportunities in countries such as China and especially India.

The brand-new release 11YO 2022 Special Release from Talisker speaks directly into this development...

Talisker From The Isle Of Skye

When talking about Scotland and whisky, it is hard to avoid the Isle of Skye, which has almost become a pilgrim destination that must be visited before whisky enthusiasts can truly call themselves whisky lovers.

Here on the Loch Harport coast, single malt whisky has been produced since 1830 under the name Talisker, which today is even the oldest distillery on the iconic whisky island.

In the nearly 200 years since then, the category has seen several transformations and ups and downs, while the industry as a whole today looks stronger than ever.

This is evident, when you look at Talisker's owner Diageo, which is a mastodont of a spirits producer.

Diageo has an impressive product portfolio of well-known brands, but it is undoubtedly in the category of Scotch single malt whisky that we should find Diageo's flagships, with Port Ellen and Brora being the most iconic. However, these distilleries were closed many years ago and are only now reopening with new production - and by their very nature it takes a long time for these distilleries to present even 7- or 12-year-old whisky.

This is why Diageo needs to push other prestige brands to the forefront - and one of the most prominent is Talisker.

Diageo: The Monster Engine Behind Talisker

Diageo is, depending on how you look at it, the largest - or among the largest - producers of spirits in the world. Diageo has operations in more than 180 countries and is behind more than 200 different brands, including giants like Johnnie Walker, Tanqueray, Guinness, and Smirnoff, but also a heavy portfolio of high-end whisky brands like Port Ellen, Brora, Talisker Lagavulin and others.

Diageo increased sales in the financial year that ended on 30/6-22 by 21.4% to € 17.8 billion, with the so-called premium plus brands* accounting for a full 57 % of sales, while Scotch whisky sales alone increased by 29 %.

Talisker 11YO 2022 Special Release - Great Whisky At Low Price

Talisker 11 YO 2022 is a brand-new release - bottled in March 2022 and released recently. This Talisker expression comes from ex-bourbon American oak casks as well as wine-seasoned casks. Talisker 11YO 2022 is bottled as cask strength and holds 55.1 % ABV.

This release is in a low price range, which makes it suitable for investment.

With an investment price of € 90*, it is among the lowest prices in the world: the lowest price on whiskybase.com is €85 per bottle, while the average offer price is € 104 per bottle. On wine-searcher.com, the lowest price per bottle (in whole cases) is € 113.

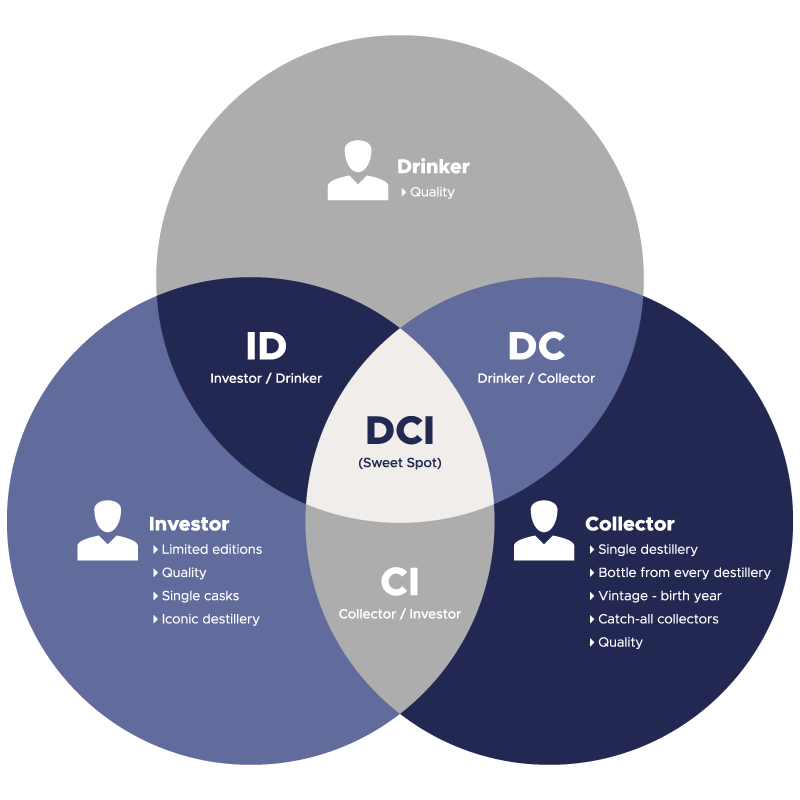

The DCI Model

Drinker, collector, investor = sweet spot. We have had several whisky cases that hit this sweet spot, Talisker 1978 and Bowmore 31YO being good examples.

Talisker 11YO, however, is of a completely different character. Collector's appeal? Maybe in the long run, when complete sets of special releases might become interesting. Classic whisky investors' radars are not pointed in this direction either. It is the category of "drinkers" that is really interesting. In fact, a whisky case like this can be put in perspective with what we know from Champagne. Here, the hiding tradition is minimal, while consumption is high due to a low price level - relative to quality and the nature of the product.

This is exactly the case with a whisky like Talisker 11YO 2022 Special Release. Here, whisky drinkers today get whisky of undeniable quality from a famous distillery that has been 11 years in the making - at a price that gives no reason to do anything but enjoy it here and now.

This means that whisky lovers buy, enjoy, discard, and do not save for later. Later, older vintages become excite ng as developments can change the distillery, change the casks, change the distillers, while older things are just attractive in this world. At the same time, distilleries and their owners have an interest in increasing profits, so the price of new releases is likely to increase when a new release is launched.

These are mechanisms that you as a whisky investor can potentially benefit from - and you will be among the few. Investing in this type of whisky is not "a thing".

Whisky Growth: Prospects For The Whisky Category

Despite historical ups and downs, whisky never really seems to go out of fashion, and the category only looks set to grow in the future. According to Allied Market Research, the global (malt) whisky market is expected to grow by an average of 4.7 % per year over the next ten years.

Among the biggest importers of Scotch whisky (by value) are the US (+8.4 % to €900.1M in 2021) and France (+2.8 % to €441.4M in 2021), but China has also moved up the list and is worth keeping an extra eye on. In just a few years, China has become a permanent resident on the list and currently sits firmly as the world's 5th largest importer, increasing imports by 84.9 % to € 225.7 million in just one year between 2020 and 2021 - a trend that is expected to continue - albeit at more moderate growth rates due to a rapidly expanding middle class and rising affluence.

But it is in India that the really big potential lies. India is unquestionably the world's largest whisky market* and in fact the world's third largest importer of Scotch whisky (by volume) with 95 million bottles by 2020 according to The Scotch Whisky Association. But while exports of Scotch whisky to India have increased by 200 % over the past decade, it only accounts for around 2 % of India's whisky market. The small share is largely due to an Indian import tariff of as much as 150 % on Scotch whisky.

What is interesting here is that the UK and India are currently negotiating free trade agreements, with the whisky tariff being one of the items on the agenda. However, the negotiations have been delayed due to political instability in the UK, but the UK promises a settlement without giving a deadline.

The Scotch Whisky Association estimates that a reduction in the tariff would result in increased exports to India of € 1.1 billion over the next five years.

The potential is massive, and while whisky production obviously cannot be accelerated, demand seems only to be increasing, while India and China could really make it explode.

*whisky in general, not "scotch"

RareWine Invest's Opinion

Whisky is a large and historically important category within wine and spirits, and despite historical ups and downs, it seems that the category has become so large and has gained so much momentum that it is simply impossible to imagine it fading away.

The global whisky market is estimated to grow by an average of 4.7 % a year over the next ten years, while individual markets such as China and India in particular could see the whole thing explode.

The production of whisky cannot be accelerated, and in fact must be aged for a minimum of three years before it can even be called whisky. At the top end of the whisky scale we find Scotch whisky, and to some extent Japanese. And among the best here we find Talisker.

Talisker 11YO 2022 Special Release offers right now whisky investment in a price range where the audience and consumption are huge. It appeals to the so-called "drinkers” but may just as well appeal to collectors in the future when the bottles that were once so accessible have disappeared from the market.

If you believe in the potential for price increases among "cheap" whiskies, and you believe in the will and ability of mastodons like Diageo, Pernod Ricard, and Beam Suntory to lift the whisky category even further, then Talisker 11YO 2022 Special Release is for you.

This is a different way of thinking about whisky investment - as opposed to the million-dollar bottles that are decades old. The market prospects are interesting, and the potential is huge.

Invest In Talisker 11YO 2022 Special Release

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | VINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2022 | Talisker 11YO - 2022 Release | 700 | GB/OC6 | € 90 |