Investment Tips - Champagne - 11. July 2023

News - 2013 Dom Pérignon | The World's Most Famous Wine

Will global warming affect the future of champagne quality? We do not know yet, but we do know that Dom Pérignon's current quality is unquestionable.

”The aroma composition could not have been anything else. This unique style is perhaps what impresses most in the world's most famous wine […] I will store my bottles for a really long time as I believe in a linear and beautiful storage development. 2013 Dom Pérignon is restrained beautifully and minimalistic clean as a Japanese garden in spring.” - Richard Juhlin

Perhaps Richard Juhlin is coloured by his field of expertise when he names a Champagne as the most famous wine in the world. But many of the world's wine connoisseurs would probably agree with that postulate.

And the 2013 Dom Pérignon is precisely the wine available through this investment tip. In addition to strong brand positioning, the latest release is backed by great scores, great historical returns and, not least, a growing demand for the world's best champagnes.

2013 Dom Pérignon: Most Traded By Value YTD

While Juhlin's postulation above can never be definitively proven, it does not change the fact that at the end of June 2023, Liv-ex declared 2013 Dom Pérignon the most traded wine by value for the whole of 2023. Furthermore, they presented that the Champagne category has accounted for 12.7% of trading by value since the start of the year - the third largest share of trading on Liv-ex in 2023 after Bordeaux and Burgundy - a share that has only increased in recent years.

There is demand for Dom Pérignon's latest release - and there is demand for Champagne.

And although there is now an immanent demand for Champagne, China could play a crucial role in the future demand for exclusive bubbles:

“According to the analysis and consulting firm GlobalData, the market for wine in China will almost double by 2026. In the analysis's forecast, the market will grow from $ 42 billion in 2021 to $ 72.2 billion in 2026, equating to an average annual growth of 11.5 %. Growth is forecast to be led by still wine, while the sparkling wine category is estimated to grow by 11.3 % on average per year to 2026.”

The above section is sourced from our market analysis: Analysis: The Prospects In Champagne - Will The Corks Pop In The Future?

Dom Pierre Pérignon - Forever An Icon In Champagne

The monk Dom Pierre Pérignon did not invent Champagne, although rumours to that effect are hard to stop. However, he did revolutionise many processes in the production of Champagne - processes that are still used today. And it is perhaps these achievements that have resulted in his legacy as a legend accompanied by extravagance, perfectionism, and luxury.

The Champagne monk decided to work with pinot noir on a larger scale than had been done before. He used cork stoppers to seal his bottles and already at harvest, he blended the different grapes to enhance the complexity of the wine.

In 1715, Dom Pierre Pérignon died, but the results of his champagne revolution live on - today managed by the world's largest luxury conglomerate LVMH Group, which is also behind Louis Vuitton, Hennesey, Dom Ruinart and Krug, to name a few.

Read the full portrait of Dom Pierre Pérignon in the article: Dom Perignon - The Monk, The Legend & The Wine

Consistent Quality Characterises The Reputation Of The Monk

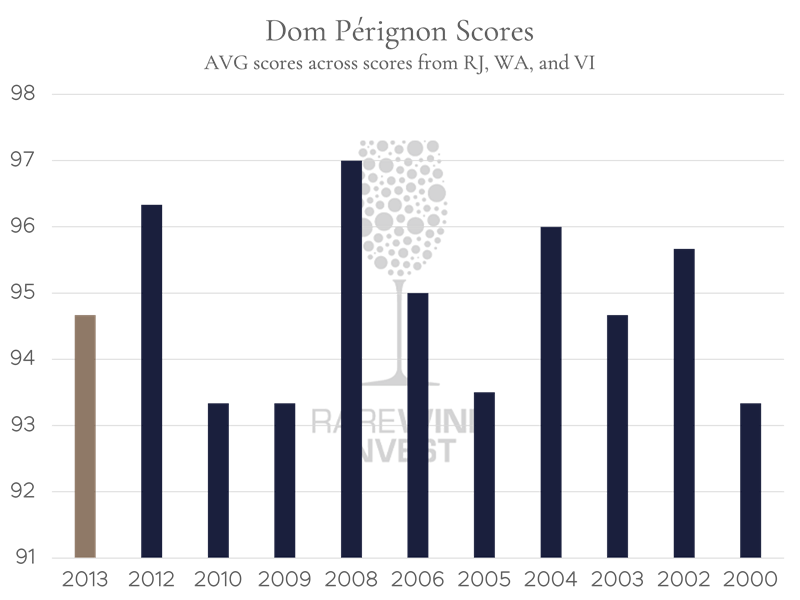

In this millennium, 11 vintages of Dom Pérignon have been released, and these are ranked between 92 and 98 points by Richard Juhlin, Wine Advocate and Vinous respectively. 2013 is the latest release, and it gets 95 points from Richard Juhlin, 95 points from Wine Advocate and 94 points from Vinous. This gives it 94.7 points across the three critics, placing it firmly in the centre of the quality-heavy field.

It is worth noting that in these 11 releases, the Champagne guru Richard Juhlin has awarded a maximum of 97 points to the 2008 Dom Pérignon, which represents a legendary vintage in Champagne - just two points away from the 2013 vintage.

Dom Pérignon: How It Performs

Dom Pérignon has often been the subject of investment spots through RareWine Invest for several reasons. First and foremost, Dom Pérignon has an inherently strong brand positioning. Furthermore, it has delivered great historical returns across vintages.

According to Liv-ex, the last ten* vintages of Dom Pérignon that have been on the market for at least five years have returned an average of 72% over the last five years, which equates to 11.5% per year.

In this case, it is also obvious to consider vintages whose points correspond to 2013 Dom Pérignon. According to wine-searcher.com, the offer prices of 2006 Dom Pérignon (95 AVG points) and 2003 Dom Pérignon (94.7 AVG points) have developed by +8% per year in the 8 and 10 years of available data, respectively.

In other words, Dom Pérignon's historical returns across vintages fully live up to the consistent quality that permeates the champagne house.

*1996, 1998, 1999, 2000, 2002, 2003, 2004, 2005, 2006 and 2009

Attractive Entry Price For 2013 Dom Pérignon

Your price for 2013 Dom Pérignon is just €175*. Comparing this price with the latest RareWine rating for 2012 Dom Pérignon, the price of 2013 Dom Pérignon looks favourable.

2012 is a great vintage in Champagne, and 2012 Dom Pérignon is rated slightly higher than 2013 Dom Pérignon in terms of quality - however, the price is €210*, which is 20% more than the price of 2013 Dom Pérignon. 2012 Dom Pérignon has only been on the market for one more year than 2013 Dom Pérignon, and it is still available on the market. And as we all know, it is usually not until the quantities disappear from the market that the price increases really start to occur.

Similarly, the 2010 Dom Pérignon, which is rated lower than the 2013 in terms of quality, was most recently valued by RareWine at €180*. In the above perspective, €175* for a new release of Dom Pérignon seems particularly attractive.

*Price per bottle, ex. duty, tax, and VAT, in whole cases and perfect condition

Invest In Champagne: Why?

In recent years, Champagne has become one of the best investments in the wine category. Even the S&P 500 and gold have been beaten by the bubbly category. According to Liv-ex, the high interest in Champagne was fuelled by a mismatch between price and quality, with the famous 2008 vintage in Champagne kick-starting investment interest, followed by great vintages such as 2012, 2013 and 2014.

Furthermore, Liv-ex says that climate change is also contributing to the continued investment in Champagne, as investors and Champagne lovers worry about how global warming will affect the quality of future vintages.

Quality is one thing. Quantity is another.

The permitted harvest yield in Champagne from 2013 to the 2021 vintage has been below the permitted yield between the 2007 and 2022 vintages - ergo, for years you have had lower harvest yields and thus lower stock levels than you have had in the past - but not lower demand. Quite the contrary.

In response, the Champagne Committee decided to set the harvest yield for the 2022 vintage at 12,000 kg/ha, which is the highest since 2008 (12,400 kg/ha). However, even though the authorised yield has been raised, it will be many years before the market will notice the increased production, as good vintage champagnes by their very nature have a cellar life of 10 years.

And even if the big Champagne houses are allowed to increase yields, the high quality of their world reputation is unlikely to be compromised - the Champagne brand is their most valuable asset, which is why harvest yields and supply are tightly controlled.

Rarewine Invest's Opinion

Dom Pérignon is popular: Both according to Liv-ex and according to Richard Juhlin. This is a unique opportunity to get in on the 2013 Dom Pérignon from the start - and at an attractive price. Dom Pérignon is a sought-after celebrity whose predecessors have shown what great returns look like. The future decline in quality due to climate change is not yet a fact, but it is a fact that Dom Pérignon's current quality is unquestionable.

The future of Champagne investment looks particularly interesting in light of the above. And there is potential in getting in on a champagne investment from the start.

Invest in 2013 Dom Pérignon

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2013 | Dom Pérignon | 750 | OC6 | € 175 |